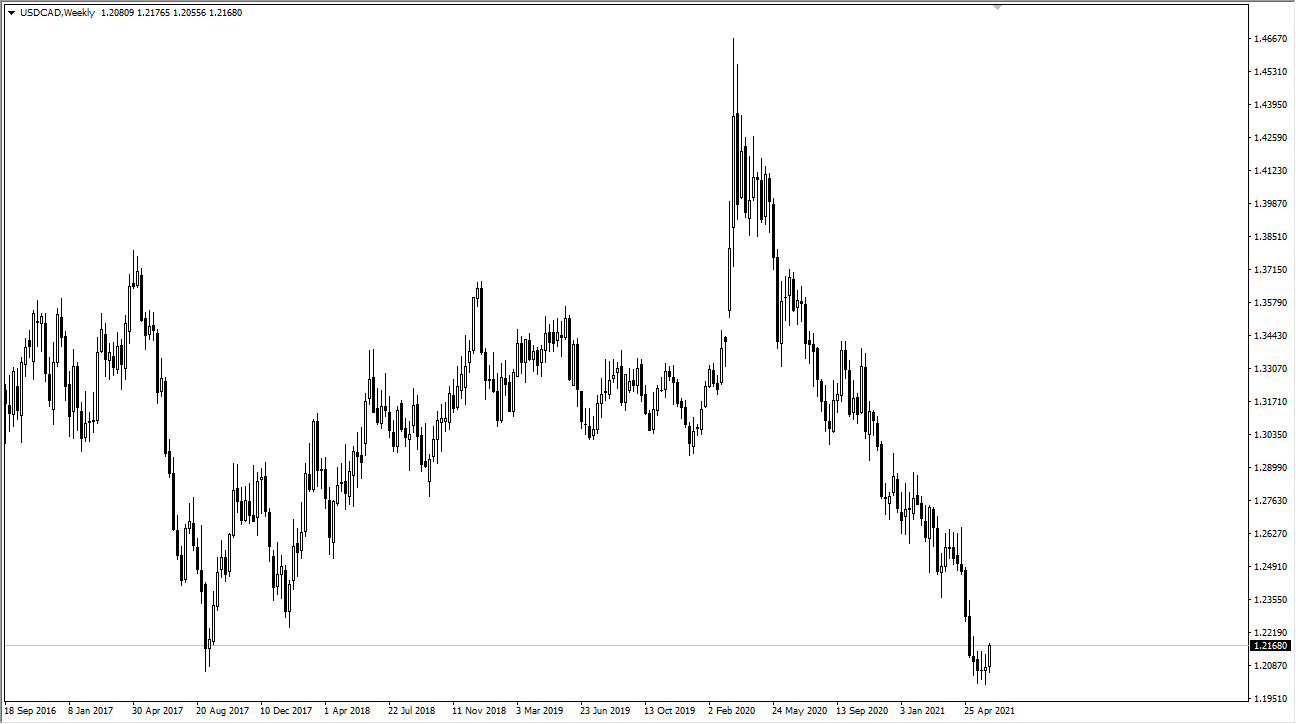

EUR/USD

The euro initially tried to rally during the course of the week but by the time we get towards the end of it, it sold off quite drastically. At this point, it looks as if the euro will probably continue to drift lower, perhaps reaching towards the 1.20 handle. That is an area that I think does have a significant amount of support attached to it, though, so pay close attention to it for a potential bounce. If we break down below there, then I think we will have even further to go. For what it is worth, we have seen a lot of selling pressure above, so I think we may get a little bit of a pullback.

