The S&P 500 rallied during the trading session on Friday to close out the week after the jobs number was 559,000 added for the previous month, instead of the whispered 1 million. Because it was not as strong as people suggested it could be, the Federal Reserve may not feel the pressure to taper quantitative easing, which by extension means that Wall Street gets cheap money. With that being the case, they continue to borrow more and more, and then plow into stocks on highly levered bats.

This does not mean that I think the underlying market itself is stable, but at the end of the day this is a one-way bet due to the fact that it is so highly manipulated. Think about it for a moment: Bank of America just yesterday released a “meme stock watchlist.” If this does not scream of bubble territory, not much will. Nonetheless, you can only buy this market due to the fact that if you sell it, you will not only lose money, but worse yet, you could actually make money. What I mean by that is it will only be a matter of time before the Federal Reserve steps in to save everyone. They have done it multiple times over the last 13 years, as the game has most clearly been rigged.

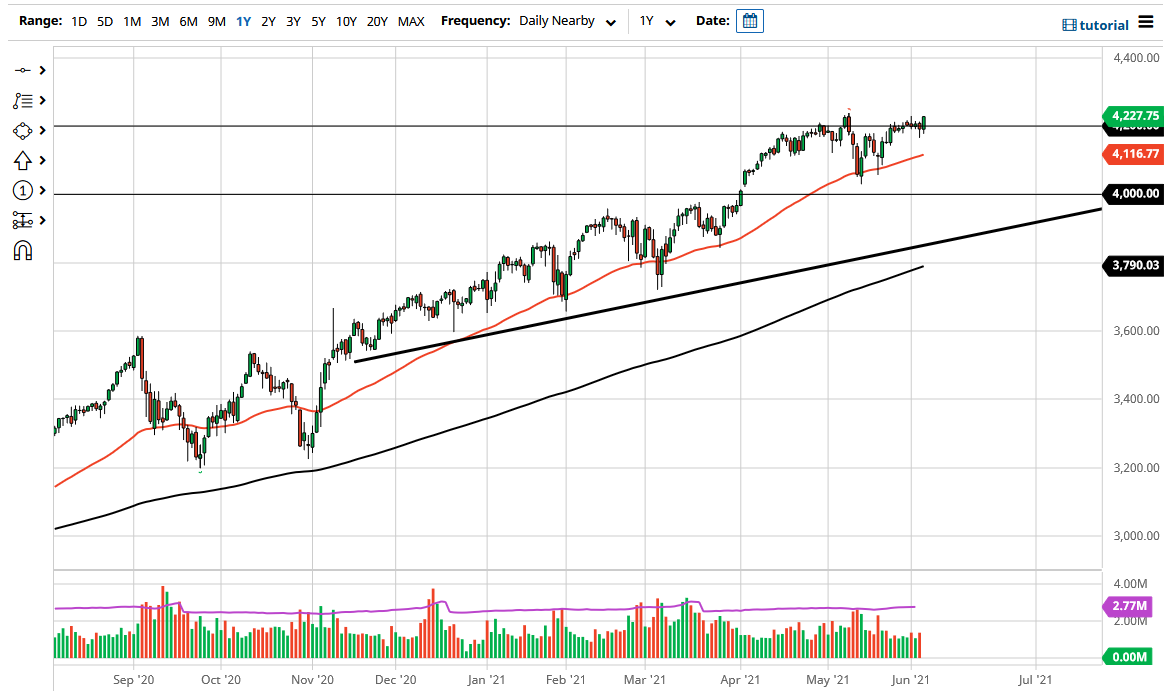

This is not to say that you cannot win at this game, just that you need to understand the type of game that you are playing. Short sellers have been absolutely eviscerated multiple times, and I think that will continue to be the case. Furthermore, the Friday candlestick is closing at the absolute highs for the day, so it does suggest that there is not only bullish pressure, but a lot of conviction as people were more than willing to go home over the weekend long of the market. In fact, if we can reach just a little bit higher near the 4230 level, then it opens up the door for the next move higher. The market does tend to move in 200-point increments, so I would assume that 4400 is the target based upon historical cycles. It is not until we break down below the 4000 level that I would be remotely concerned about the uptrend, but still would not be a seller.