The West Texas Intermediate Crude Oil market initially fell during the trading session on Thursday, but then turned around to form a bit of a hammer. This suggests that the market is still supported, but you should also pay attention to the fact that the Wednesday candlestick was also shooting star, showing a little bit of hesitation. In fact, you can even look at the Tuesday candlestick to see that the market is somewhat flat. It is interesting, because we have been in a nice run to the upside, although I would not say that it is concerning.

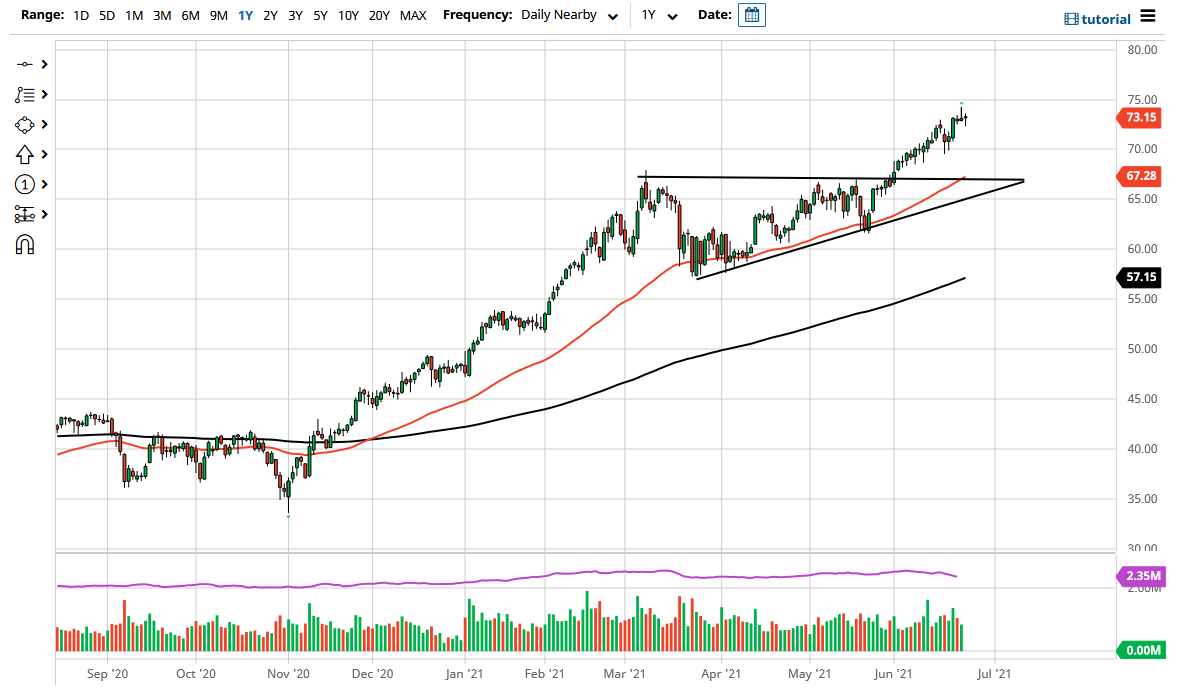

As we have seen a lot of choppy behavior in the short term, the reality is that we are simply trying to figure out whether or not we need to pullback in order to find buyers, or if we are going to continue to go to the upside? When you look at the ascending triangle underneath, you can see that the 50 day EMA has also reached towards the top of the ascending triangle, which of course has been important. The “measured move” from the ascending triangle suggests that we could reach towards the $77.50 level, which is an area that in the past has been important.

Pullbacks at this point should continue to see plenty of buyers, especially at the $70 level and the $67.50 level. Ultimately, crude oil is expected to be in high demand as the economy around the world continues to wake backup after the pandemic, meaning that we have worked through the excess glut of crude oil that had formed during the illness, and now it looks very likely that we are going to be short of necessary supply. In fact, it has gotten bad enough that several OPEC members are starting to talk about increasing output.

That being said, it is likely that the output additions will be enough to overcome the potential demand, especially as countries like India come back online. With this, I like the idea of buying dips and finding value along the way, as this is a market that clearly has an upward momentum to it over the longer term but may simply just be taking a little bit of a breather in the short term in order to build up the necessary momentum to overcome the psychologically important $75 level.