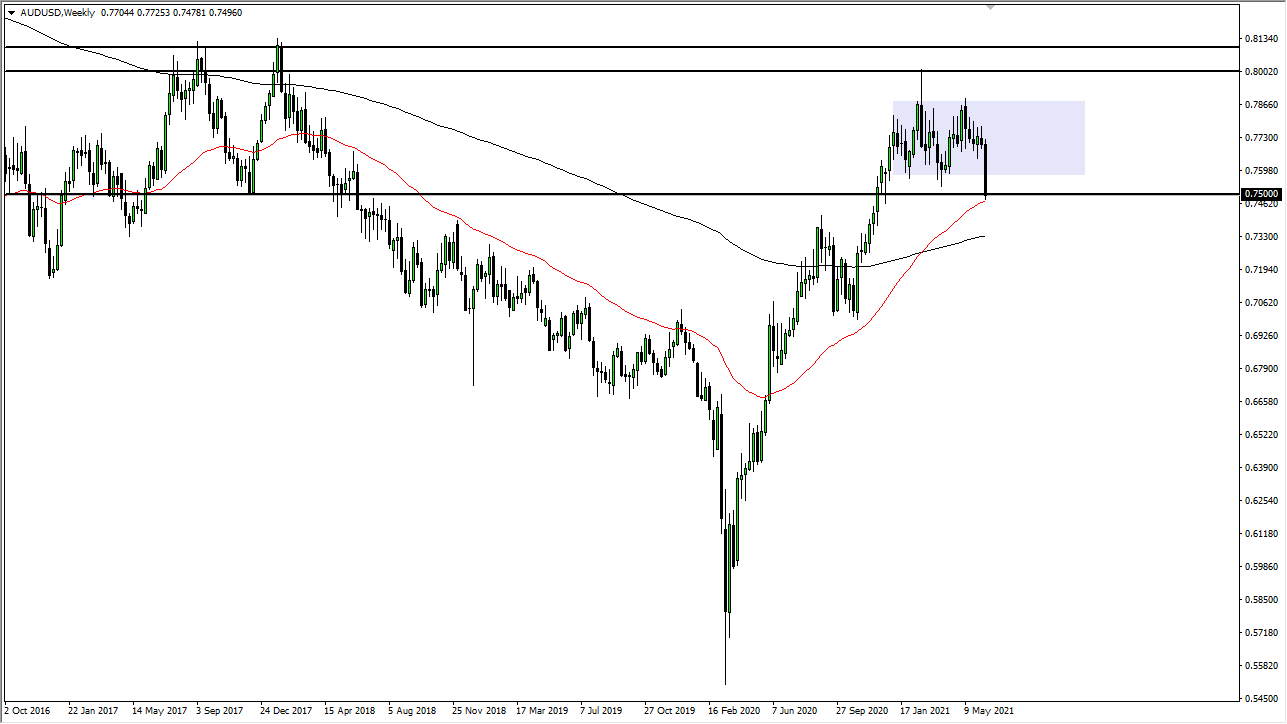

AUD/USD

The Australian dollar had a horrible week, ultimately reaching down towards the 0.75 handle. This is a market that certainly seems to be struggling and now it looks very likely that we are going to continue to go much lower. The fact that we are closing at the very bottom of the candlestick does suggest there is going to be a bit of follow-through coming. With this, I believe that the first signs of weakness should be sold into, as it is likely that the Aussie could go looking towards the 0.70 level. It looks as if the US dollar is going to strengthen, at least for the short term.

