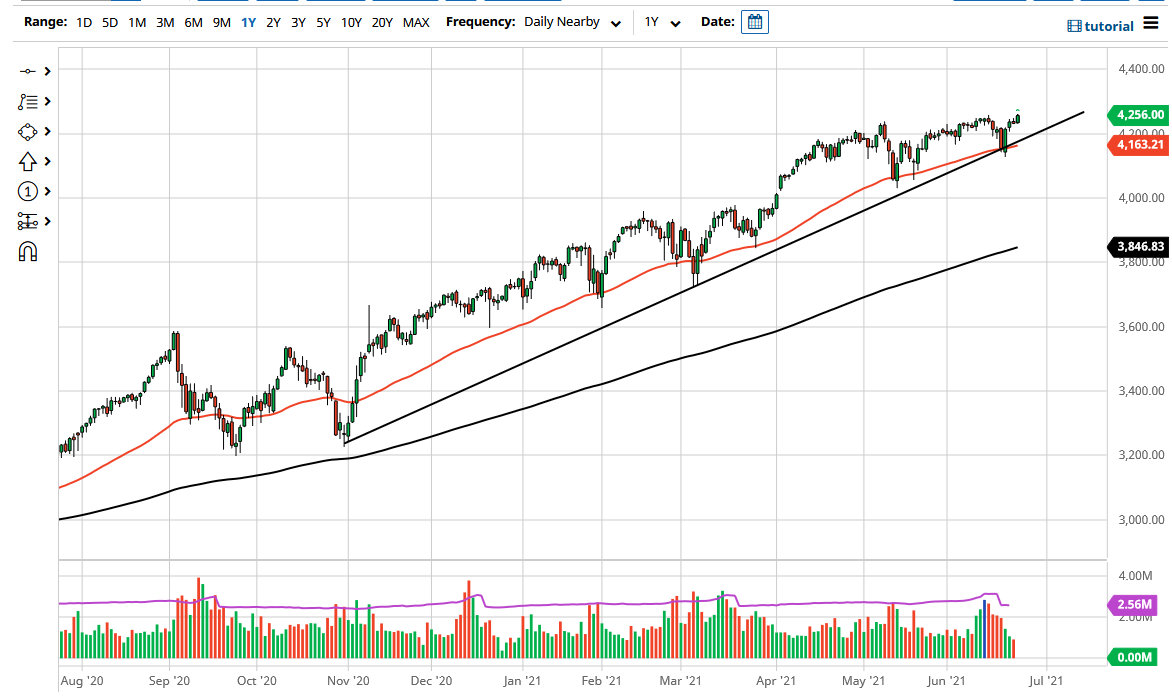

It looks as if the market is settling at an all-time high, and at this point in time it is very likely that we will continue to see a lot of buyers on dips. After all, we have the 50 day EMA walking right along the uptrend line, which sits just below the 4200 level. In fact, we have so much support there that I think that any dip will more than likely be bought into, due to the fact that the Federal Reserve of course has started to walk back its hawkish talk, so at this point in time it looks like it will be “more of the same.”

Even if we do break down below the 50 day EMA, the uptrend line, and of course the 4200 level, then I think it is likely what we will see next is some type of significant move down towards the 4000 level, which of course is a psychologically important level that a lot of people would be paying close attention to. Furthermore, there is a gap that sits at this level, so it makes quite a bit of sense that we would see a bit of push back to the selling pressure.

If we do break down below 4000, then I would be convinced to start buying puts, because I do not have any interest in trying to flat out short the market. After all, the Federal Reserve is very sensitive to the markets falling and will jump in and start jawboning the market higher if there is any hint of trouble going forward. We have just seen that exact same thing happen within the last seven days or so, so there is no reason to think that it will change anytime soon.

At this point, the market continues to be more of a buy on the pullbacks type of situation. I just do not see how this changes anytime soon, so there is no point in fighting it despite the fact that the underlying economy may not necessarily be as bullish as the stock market seems to be. The S&P 500 tends to move in 200 point increments, so this is what i expect comma a move towards the 4400 level