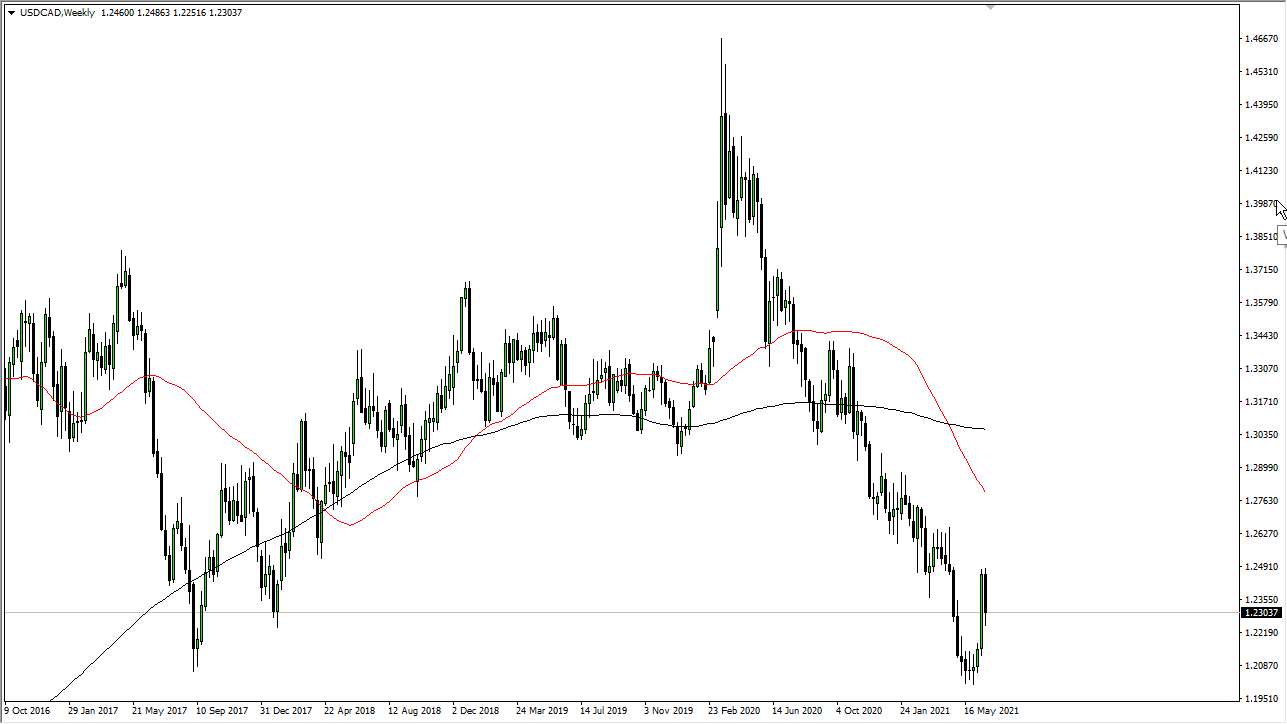

EUR/USD

The euro initially rallied during most of the week, but as you can see, the market is struggling with the idea of the 1.20 handle. At this point, the question is whether or not we will break down to a lower level, because we clearly have run out of momentum late in the week. Furthermore, the weekly candlestick from the previous week was so negative that it suggests that there is probably more to this move to the downside. If we break above the 1.20 handle, then it is possible that we could recapture the 1.21 level, but right now it seems more likely than not that we will drop a bit.

