Anybody who follows my writing here at DailyForex knows that I absolutely do not short US indices. This is because the Federal Reserve will do whatever they have to in order to support the markets. It is through that prism that I look at the indices, so I am either flat, long, or if things are really bearish, I am a buyer of puts. This is mainly through experience over the last 13 years since the Great Financial Crisis, as the Federal Reserve will “talk of the market” if they have to. Sometimes they even go as far as buying corporate bonds.

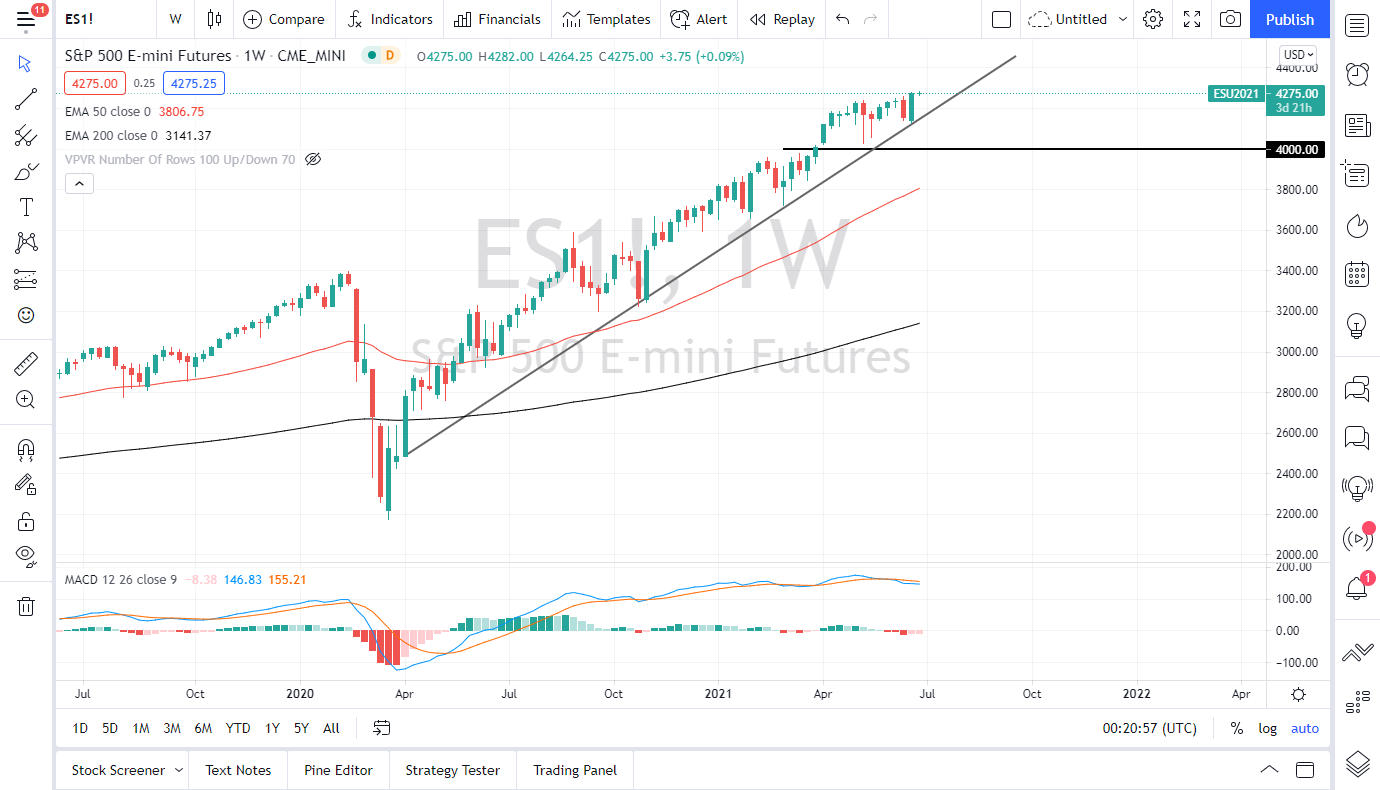

With all that being said, I still use the same technical analysis for this market, and I certainly see a lot of bullish momentum at the moment. You can see that we are currently breaking out to reach towards the 4275 handle, but I think at this point it is only a matter of time before the S&P 500 E-mini contract reaches towards the 4400 level, as it does tend to move in 200-point increments. Furthermore, we also have a nice uptrend line that we have been respecting for well over a year. There is no reason to doubt that it will hold, but even if it does, the 4000 level underneath should be rather supportive. This is not only because of the large, round, psychologically significant figure, but also the fact that there is a little bit of a gap there.

Beyond that, we are getting rather close to Q2 earnings, so I think that could be the next catalyst going higher. The more dovish that the Federal Reserve remains, the more likely this market will go higher. If we do get a bit of US dollar depreciation, that could also propel the market higher.

That being said, another thing to keep in mind is that the US is far ahead of most other developed nations when it comes to the idea of reopening, so that in and of itself could make the S&P 500 rather attractive. Furthermore, the Federal Reserve has given the “green light” for financials to start doing buybacks and giving dividends again, which are a large part of the S&P 500 as well. With that being said, I fully anticipate that the market will continue to go higher throughout most of the summer.