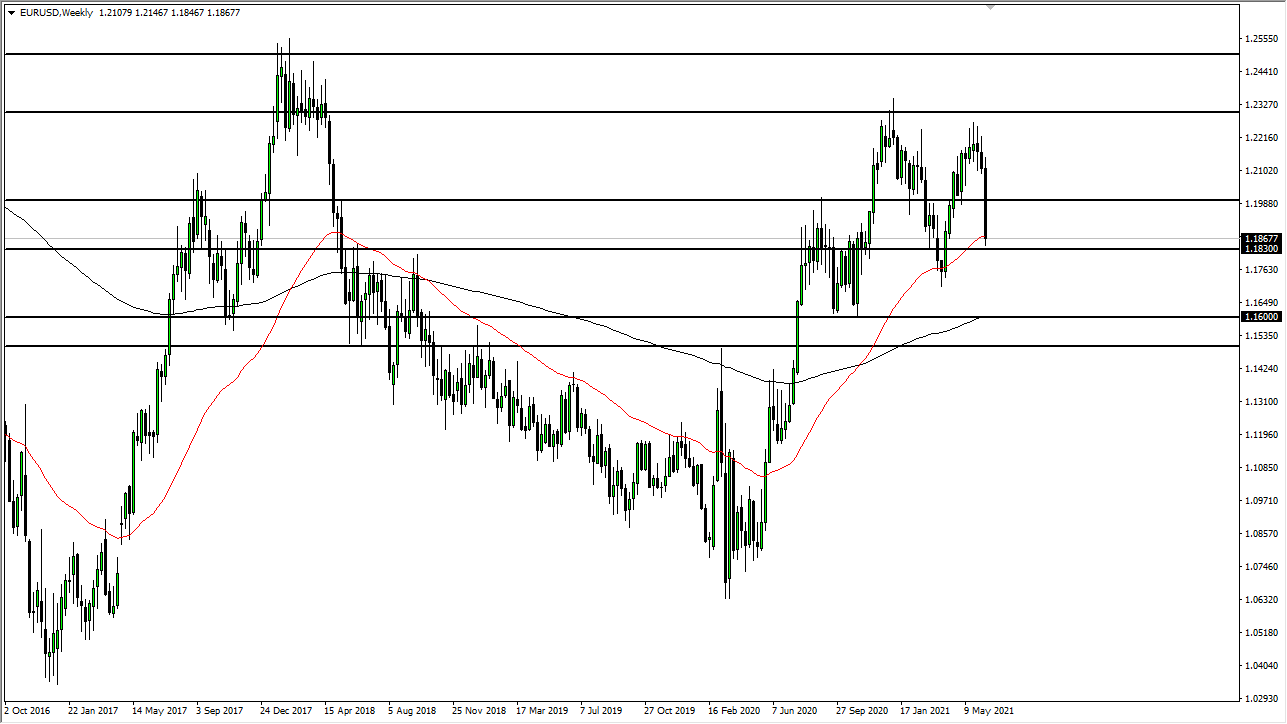

EUR/USD

The euro got absolutely hammered during the week as well, just as anything that was not the US dollar did. Ultimately, this is a market that I think will continue to see downward pressure, but I also recognize that there is significant support just below at this swing low. There has been a major shift in attitude as the Federal Reserve has suggested that perhaps they were “thinking about thinking about tapering”, and that has had the market freak out. I anticipate that rallies will be sold into, with the 1.20 level being a significant resistance barrier.