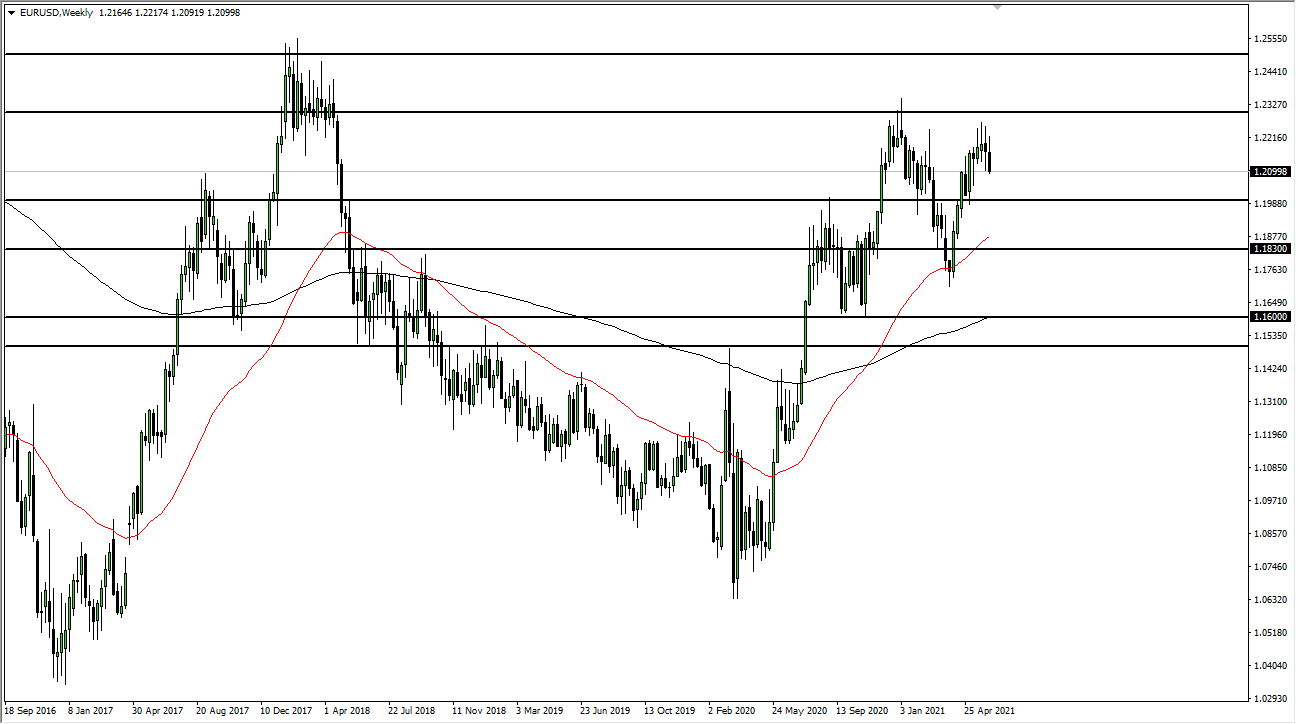

GBP/USD

The British pound pulled back during the week as it continues to see a lot of trouble at the 1.42 handle. If we do pull back from here, I expect the British pound will find plenty of buyers near the 1.40 handle, an area that has been significant resistance recently. On the other hand, if we can turn around and break out to a fresh, new high, then it is possible that this market will take off towards the 1.45 handle. I suspect what we are going to see this week is probably a bit of choppy and slightly negative trading in a bit of profit-taking.

