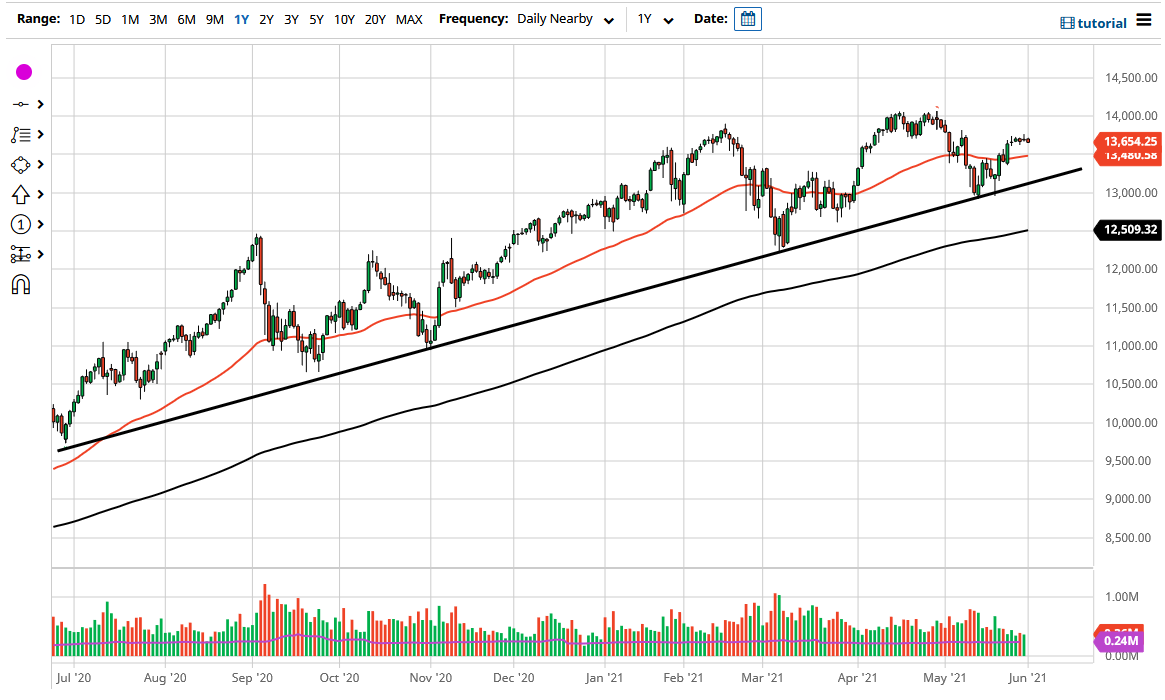

The NASDAQ 100 futures were slightly negative in limited trading on Monday due to the Memorial Day holiday. Because of this, the market looks as if it is trying to rollover just a bit in order to find some type of support. That being said, I would not read too much into the candlestick other than the fact that it looks like the other ones from the past 45 sessions. This does suggest that the NASDAQ 100 is probably going to continue to struggle to go higher in the short term, but long term, it is most certainly going to remain a very positive market.

Underneath, we have the 50-day EMA coming into the picture to offer potential support. After that, we also have a significant uptrend line that is worth paying attention to, so I do not really see a scenario in which you could be a seller of this market. However, if we were to break down below that uptrend line, then I would consider buying puts as a way to limit your potential losses but still take advantage of any significant selloff. Remember, the NASDAQ 100 has a history of selling off quite drastically, only to turn around and recover just as quickly.

To the upside, I believe that the 14,000 level is a target on and impulsive green candlestick, but it might be a bit quiet this week as we await the jobs figures out the United States. If we could break out of the range that we had been in and get above the 14,000 level handily, that could open up a move towards the 14,500 level, possibly even the 15,000 level eventually. That is my longer-term target, but that is more or less something that I am thinking might happen by the end of the year, not the end of the week.

Expect choppy behavior in general, but more of a positive tilt than anything else. When I look at this market, I expect that pullbacks will offer buying opportunities given enough time, because that is a natural proclivity of the market in a deep liquidity-injected type of environment that we have seen. I do not see the central banks changing much, and therefore any “knee-jerk reaction” will be bought into given enough time.