After suffering many slings and arrows the past year due to the coronavirus fallout, the USD/BRL has now proven it has the ability to shift its trajectory and create a substantial bearish trajectory. The past twelve months of trading for the Brazilian real have created many volatile days and sudden reversals, which have certainly hurt some speculators. However, since traversing near the 5.8000 vicinity in March, the USD/BRL has unleashed a fairly consistent and incremental bearish cycle. Intriguingly, while many other major Forex pairs suffered against the USD in recent weeks, the Brazilian real has proven rather strong.

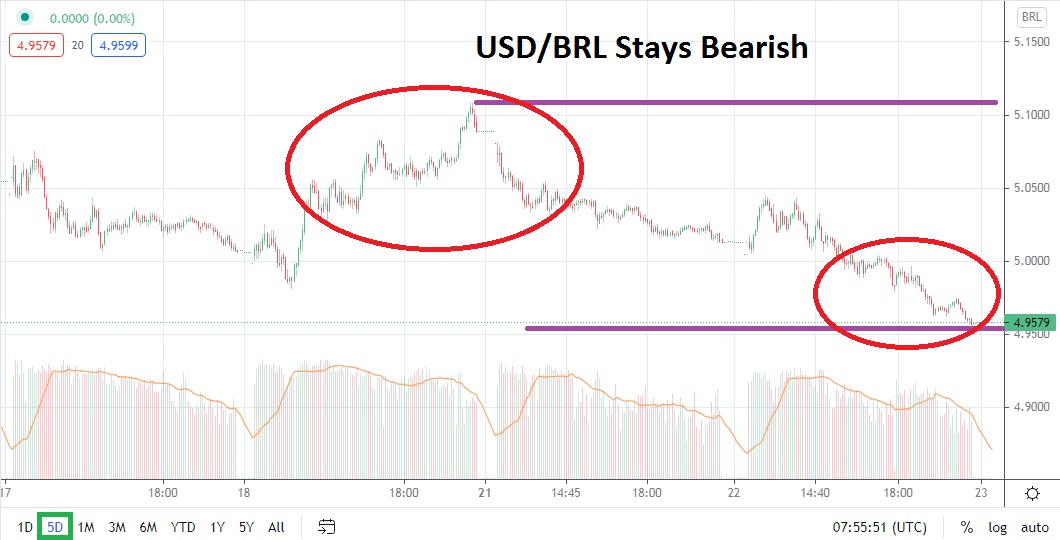

As of this morning, the USD/BRL is trading below the 5.0000 juncture. This accomplishment happened briefly on the 18th of June, but selling pressure yesterday demonstrated an ability to sustain values below the important psychological barrier and, as of this writing, the USD/BRL is near the 4.9600 mark. If the Forex pair is able to open near this value and maintain its price range, speculators may believe this is a strong indicator that the bearish momentum of the USD/BRL is not finished.

Traders need to pull out long-term charts when they consider what potential moves the USD/BRL can achieve, if it continues to build on its downward thrust. The last time the USD/BRL tested its current price levels was in the first week of June, but the calendar year was 2020; yes, over one year ago. The last time the USD/BRL substantially traded below its current juncture was in March 2020. In the first week of March 2020, the USD/BRL was trading near 4.4600, which is a big distance compared to the current value of the Forex pair.

The USD/BRL certainly may be confronted by doubters who believe the economy of Brazil still faces strong headwinds fiscally due to the impact of coronavirus. However, the bearish trend, which ignited three months ago in the Forex pair, may have additional ground to cover before support proves durable. Certainly there will be reversals higher, but until the USD/BRL breaks through resistance near the 5.1100 mark up above, technical sentiment may continue to favor pursuit of selling wagers.

Traders who want to sell the USD/BRL and remain conservative may want to wait for slight upticks which test the 4.9700 to 5.0000 levels. Current resistance levels can be used as stop-loss ratios. Traders should not become overly greedy and cash out winning positions if they flourish. The USD/BRL remains a volatile Forex pair which can challenge all speculators, including those with years of experience.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.0460

Current Support: 4.9200

High Target: 5.0930

Low Target: 4.8500