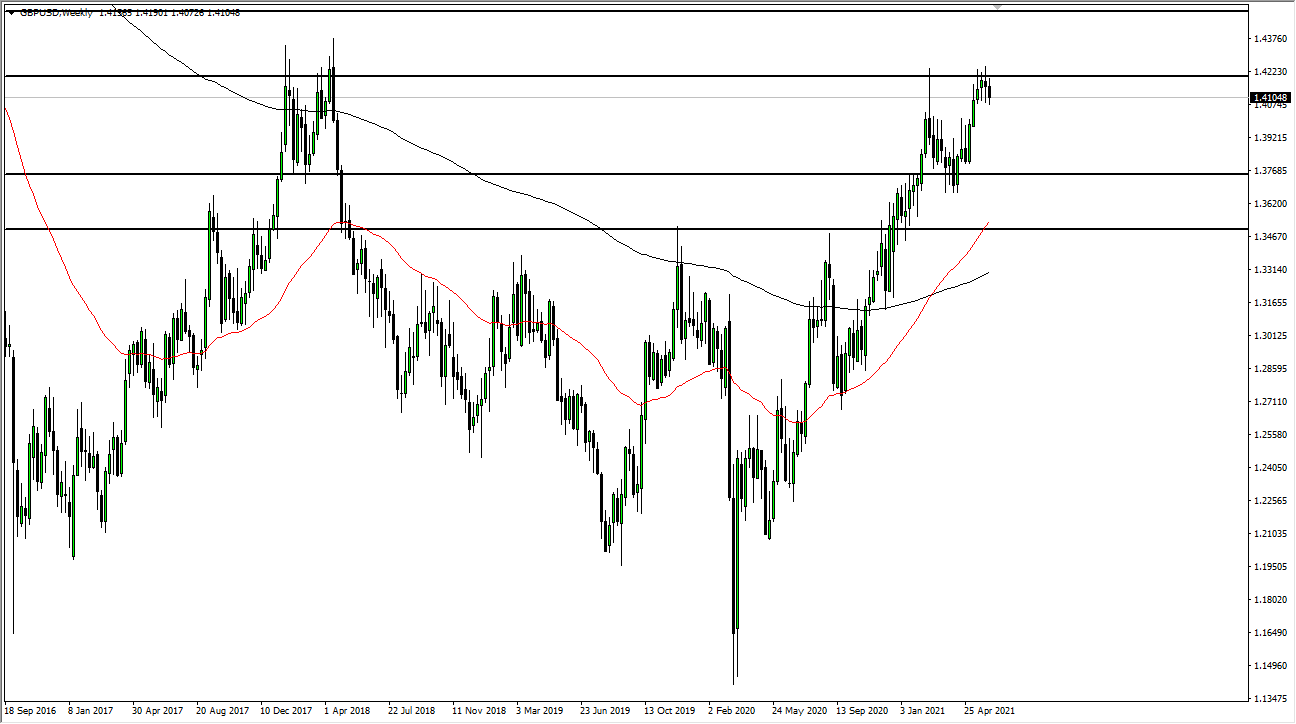

NZD/JPY

The New Zealand dollar had a tough week against the Japanese yen, sliding down towards the ¥78 level. This is an area where I see a significant amount of previous resistance that could now turn into support. If we break down below the ¥78 handle, it is very likely that we should go looking towards the ¥77 level. Alternately, if we can stay above the ¥70 level, then it is very likely that this market will continue to reach towards the ¥80 level again. Keep an eye on overall risk appetite, because this market tends to go up and down based upon the overall proclivity of traders in most markets.

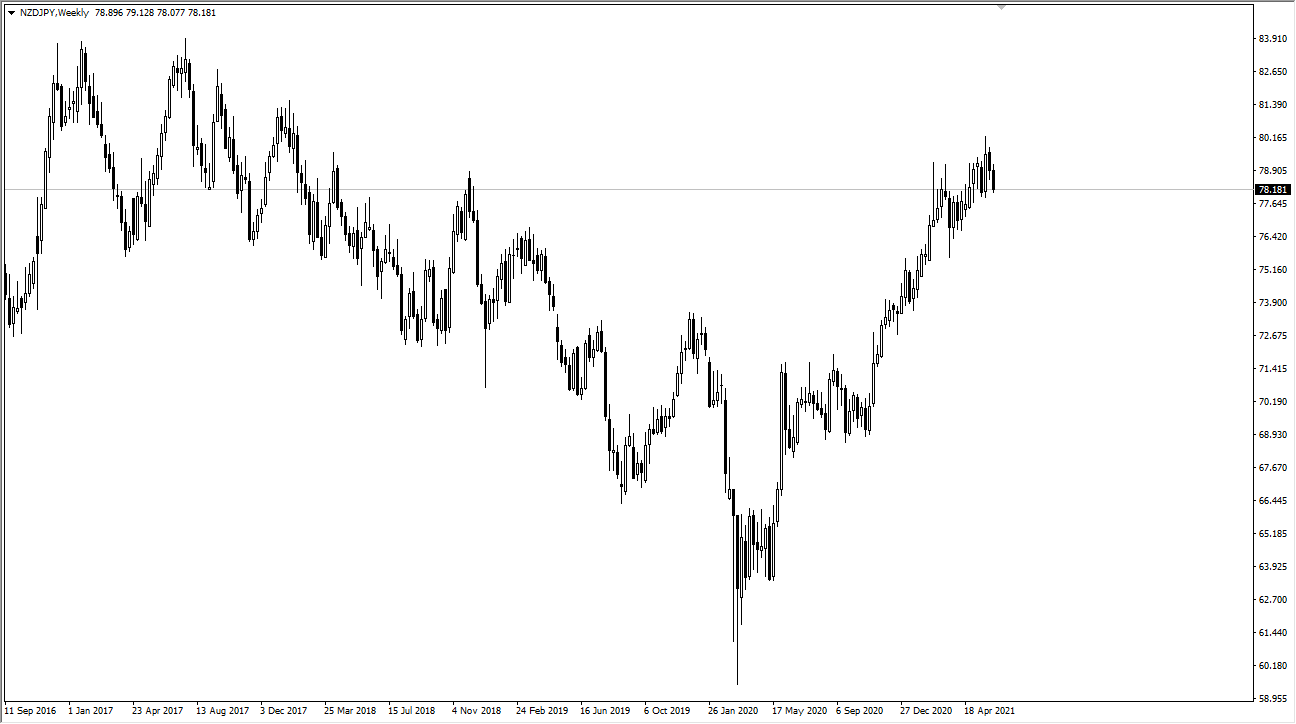

USD/CAD

The US dollar rallied significantly against the Canadian dollar during the week, breaking above the crucial 1.2150 handle. Because of this, it is very possible that we could rally just a bit, perhaps in a bit of a relief rally. On the other hand, if we break down below the 1.21 handle, then it is likely we could go looking towards the lows again. Keep an eye on crude oil, because the currency market is moving in the opposite direction of where you would expect it to, based upon what oil has been doing.