The NASDAQ 100 fell rather significantly during the trading session on Wednesday as we waited for the Federal Reserve announcement. The fact that the dots on the dot plot moved a bit further to the forefront suggested that tapering could be coming sooner than originally anticipated, but I would not read too much into it. At the end of the day, the market ended up recovering a lot of the losses, so I think we are more than likely going to continue to see a “buy on the dip” type of mentality, as the market is obviously seeing bullish pressure based upon the fact that a lot of short covering happened later in the day. In fact, the daily candlestick ended up being a bit of a hammer, so that suggests that we could continue to try to press towards the upside.

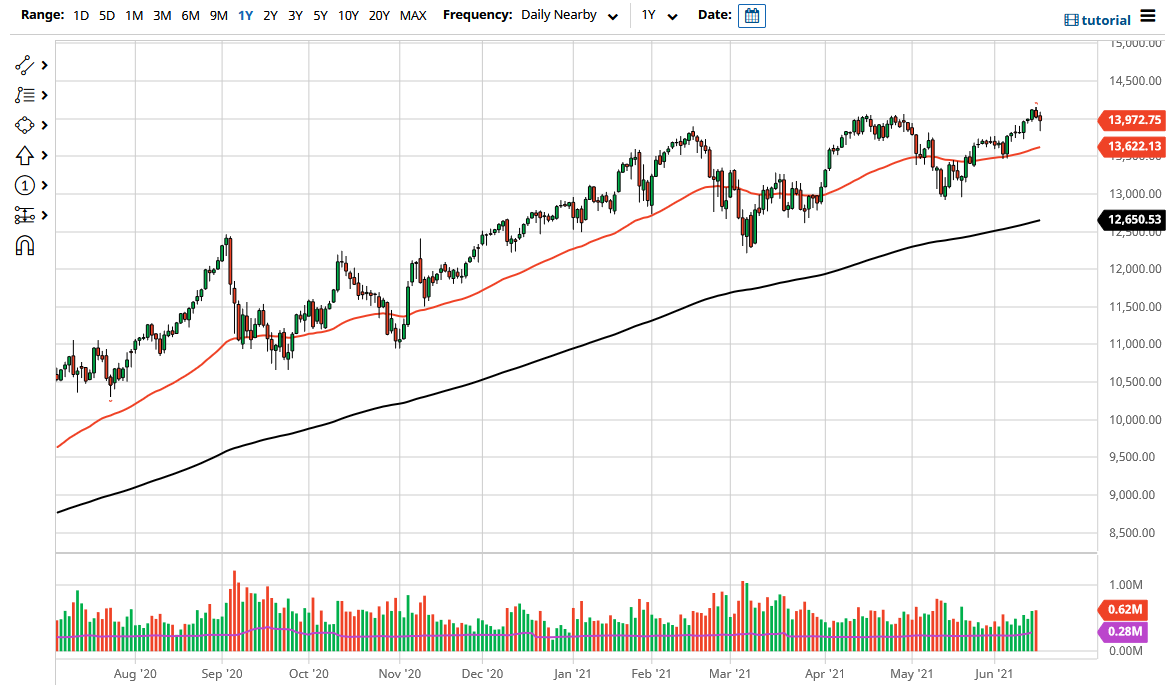

Looking at the chart, it is obvious that the 50-day EMA underneath should offer support, and it is also just as obvious that the 14,000 level continues to be a bit of a magnet for price and support as well. With that being said, I like the idea of buying this market every time it offers a little bit of value, and I think that is what you have seen during the day. Once the algorithms got out of the way, the real traders got involved and understood that they got a bit of a sale.

To the downside, even if we break down below the 50-day EMA and the 13,500 level, it is very likely that we would see support at the 13,000 level as well, where the 200-day EMA is rushing towards. Ultimately, I think that is your short-term “floor in the market”, assuming that we can even get to that level. I would not hold my breath on this, because I think it is going to take quite some time before anything like that happens. We would have to see some type of major spike in interest rates. Interest rates in the 10-year went up to about 1.57 or so during the day after the announcement, but it was not some type of major move like the currency market might have you believing. Nothing’s changed, and in fact I believe that now that we are past the Fed meeting, we probably have further to go to the upside.