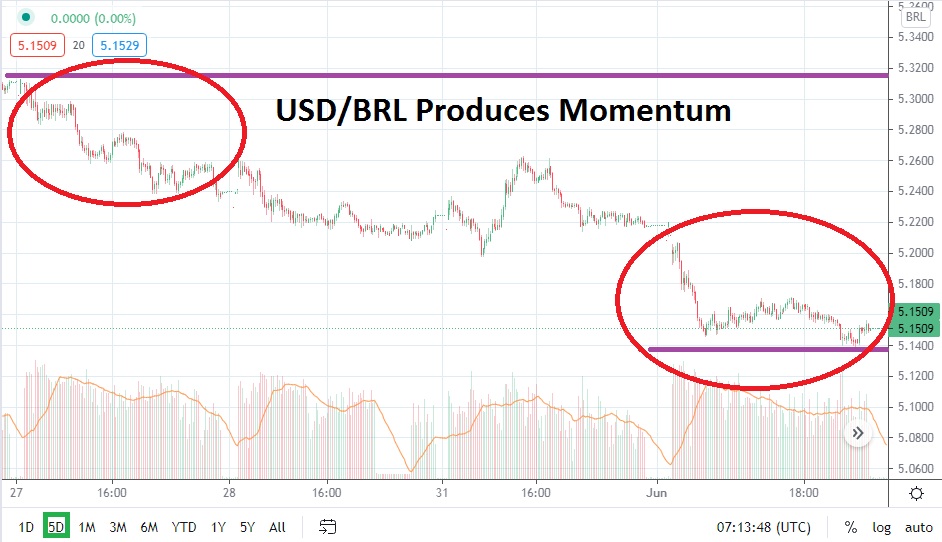

After languishing near support ratios and reversing higher off them for a prolonged amount of time, the USD/BRL actually broke through the 5.2200 ratio with a lot of noise yesterday. After reaching a high of around 5.2600 on the 31st of May, the USD/BRL continues to display actual bearish sentiment, and the Forex pair is now testing values not genuinely traded in a large manner since the third week of December 2020.

The USD/BRL appears to have grasped onto its bearish trend and is showing signs of being able to maintain the stance. Certainly there will be speculators who are still skeptical of the USD/BRL’s rather impressive bearish trend and will want additional proof before they proclaim they are believers. This is because the USD/BRL has delivered a parade of choppy results the past six months.

On the 15th of December 2020, the USD/BRL was trading near the 5.0000 ratio, and on the 8th of March, the Forex pair traded near a high of 5.8800. The bullish move higher happened incrementally and caused plenty of disdain as the Brazilian real simply refused to correlate with many of the other major Forex pairs teamed against the USD. Since the second week of March, however, the USD/BRL has turned around and traded lower. No, the bearish path has not been easy to trade, but the trend is evident.

Traders who remain suspicious of the USD/BRL may want to see trading sustained below the 5.2000 juncture near term before they step into the speculative landscape and seek further downside potential. If the USD/BRL continues to trade lower, the next legitimate targets are the 5.1300 to 5.100 junctures. Traders should use limit orders when wagering on the USD/BRL to make sure their price fills meet expectations. Also, traders should be prepared for quick-hitting trades and capture profits when they become a reality. The USD/BRL has a habit of creating cyclical reversals short term which can test the emotions of speculators.

Intriguingly for short-term traders may be the notion that current resistance levels around the 5.2000 mark can be used as a stop-loss ratio. The junctures of 5.2200 to 5.2500 should be watched carefully, because if they prove vulnerable, this may cause a healthy dose of nervousness among bearish speculators. However, the USD/BRL’s trend has produced downside momentum, which may continue to be demonstrated near term.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.1950

Current Support: 5.1100

High Target: 5.2570

Low Target: 5.0800