The NASDAQ 100 rallied a bit during the trading session on Wednesday but as you can see, we did up forming a hammer just as we did on Tuesday. With the CPI numbers coming out during the trading session on Thursday, it is probably not a huge surprise to see that traders may have been a little bit reluctant to put a lot of money to work.

That being said, if the inflation numbers do cool off a bit, then it is likely that the NASDAQ 100 might be one of the main beneficiaries as it typically favors growth stocks when rates are lower and of course vice versa. This has been one of the biggest problems with the NASDAQ as of late, interest rates have spiked again, and that of course works against the value of the main drivers of this index. Nonetheless, this is an index that is highly correlated to the top five or six companies, so you really only need to pay attention to all of the usual suspects.

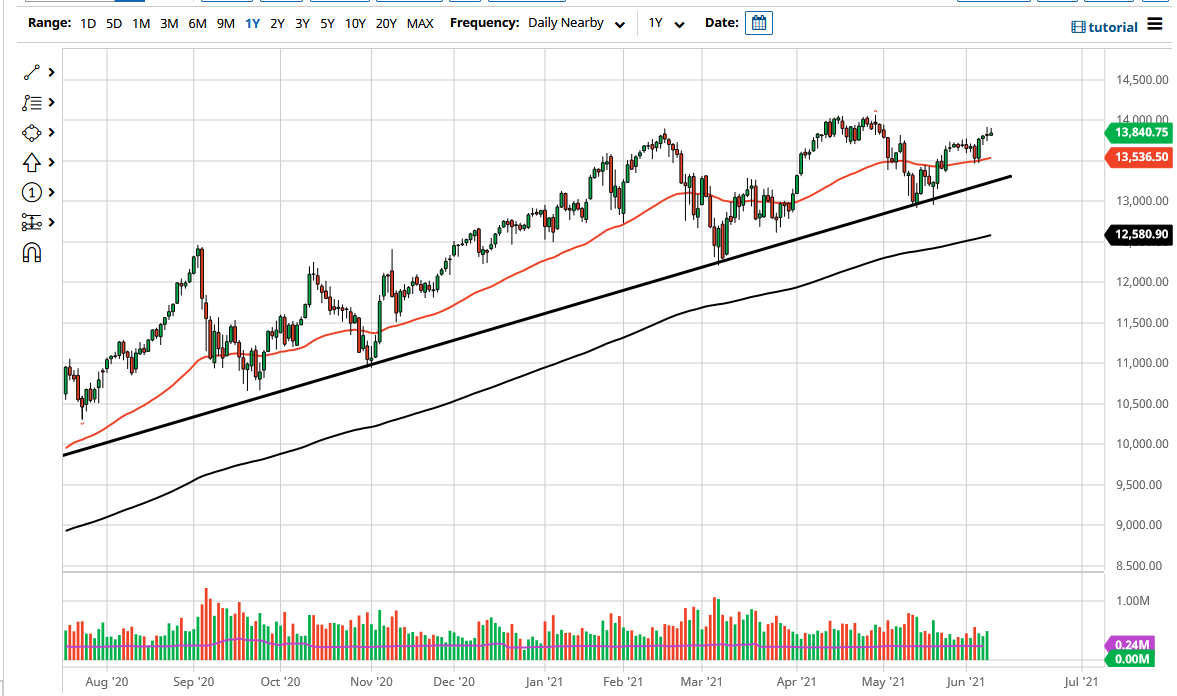

To the downside, I believe that the 50 day EMA at the 13,535 level continues offer support, followed by an uptrend line just below there. Both of those areas could be buying opportunities if we get some type of selloff due to the announcement, as it could offer quite a bit of value. In fact, I have no interest in shorting this market but if we did end up breaking down below the uptrend line, then you might be able to convince me to start buying puts, but that is about as bearish as I get when it comes US indices as they are so heavily manipulated by the Federal Reserve and its actions.

The 14,000 level above is significant resistance, and as a result I look at that being broken to the upside is a very bullish sign. At that point, I would anticipate that the market would go looking towards the 14,500 level, followed by the 15,000 level which is my longer-term target. This does not necessarily mean that we get there overnight, but I do think that the occasional pullback is going to end up offering plenty of value the people can take advantage of if they are patient enough. Until then, I think that we bang around between 13,500 on the bottom and 14,000 on the top.