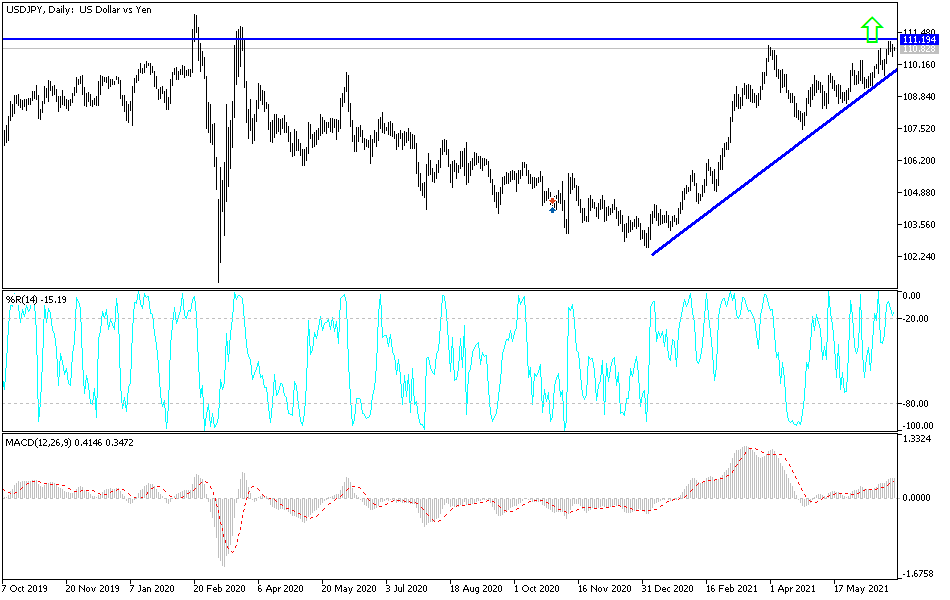

In the case of the USD/JPY currency pair, there was an additional factor as Japan is exposed to a state of instability with the increase in the number of Corona injuries. It has to move towards the higher resistance level 111.11 for the pair since March 2020. The currency pair was subjected to selling at the end of last week towards the support level 110.48 and closed trading around the level of 110.77. Positive US economic release results support the dollar as well.

US consumer spending was flat in May as income fell for a second month as the impact of the government's pandemic stimulus payments waned. However, inflation has made significant gains with prices excluding food and energy rising the most in nearly three decades. In this regard, the US Commerce Department reported that the flat reading of consumer spending in May represented a marked slowdown after gains of 0.9% in April and a 5% increase in March. The department reported that the increase in spending in March was driven by the distribution of payments of up to $1,400 per capita from a $1.9 trillion stimulus bill. With those payments expiring, income fell 2% in May after an even larger drop of 13.1% in April. Wages and salaries, the main component of income, rose 0.8% in May, reflecting higher employment levels.

Inflation linked to the measure of consumer spending that the Fed closely monitors rose 0.4% in May and has risen 3.9% over the past 12 months. It was the largest 12-month increase since 2008 and well above the Fed's 2% target for annual rate increases. Core inflation, which does not include volatile food and energy prices, rose 0.5% in May and rose 3.4% over the past 12 months, the largest jump since 1991.

These sharp price gains raised fears that hyperinflation could become a threat, something not seen in this country since the oil shocks of the 1970s. However, US Federal Reserve Governor Jerome Powell told Congress earlier this week that he still believes the current rise in inflation is temporary and is mainly caused by temporary problems in reopening the economy such as supply chain bottlenecks.

In general, consumer spending is closely monitored as it accounts for more than two-thirds of economic activity. Even with the slowdown in spending growth in May, economists remain optimistic that consumers will make a solid rebound this year. In a release last week, the US government reported that the overall economy, as measured by gross domestic product, grew at a robust 6.4% rate in the first three months of this year.

USD/JPY technical analysis: The stability of the price of the USD/JPY currency pair is still above the 110.00 psychological resistance that supports the bulls’ control over the performance. As I mentioned before, that the move towards and above the resistance 111.20 pushes the technical indicators to strong overbought levels unless the pair gets to more momentum, profit-taking may be initiated at any time. According to the performance on the chart of the daily time frame, the bears' control over the performance will not return without breaking the 109.72 support level as a first stage. The general trend of the currency pair is still bullish.