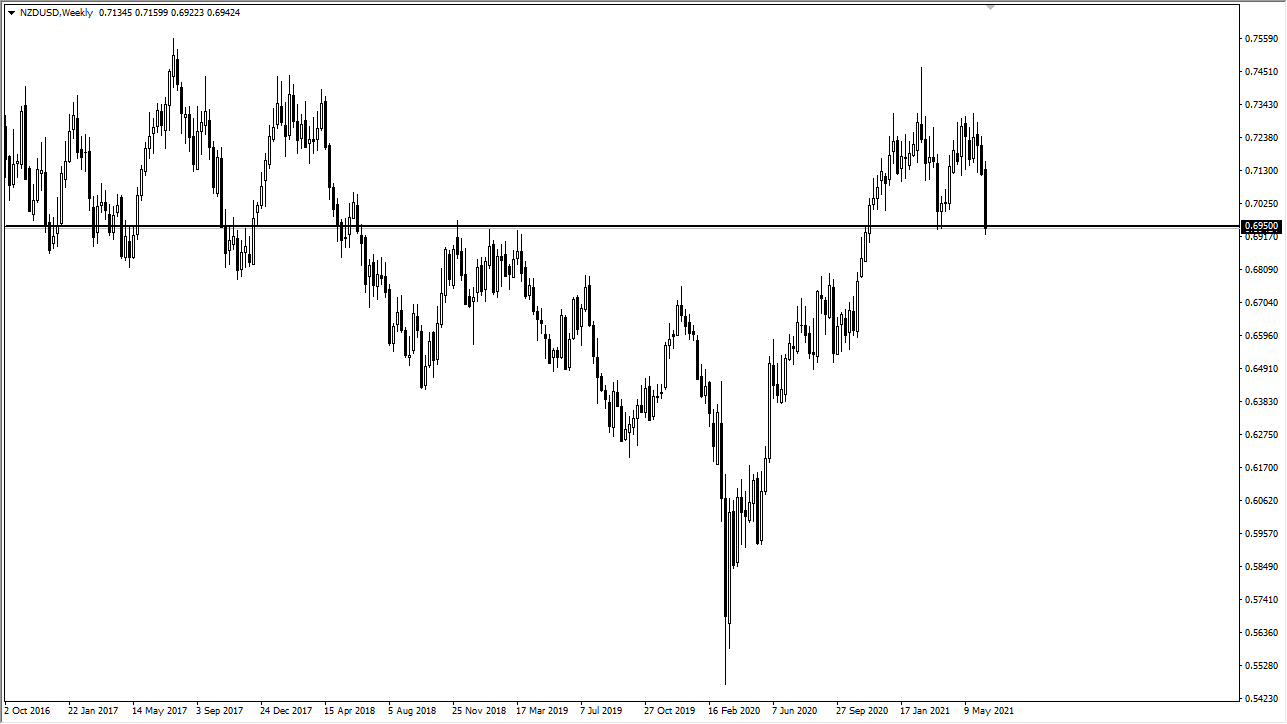

NZD/USD

The New Zealand dollar has gotten hammered during the week to reach towards the bottom of the overall range that we have been in, and now it looks as if we are going to try to break down below the 0.69 level. If we do, it is likely that we could see a bigger move to the downside, perhaps reaching down towards the 0.67 handle. On the other hand, if we were to turn around and break above the 0.7050 level, then it is likely that we would see a bit of recovery to the upside.

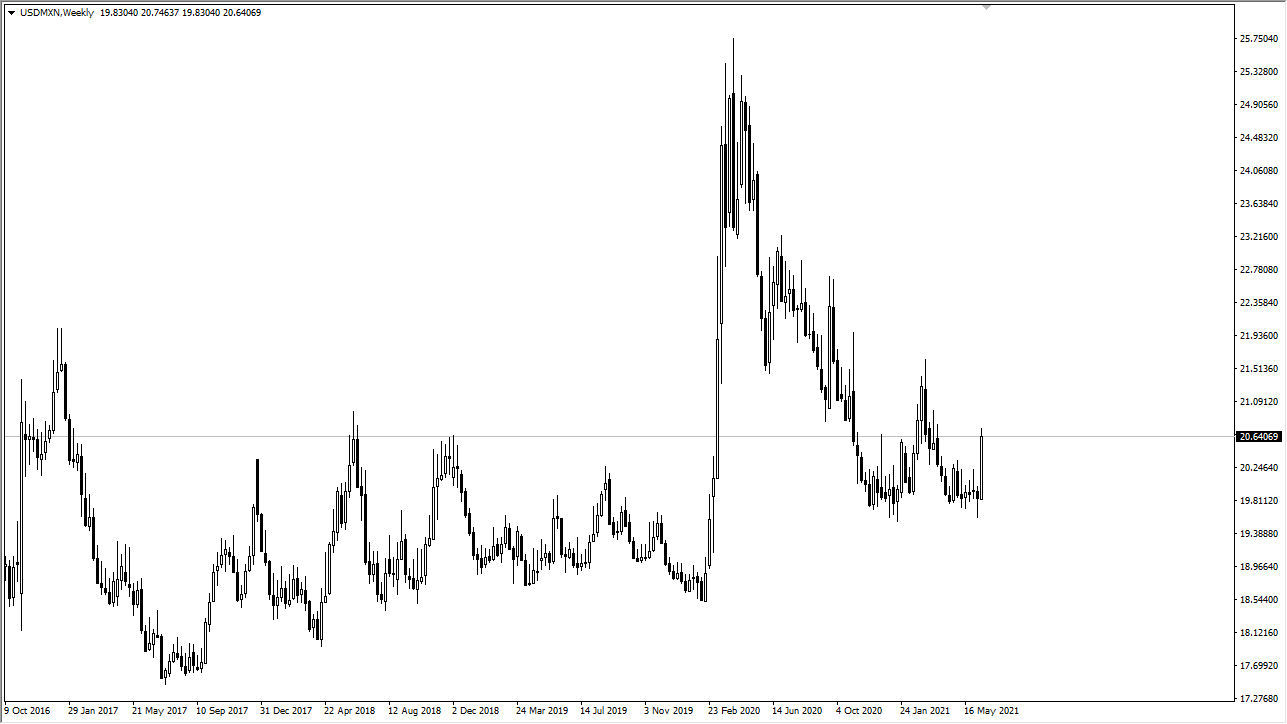

USD/MXN

The US dollar rallied quite drastically against the Mexican peso during the week to break above the 20.64 level. While not necessarily what I would consider to be a “major pair”, it is worth noting that it appears that we have formed a bit of a “double bottom” in this market, and we could see similar action in other emerging market currencies, so I am using this as a proxy to show just how strong the US dollar is against so many of the smaller currencies.