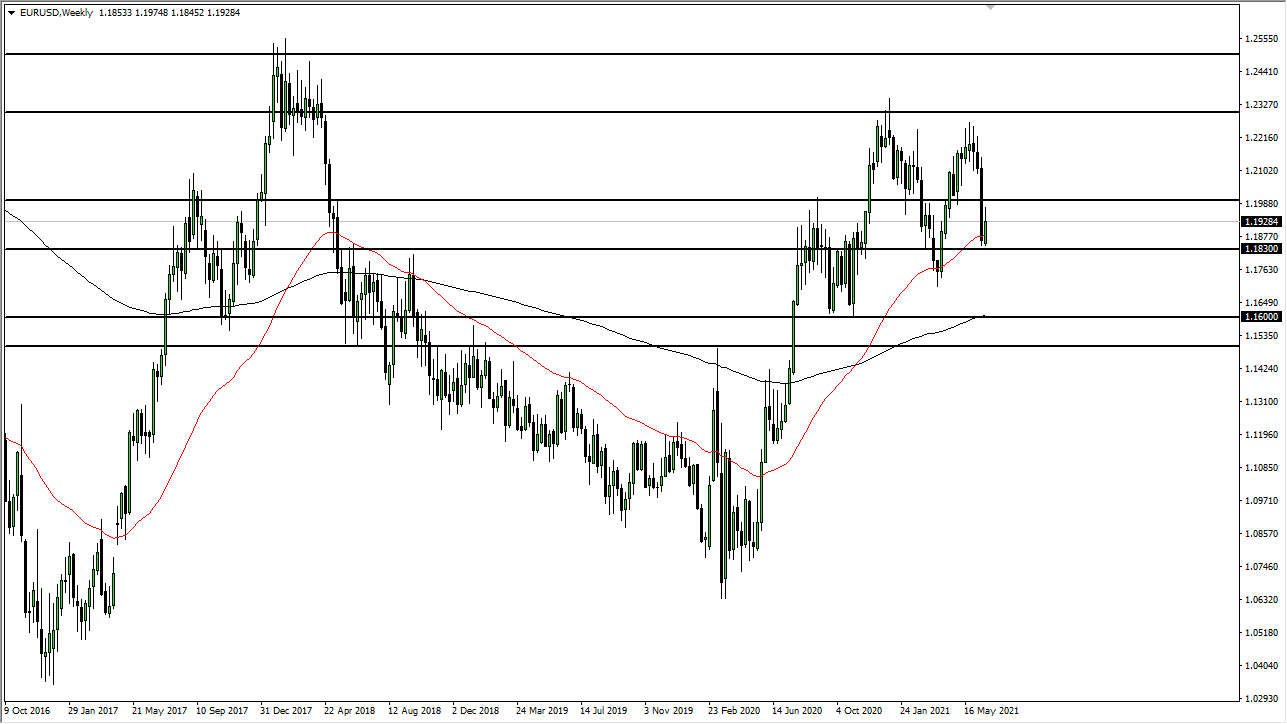

GBP/JPY

The British pound had a relatively positive week, but it is obvious that the ¥155 level continues to be a major barrier. Because of this, I think that if we can clear the ¥156 level, we will continue the longer-term move to the upside. However, it is likely that we will stay in a range between ¥155 and ¥150 underneath. With that being said, the market is likely to see choppy behavior and I think we will stay in a range, causing bits of volatility. I believe that this next week will probably be more or less a range-bound opportunity.

