For the second day in a row, the USD/JPY currency pair is trying to breach the 110.00 psychological resistance level to get out of the quagmire of the decline.

This strongly and directly affects the performance of the dollar against the rest of the other major currencies. Ahead of its announcement, partly reflecting the positive effects of increased Covid-19 vaccination rates and lax social distancing measures, the Fed's Big Book said the US economy grew at a somewhat faster rate from early April to late May.

The Beige Book, a compilation of evidence on economic conditions in each of the twelve federal districts, still describes the pace of economic growth as moderate. For its part, the Fed said the effects of expanded vaccination rates were more pronounced in consumer spending, as increased leisure travel and spending on restaurants added to continued strength in other spending categories.

However, several regions also pointed to the negative effects of supply chain disruptions, with manufacturers reporting that widespread shortages of materials and labor combined with delays in delivery made it difficult to get products to customers. Similar challenges have also affected the housing sector, where strong demand, buoyed by low mortgage interest rates, has outpaced homebuilders' ability to build, prompting some to limit sales.

The US central bank has acknowledged that ongoing disruptions in the supply chain have also contributed to increasing overall price pressures since the last Beige Book was released in April. The Fed also said: "Input costs continued to increase across the board, with many contacts citing sharp increases in construction and raw material manufacturing prices."

With boosting demand allowing some companies to pass through the higher costs of their customers, contacts expect to face further cost increases and higher prices in the coming months.

Ahead of Friday's closely watched monthly US jobs report, the Big Book said employment levels increased at a relatively steady pace, with two-thirds of the counties reporting modest employment growth during the reporting period. While job growth was strongest in food services, hospitality and retail, the Fed noted that it was still difficult for many companies to hire new workers, especially low-hourly workers, truck drivers and skilled tradesmen.

The Fed also said: "A shortage of job candidates has prevented some companies from increasing production and, less commonly, has led some companies to reduce their hours."

The release of the Beige Book comes two weeks before the Fed's next monetary policy meeting, which is scheduled for June 15-16.

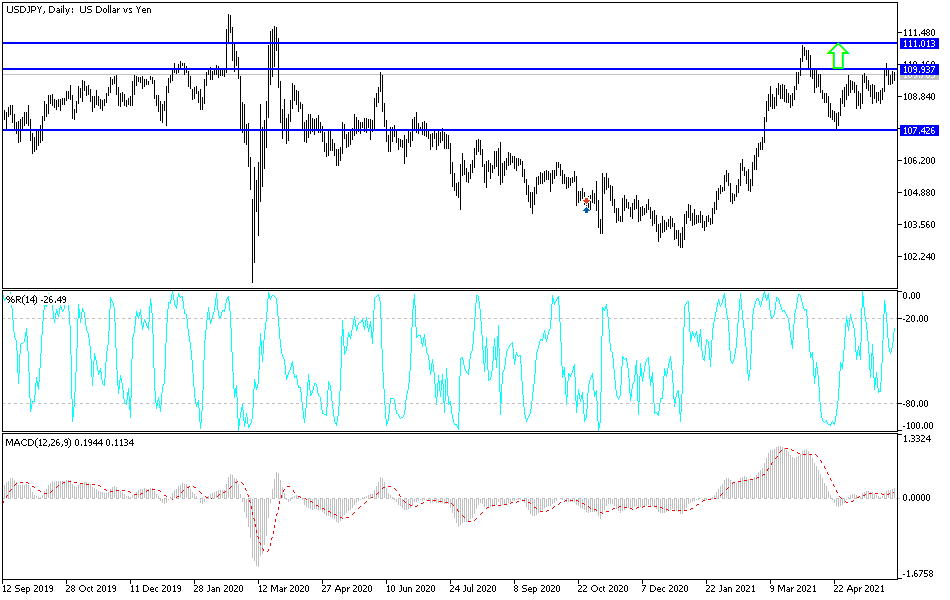

According to the technical analysis of the pair: As I mentioned before, the performance of the USD/JPY currency pair will not strengthen without a breach and stability above the 110.00 psychological resistance because it will motivate forex investors to buy to push the currency pair to stronger upward levels and the closest to it after that 110.35, 111.20 and 112.00. It all depends on the confidence of investors in the event that the results of the economic data today and tomorrow are better than expected. Conversely, negative results may push the currency pair to move within its descending channel, reaching the support levels 109.25, 108.80 and 108.00 again.

The dollar will be affected today by the announcement of the ADP reading of the change in the number of non-farm payrolls, the weekly US jobless claims, the non-farm productivity and the ISM services PMI reading.