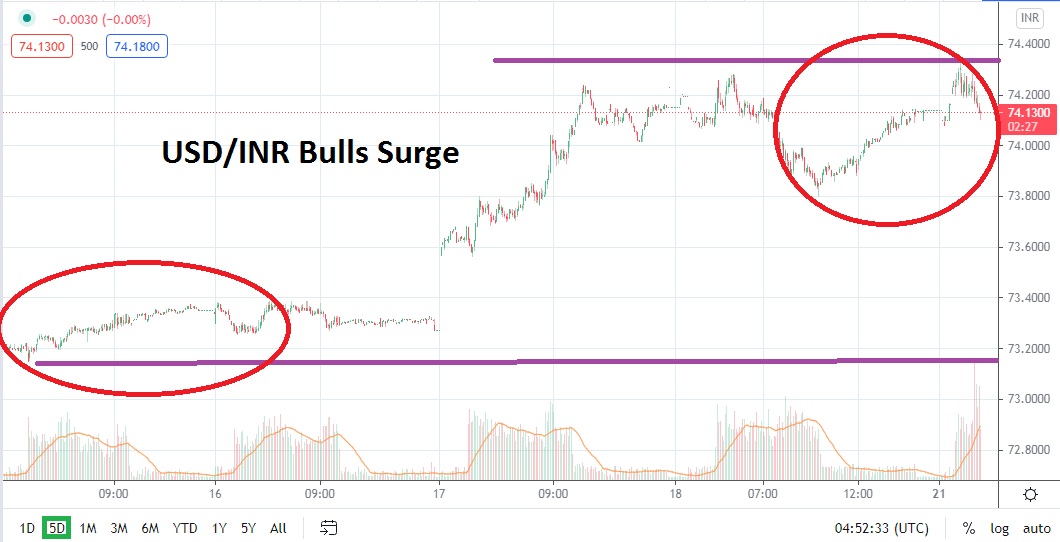

The USD/INR has continued to demonstrate a strong surge higher and broken additional resistance as the bearish trend has seemingly been crushed for the time being. As of this writing, the USD/INR is trading above the 74.1500 mark with fast conditions being demonstrated. Speculators who have stubbornly held onto their bearish technical perceptions have likely suffered a tough period of trading results the past week-and-a-half.

When last Thursday’s trading opened, the USD/INR was still within sight of its rather bearish stance as it moved near the 73.3000 juncture. The Forex pair continued to surge higher, and by Friday, the USD/INR had tested the 74.3000 mark before losing a bit of steam as the weekend approached. Upon opening this morning, the USD/INR moved upwards again and briefly touched the 74.3300 value.

The USD/INR now finds itself in the uncomfortable position of approaching late April values for bearish speculators. Traders who believe the USD/INR has gained too much bullish traction may eventually be proven correct, but timing the Forex market correctly and latching onto the potential of downside price action reigniting may prove difficult. Since the 30th of May, the USD/INR has produced a significant trend higher which started near the 72.3000 values below.

The USD/INR is within sight of values the Forex pair traded as it came out of the apex of a new wave of coronavirus worries which hit hard in April. Technically and fundamentally, the USD/INR appears to have been overbought, but do traders want to go against the rather strong trend which has emerged the past three weeks? If a trader decides to sell the USD/INR within the current cycle of bullish trading, a healthy amount of risk management is needed, including the use of solid stop-loss orders.

The USD/INR is within a highly speculative trading landscape. Current resistance junctures of 74.2550 to 74.3000 do look tempting as places to put limit orders to actually sell the USD/INR if a speculator continues to foster an inclination of bearish sentiment. However, conservative traders may also want to use the current resistance levels as a place to aim for with long positions, and simply buy the USD/INR on moves downward as long as the 74.1000 juncture proves to be durable as support.

Indian Rupee Short-Term Outlook:

Current Resistance: 74.2550

Current Support: 74.1000

High Target: 74.4000

Low Target: 73.7500