A strong US dollar led to two sharply bearish trading sessions for the price of gold last week that pushed it towards the support level of $1855, a 3-week low. This was an opportunity for gold investors to buy, so the price of gold rebounded to the level of $1892 by the end of trading. The markets saw that the US jobs numbers still needed improvement before there might be a strong shift in the policy of the US Federal Reserve.

Gold prices rose as data from the US Labor Department showed a smaller-than-expected increase in US non-farm payrolls for the month of May, raising hopes that the Federal Reserve won't raise interest rates anytime soon. A weak dollar and lower bond yields also contributed to gold's rally.

Data from the Labor Department showed that US non-farm payrolls jumped by 559,000 jobs in May after rising by an upwardly revised 278,000 jobs in April. Economists expected the number of US jobs to increase by 650,000 jobs compared to the addition of 266,000 jobs originally reported for the previous month.

The Labor Department also said the US unemployment rate fell to 5.8% in May from 6.1% in April, while economists had expected the unemployment rate to fall to 5.9%. With a larger-than-expected drop, the unemployment rate fell to its lowest level since it reached 4.4% in March 2020. Investors seem to be looking at weaker-than-expected job growth as a "Goldilocks" situation, with the economy growing but not fast enough to encourage the Fed to tighten monetary policy.

On the other hand, a report from the Commerce Department showed that new orders for manufactured goods in the United States fell more than expected in the month of April, declining by 0.6%, after rising by an upwardly revised 1.4% in March. Economists had expected factory orders to fall 0.2% compared to a 1.1% jump the previous month.

US President Joe Biden portrayed the May jobs report as a springboard for more spending on infrastructure and education to keep growth going - essentially an argument for his agenda. But Friday's employment figures also hinted at potential limits to how much government aid could be pumped into the world's largest economy.

"We are on the right track," Biden said." And our plan is working. We will not falter now. We will keep moving forward. I am very optimistic.” Biden's challenge is to convince Americans that his administration's relief efforts to date have done well enough to sustain faster growth, rather than creating inflation and imbalances that could jeopardize public support for his plans to invest at least $3 trillion more in roads and clean energy.

The report noted that there aren't enough people looking for work, a potential problem for a president who hopes the rescue package will return the country to full employment by 2022. While Biden viewed the job numbers as an argument for his agenda, several economists were urging a degree of caution to see if more Americans would start looking for jobs after the heavy losses caused by the coronavirus pandemic.

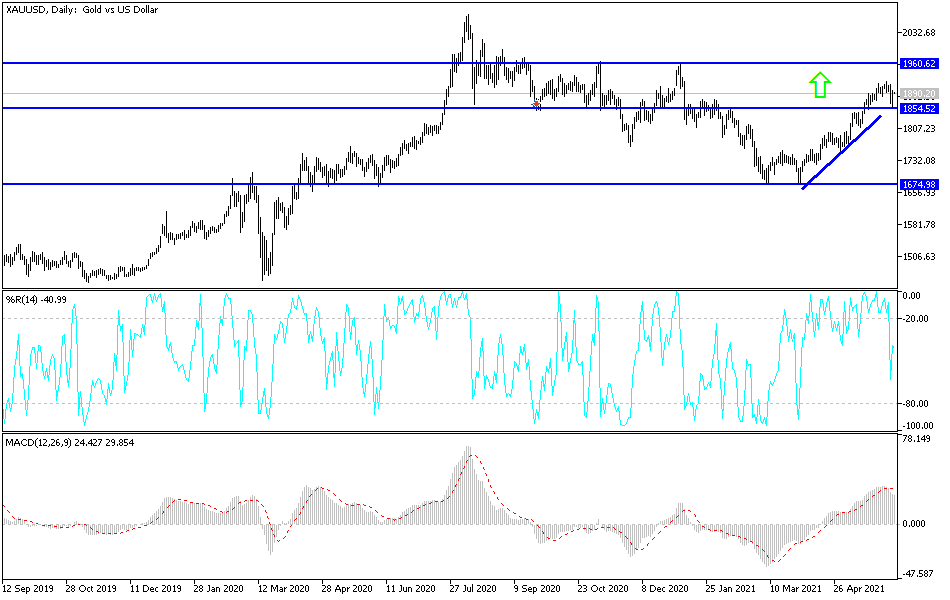

Gold Technical Analysis:

As long as the price of gold is near the resistance level of $1900, the general trend of gold will remain bullish. So far, gold investors are buying the dips, and the closest support levels for gold are currently $1885, $1870 and $1855. On the daily chart, the general bullish trend will not be broken without testing the $1855 support again.

The price of gold will be affected today by the strength tof the US dollar after the recent jobs data and the extent of risk appetite.