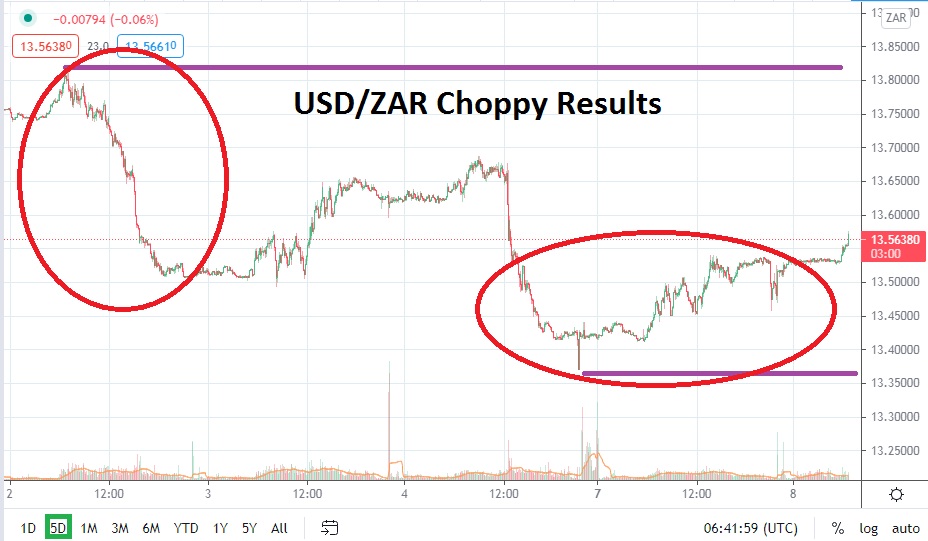

While the USD/ZAR continues to trade within a long-term bearish trend, recent price action has proven to be choppy, and this morning, a slight reversal higher has been demonstrated. However, the move upwards has not been violent and traders who continue to foster bearish sentiment for the USD/ZAR may find an opportunity to take advantage of this potentially momentary climb.

Short term, there appears to be adequate resistance near the 13.59000 to 13.61000 junctures, and the higher value may prove to be a good spot for aggressive traders to consider using as a stop-loss ratio. Yes, the USD/ZAR did trade near the 13.68000 level on the 4th of June, but after touching this mark, the Forex pair saw a wicked move downwards which touched the 13.36000 vicinity only two days later.

Speculators need to consider the notion that the USD/ZAR remains well within a long-term bearish cycle and is challenging values it has not traded with any endurance since January of 2019. This isn’t to say that the downward movement of the USD/ZAR will last into infinity, but it does highlight the current trend, and jumping off the train early could prove dangerous. Yes, traders can certainly be buyers of the USD/ZAR and take advantage of cyclical reversals higher which are a natural component of Forex.

More conservative traders however, may want to use moves higher as a place to activate limit orders which seek selling positions. The current resistance junctures already written about of 13.59000 to 1.361000 may prove to be attractive spots to initiate shorts. Speculative traders who are more aggressive may want to get into the market now with the goal of targeting support near the 13.52000 level which is rather close. This would be a quick-hitting trade which needs to have working take-profit values to cash out profitable positions.

The long-term trend of the USD/ZAR has certainly been bearish. Yes, the past week of trading has produced choppy terrain as important support levels have been tested and slight reversals continue to be exhibited. Traders should not be overly greedy under the current conditions, but moves upwards may cause speculators to be skeptical of the heights being attained, and cause them to wager that the USD/ZAR will continue to move towards its bearish values again.

South African Rand Short-Term Outlook:

Current Resistance: 13.61000

Current Support: 13.52000

High Target: 13.67700

Low Target: 13.44000