The pair is stable around the 110.50 resistance level, amid sharp gains for the US dollar from clear indications from the bank that the US interest rate hike is imminent. In contrast, the Bank of Japan sticks to its cautious stance as Japan continues to face the pandemic. Although some cities have lifted the state of emergency ahead of the Tokyo Olympics, many still doubt that the Japanese economy may be able to benefit from the event and fear losses will mount instead.

Thousands of Japanese companies have begun distributing COVID-19 vaccines to workers and their families in an employer-led campaign that reaches more than 13 million people and aims to accelerate the country's slow rollout of vaccines. About 3,500 companies have signed up for free vaccines, and that number is growing. Companies must submit a plan to vaccinate at least 1,000 people per site. They decide who to include, such as families, affiliates, and suppliers. Universities are also eligible. Small businesses can apply through organizations, such as the Local Traders Association, so ideally no one falls through the loopholes, according to the Department of Health. The company's requests for vaccines are accepted until February 2022.

Japan relies entirely on imported vaccines for a campaign that began in February with medical professionals. Only about 6% of Japanese are fully vaccinated. Japan has more than 14,000 deaths from COVID-19. Vaccinations have been slowed down by failed booking procedures, unclear distribution plans, and a lack of medical staff to administer the vaccines.

The vaccination campaign is also led by local governments and the Japan Self-Defense Forces, but employer-led efforts are helping to speed this up.

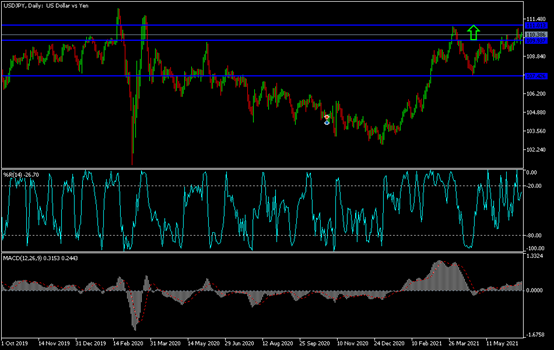

USD/JPY technical analysis: USD/JPY is still trending higher on the 4 hour chart, but it is breaking below the important channel mid-zone to show that a bigger pullback is imminent. It holds 61.8% Fibonacci level so far, but a deeper correction may test trendline support around 109.75. The 100 SMA is also holding as a dynamic support at the moment, and is above the 200 SMA to confirm that the general trend is still up.

If that is the case, USD/JPY could recover to the swing high of 110.82 or channel resistance near the key psychological mark of 111.00 from here. A break below the support could test the 200 SMA, the dynamic inflection point at 109.50, which might be the way to a correction. Stochastic is still heading down to indicate the bears' dominance, but the oscillator is approaching an oversold area to reflect the exhaustion. A reversal to the top may indicate that buyers are taking over and allowing the rally to resume. The RSI is also moving down, so the price may follow suit while the sellers are in control. This oscillator has a bit more headroom to head down before reversing oversold levels.