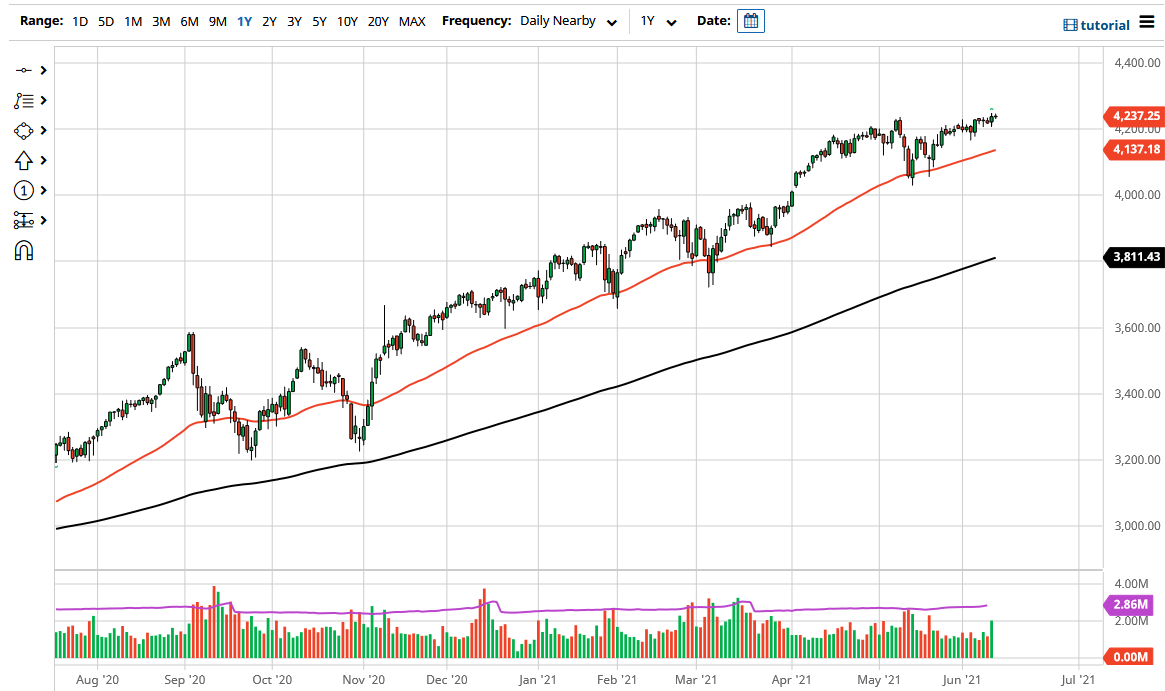

The S&P 500 did almost nothing during the day on Friday as traders focused more on the weekend. That being said, it is obvious that the market is trying to show its strength by hanging about near the all-time highs, so I do like the idea of buying dips, as it offers value in a market that has been so strong for so long.

Underneath, I believe that the 4200 level certainly attracts a lot of attention as it is a large, round, psychologically significant figure, and then we have the gap that sits just above the 4000 handle, which in and of itself is even more important for psychology, so I do think that it is only a matter of time before buyers would re-enter the market. Because of this, it is very likely that we would see a lot of value hunting and pressure to the upside if we get anywhere near any of these levels. Keep in mind that the S&P 500 is being lifted by liquidity measures, and right now it appears that Wall Street is willing to look past any talk of tapering by the Fed.

It should be noted that some people, especially those in the bond market, are signaling that there is possibly a bit of a move coming later this year, perhaps in August or September when the Federal Reserve has to start talking about tapering its bond purchases. If that is the case, bonds should see yields rise, and that will be negative for stocks given enough time. It is not so much the higher yields that cause an issue, at least not initially. It is more about the rate of change and whether or not they spike. The one thing you have to worry about in the stock market right now is whether or not yields suddenly shift higher. If it is gradual, the market can rise right along with it for quite some time.

As far as the upside is concerned, I believe that we will go looking towards the 4400 level eventually, but it is probably going to take some time to get there. After all, this is a market that is very quiet this time of year, so I think this is more of a grind than anything else. A simple glance at the last 10 or so candlesticks shows you just how much volatility has been taken out of this market.