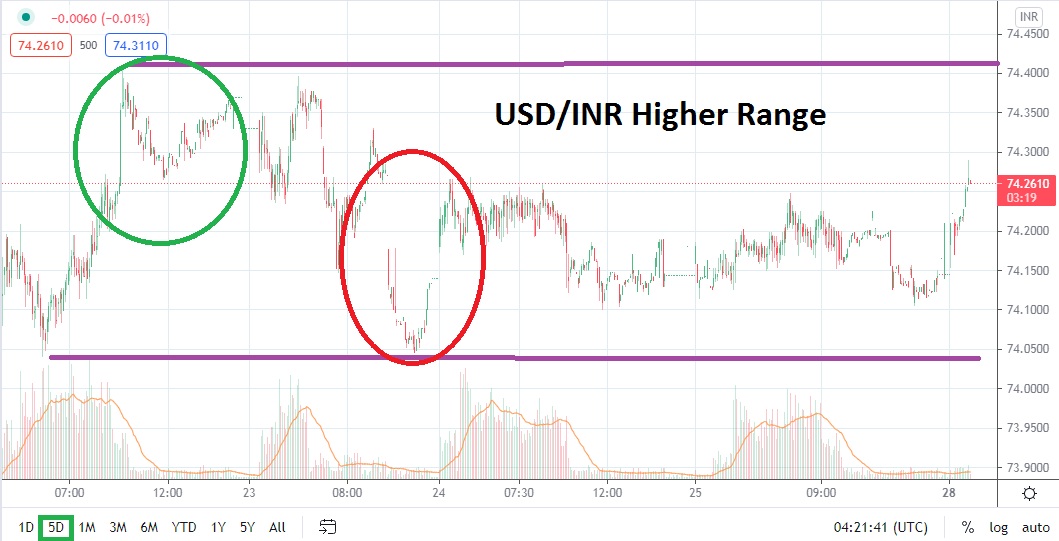

The USD/INR is certainly within the higher part of its mid-term range, but intriguingly, it produced evidence last week of starting to run out of bullish momentum. The high achieved in the past five days of trading has been approximately 74.4100 and this happened early last week. The move higher in the USD/INR may have caught bearish speculators by surprise the past month, but as the USD/INR begins to show signs of losing upwards mobility, traders may be beginning to feel attracted to wager on price action to the downside emerging again.

The highs of 74.4100 and 74.4000 which were seen on the 21st and 22nd of June tested prices not seen since the last week of April. Technically, this value could prove to be significant because when the ratios were seen at the end of April, they occurred as the USD/INR was in the midst of coming off higher values demonstrated on the 21st of the month, when the Forex pair reached an apex over 75.5500. A low of nearly 73.3100 was attained on the 29th and 30th of May in the USD/INR after the powerful move to the downside.

Since hitting this low water mark in May, the USD/INR has certainly moved higher. This was likely a reaction to the long-term lower values being tested, which likely helped ignite a wave of programmed buying among financial houses. The move higher this June was also quite possibly a reaction to pronouncements coming from the U.S Federal Reserve, which spoke about the potential to change their interest rate policy.

Technically, the inability of the USD/INR to break resistance above the 74.4000 mark last week with any sustained momentum may be a signal that the strong buying cycle within the Forex pair is ready to weaken. Traders can certainly aim for nearby resistance levels in search of moves higher, but from a risk/reward perspective, it appears that bearish momentum may be the track to pursue.

Support junctures of 74.2200 to 74.2000 should be watched closely. If the 74.2000 level is broken lower and trading is sustained beneath this mark, it could indicate that additional selling action will join the party. A bearish trend could potentially develop which may prove enticing for speculative sellers that have been waiting patiently for the USD/INR to reverse lower in a strong fashion. The near term seems to suggest that technically the USD/INR was overbought and that lower values can be attained.

Indian Rupee Short Term Outlook:

Current Resistance: 74.3300

Current Support: 74.2050

High Target: 74.4000

Low Target: 74.1000