The USD/BRL continues to demonstrate a dynamic trading environment which often proves to be extremely challenging. The BRL/USD has not correlated easily to other major Forex pairs teamed against the USD the past year. Coronavirus implications within Brazil and the behavioral sentiment these complications caused certainly did not benefit the Brazilian real.

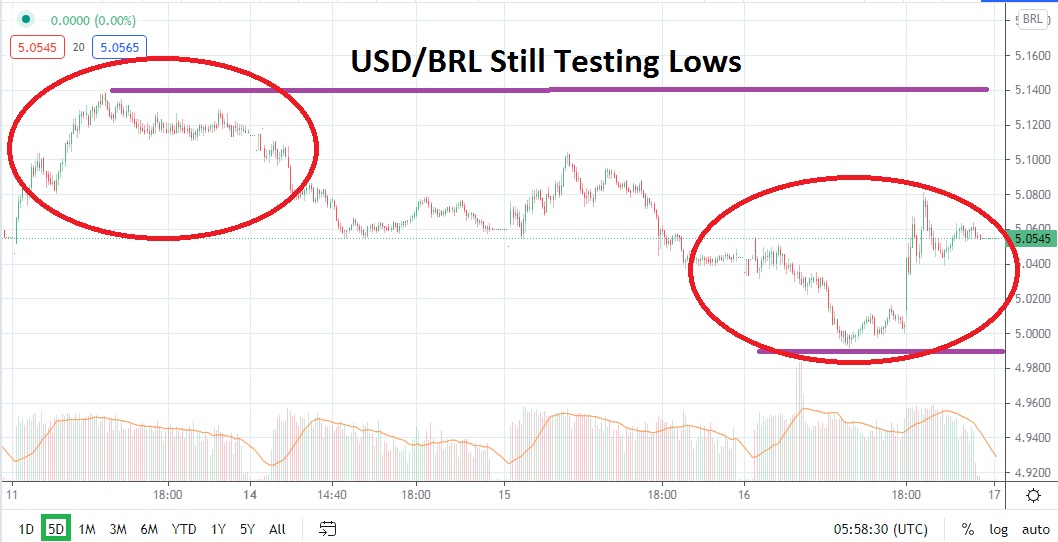

Intriguingly, since the last week of March, the USD/BRL has turned in one of the strongest bearish trends among the major currency pairs. The USD/BRL has traded from a high of nearly 5.8000 since the 29th of March and is now flirting with values slightly over the 5.0000 ratio. The bearish momentum within the USD/BRL has manifested itself rather quickly and its ability to move lower and challenge important long-term support ratios needs to be examined.

Yesterday’s trading within the USD/BRL saw the Forex pair actually break below the 5.0000 mark; the last time this had happened was in June of 2020. A low water mark of about 4.9300 was seen in the first week of June last year, which highlights that the USD/BRL is within sight of crucial support which has proven a tough barrier to puncture. It also needs to be acknowledged that the lower value in June of last year then displayed a reversal higher, which was caused because coronavirus implications in Brazil began to emerge.

The USD/BRL has seen its short-term range become slightly more volatile the past few days, which may have had something to do with financial institutions being risk-averse because of the U.S Federal Reserve’s interest rate policy, which was finally released last night. However, resistance near the 5.0700 to 5.0900 junctures does look rather durable for speculators. The current price of nearly 5.0550 may experience some early fluctuations today, but if resistance proves adequate, traders may want to focus on the potential of more bearish price action.

Selling the USD/BRL on slight movements higher may prove to be a worthwhile wager for speculators near term. If support junctures of 5.0300 to 5.0100 appear to look vulnerable, the USD/BRL may be ready to break the 5.0000 level below and begin to challenge long-term support again. The trend in the USD/BRL since late March has been bearish and there may be room for additional downward momentum.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.0770

Current Support: 5.0260

High Target: 5.1100

Low Target: 4.9300