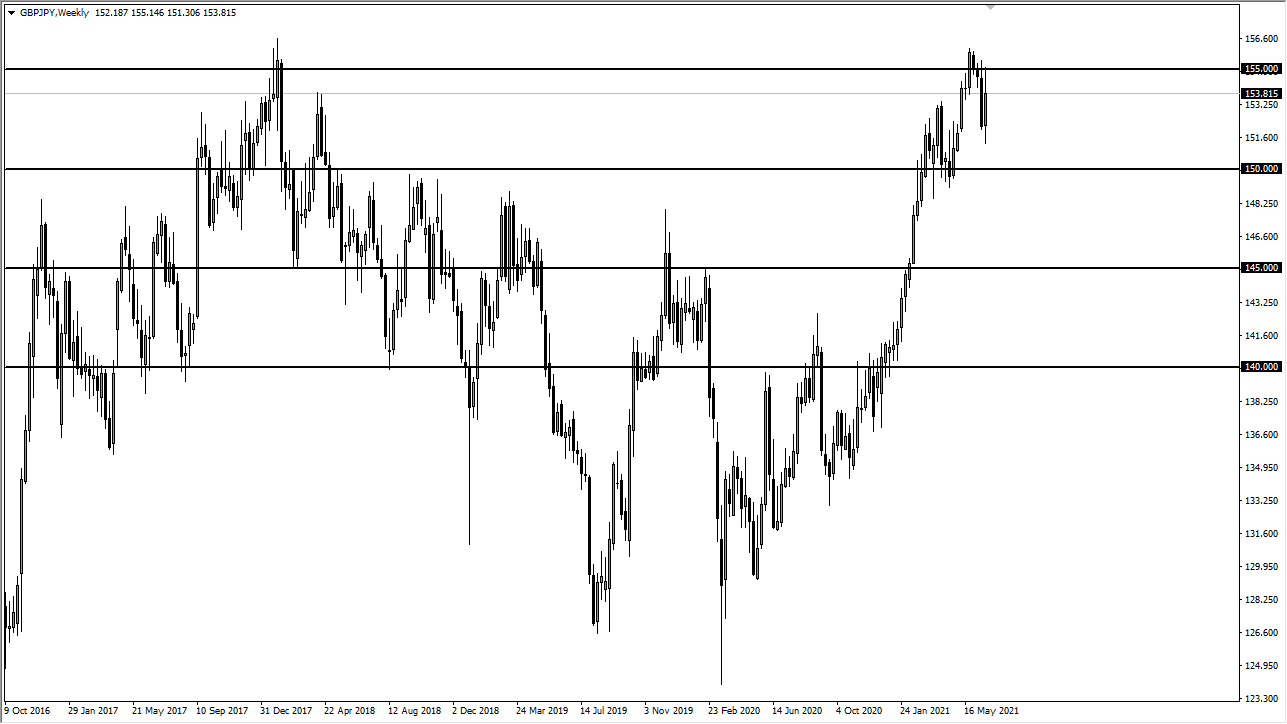

USD/MXN

The US dollar got hammered against the Mexican peso during the course of the week to reach down towards the 19.75 pesos level. That being said, the market looks as if it is going to test significant support, and the fact that we wiped out the week before does suggest that we are trying to go lower. There is a little bit of a gap underneath, and I think that should offer support; but at the end of the day, the Mexican Central Bank has raised interest rates this past week, and I think that continues to put downward pressure on the greenback against the peso. I like the idea of shorting signs of exhaustion after short-term rallies.

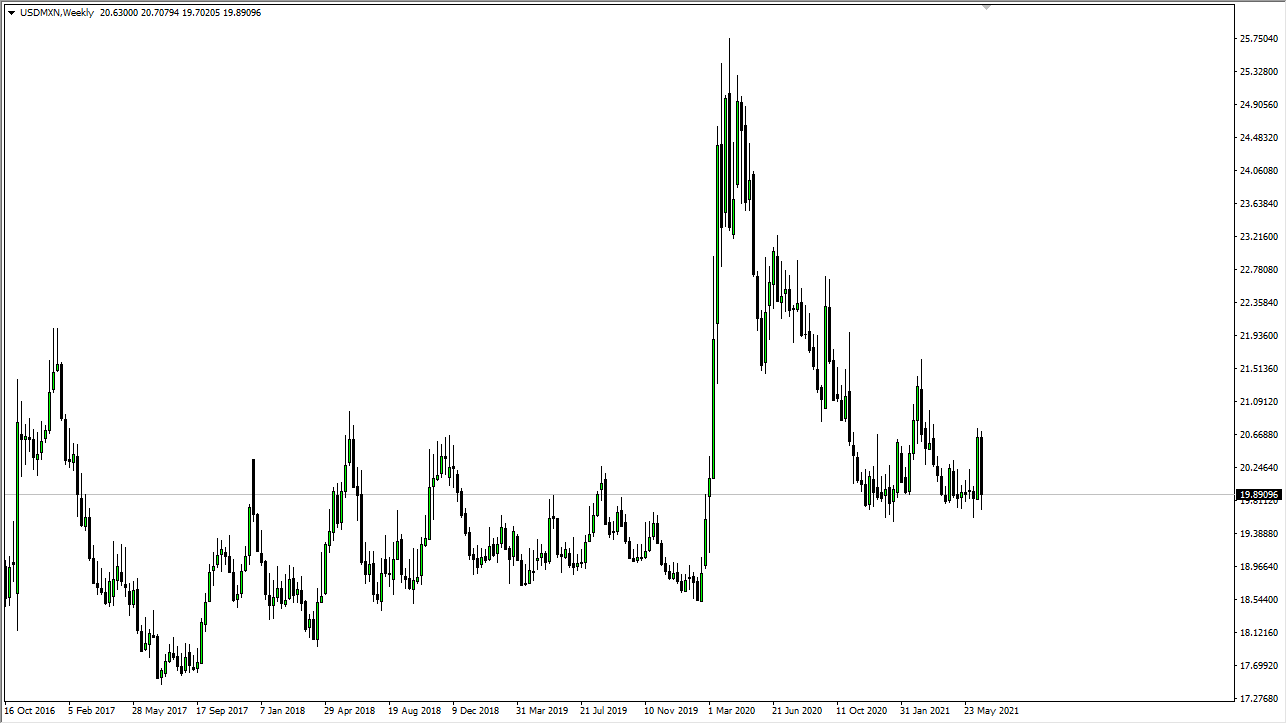

USD/CAD

The US dollar has fallen against the Canadian dollar during the week, reaching down towards the 1.23 handle. The 1.25 level above should continue to offer resistance, but at this point it will be interesting to see whether or not we continue to fall from here. If we break down below the bottom of the candlestick, then it is likely we go looking towards 1.21 handle. On the other hand, if we can take out the 1.25 level above, it is very likely that we will go much higher.