The USD/INR has continued to incrementally move higher and challenge important technical resistance the past couple of days. A short-term, risk-averse wave has overtaken the USD/INR as financial houses position their portfolios cautiously, and await the pronouncements from the U.S Federal Reserve regarding interest rate policy later today.

The U.S. Fed has been within an extremely dovish framework since the onset of coronavirus. Concerns regarding inflation have started to cause the U.S. central bank to issue talking points regarding their outlook in a focused manner while acknowledging pressures which are building economically. While the coming actions of the Federal Reserve tonight are not known, financial houses have certainly reacted by tightening their USD holdings compared to the Indian rupee.

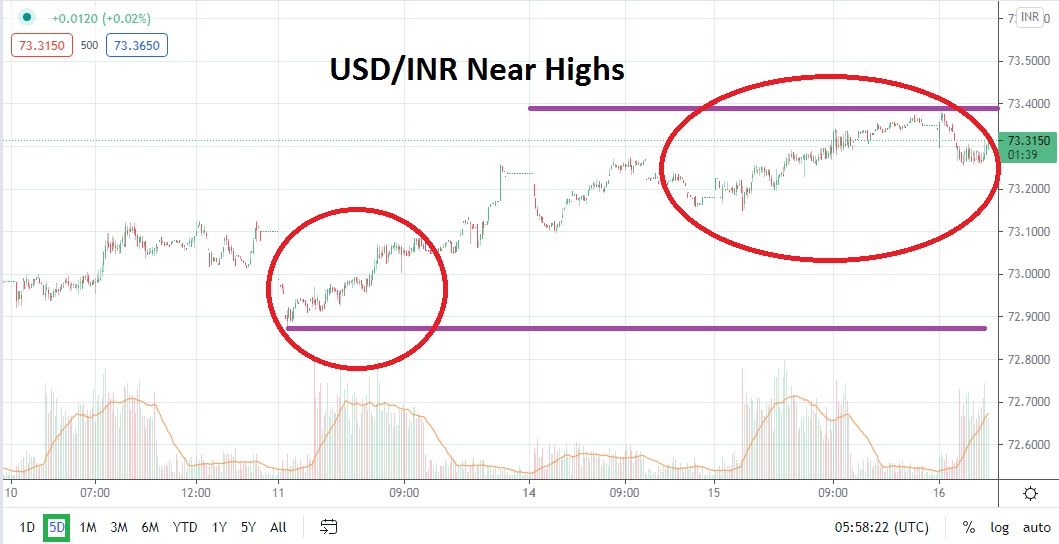

Technically, the USD/INR has reached an extremely interesting level. It can be argued that the USD/INR remains within the lower boundaries of a serious bearish trend, but since the 27th of May, the Forex pair has climbed higher. Late in May, the USD/INR was trading near the 72.3600 ratio. The Forex pair is now trading at approximately 73.3800 as of this morning. Traders who have been pursuing their bearish sentiment the past two weeks likely have been hurt.

With tonight’s U.S policy announcement hovering, traders should be ready for volatile conditions over the next twenty-four hours. Speculators participating with the USD/INR will need to be emotionally strong to handle the gyrations which are definitely going to take place. The question is where direction will unfold. To say the USD/INR will move in both directions is too easy, and traders need to be ready for swift and sudden reversals to occur.

However, if a speculator has the ability to withstand the volatility which is certain to be demonstrated and wants to be aggressive, there is a potential trading avenue they can pursue. Placing a selling position above current market values and close to perceived resistance levels could produce a speculative wager that is worthwhile. Stop-loss and take-profit orders will need to be used.

The USD/INR will move fast, and if a trader is able to catch the Forex pair on a move higher while anticipating a reversal lower because of highs attained, this could prove to be a winning tactic. If the USD/INR returns to a bearish trend, the U.S Federal Reserve will likely have to maintain their current interest rate policy tonight. This is a speculative notion and traders who venture forth with USD/INR before the interest rate mandate from the U.S central bank need to understand that there are risks.

Indian Rupee Short-Term Outlook:

Current Resistance: 73.4050

Current Support: 73.2500

High Target: 73.5200

Low Target: 73.1000