The USD/ARS continues to trade in nearly a one-way direction as the long-term bullish trend shows absolutely no signs of wavering. The USD/ARS is trading well above the 94.600 level and the 96.700 target is certainly the next step upwards. It is sincerely not a question of if the USD/ARG will eventually hit the 94.800 mark and higher; it is a question of when.

The economy of Argentina remains stoked by bad government policy, and adding misery to the situation is a breakdown in the social network as the population deals coronavirus implications. Argentina is one of the truly great nations and has one of the most romantic cities in the world in Buenos Aires, but the country is seemingly teetering on the verge of systemic collapse under the weight of economic and social plight.

The USD/ARS is a buy for speculators who can participate with the currency on their trading platforms. However, traders have to understand that there are likely costs for participating in the USD/ARS. These might include a rather large price spread, transaction costs and overnight carrying fees, all of which must be calculated into any contemplation of pursuing the bullish trend of the USD/ARS, which is not about to disappear. The question for speculators is if they can get in and out of winning trades quick enough to make the potential costs minimal when pursuing the Forex pair.

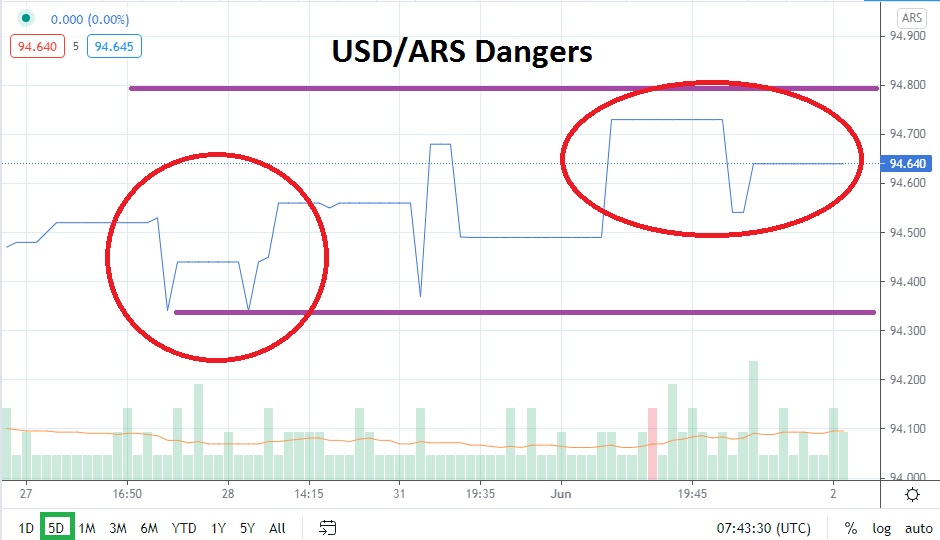

Traders should use limit orders to purchase the USD/ARS, and take-profit targets need to be implemented as soon as positions are opened. Yes, traders need to also have stop-losses in place, because there are slight reversals that are exhibited within the USD/ARS during the day’s trading. As much as the Forex pair has produced steady incremental moves higher, there are sudden dips which do happen on occasion.

However, the trend of the USD/ARS continues to be upwards, and it will take a significant change in the direction of Argentina to change the negative momentum. If a speculator can buy the USD/ARS around the 94.630 to 94.620 junctures that could be good, but more aggressive traders simply may want to be buyers closer to current market prices and then let their trades work with appropriate stop-loss and take-profit orders working.

Argentine Peso Short-Term Outlook:

Current Resistance: 94.700

Current Support: 94.610

High Target: 94.820

Low Target: 94.290