After hitting a high of nearly 92.42000 on the 18th of June, the USD/CHF has been able to produce a rather steady move lower. In early trading this morning, the USD/CHF is trading below the 92.00000 ratio, and this could prove to be an important barometer for speculators. As late as the 16th of June, the USD/CHF was trading near the 89.85000 juncture. The move higher certainly coincided with financial institutions readjusting their positions as the U.S Federal Reserve moved forward with its interest rate pronouncements.

However, the past week of trading has begun to show that it may be possible that the sudden surge higher within the USD/CHF could have been overdone. The high water mark of nearly 92.42000 achieved ten days ago tested values seen in the middle of April. Since trading within those higher vicinities in mid-April, the USD/CHF touched a low of nearly 0.89250 on the 9th of June.

Technically, the move higher after touching the low water marks in the second week of June could be considered a natural reversal higher within a healthy market. However, this would be discounting the impact that nervous trading potentially had on the USD/CHF leading up to the U.S central bank's FOMC Monetary Policy Statement. Not only was the bullish move significant, but intriguingly, it did run out of momentum within two days and the USD/CHF has correlated well with other major Forex pairs teamed against the USD.

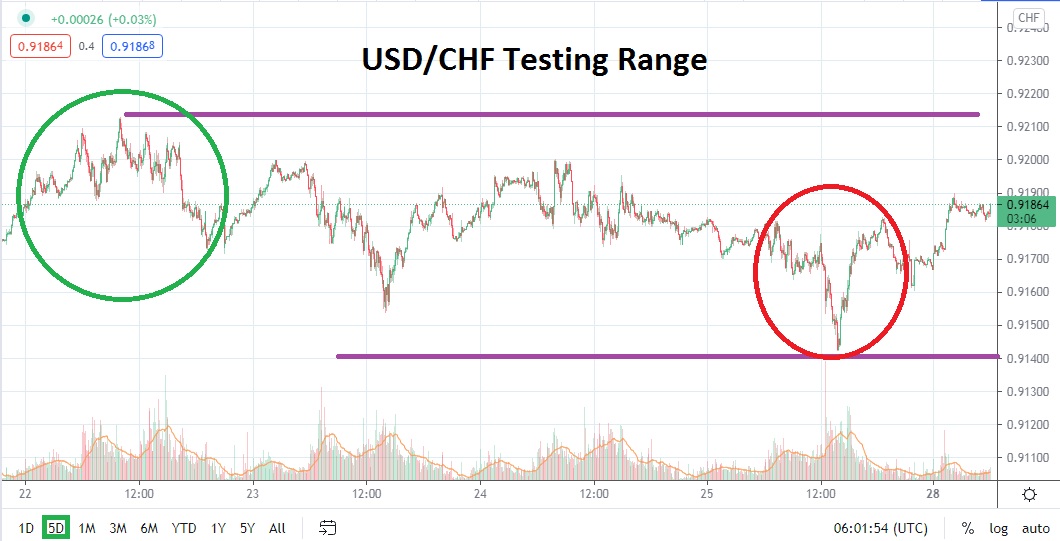

Trading the past handful of days has produced incremental tests lower and support junctures do seem to be legitimate targets. If the junctures of 0.91850 to 0.91900 are able to prove durable as resistance in the coming hours, this could be a signal that additional selling will gather power. On the 23rd of June, a low of 0.91530 was approached, which did cause a reversal higher, but resistance near the 0.92000 proved rather steady. Before going into the weekend, the USD/CHF actually tested lower values near the 0.91350 level before seeing another reversal higher.

The current price level of the USD/CHF does appear rather attractive as a potential area to initiate selling positions. Cautious traders may want to place limit orders slightly above existing market values, while using nearby resistance as their chosen spots to sell the USD/CHF. The ability of the Forex pair to create reversals higher within the past few days of trading should also cause traders to use adequate take-profit targets that do not look for vast move downwards quite yet. Traders are advised not to be greedy and simply cash in profits which are attained when possible, without letting them vanish into thin air.

Swiss Franc Short-Term Outlook:

Current Resistance: 0.92050

Current Support: 0.91700

High Target: 0.92190

Low Target: 0.91350