The S&P 500 has initially pulled back during the trading session on Thursday to reach down towards the 4200 level, as the numbers were coming out. After the CPI numbers came out hotter than anticipated, traders decided to turn things around as the Federal Reserve has made it abundantly clear that they were not going to do anything remotely close to tapering or tightening. Because of this, it is more of the same “buy on the dips” type of mentality as the traders around the world continue to look for some type of way to preserve wealth in an environment that it could be destroyed rather quickly.

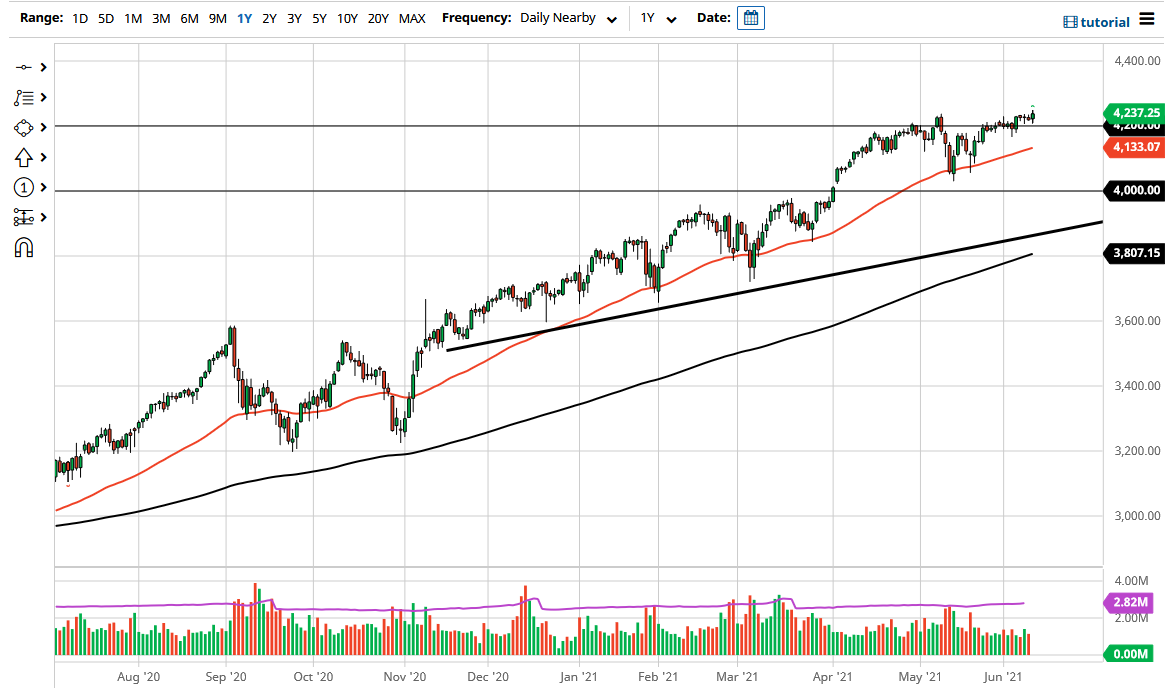

Looking at this chart, we have ended up forming an ascending triangle, and as a result it is likely that we will eventually see a move towards the 4400 level. The market does tend to move in 200 point increments, so all things being equal it suggests that we could go to that area. Short-term pullbacks at this point in time continue to get bought into, and I believe that the 50 day EMA underneath will continue to be supportive as it has been for quite some time. In fact, it almost functions is a trendline in this uptrend.

If we break down below the 50 day EMA, then it is possible that we could go looking towards the 4000 level underneath, as it is a large, round, psychologically significant figure and it is of course an area where there is there is a gap that a lot of people will be paying close attention to. In general, I do not have any scenario in which I am willing to sell, but if we broke down below that 4000 level it is likely that I could be a buyer of puts, but we will have to see how that all plays out. You could make a little bit of money in the markets trading options without overexposing yourself to the Federal Reserve and the other central banks around the world to continue to throw a ton of liquidity at the world. In other words, this continues to see plenty of reasons to go higher, not just from the technical side. Ultimately, this is a market that I think continues to see plenty of interest to the upside. Selling is almost all but impossible.