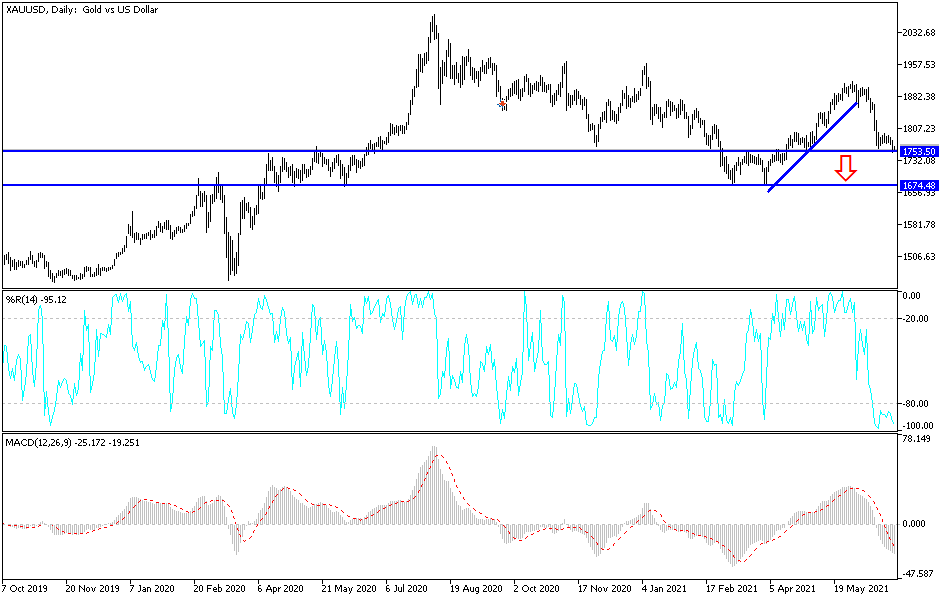

The price of the yellow metal is awaiting the announcement of the American jobs numbers, which often move the dollar. The positive numbers will not be in favor of the opportunity to correct upwards for gold, but will increase the suffering to move towards stronger support levels. The closest to them are currently 1748 dollars and 1728 dollars an ounce, respectively, which are sufficient levels to move the technical indicators to severe oversold levels.

On the upside, as I mentioned before, there will be no chance for gold to correct upwards without breaching the psychological resistance level of $1800 an ounce.

In addition to the dollar level, investors are counting on the increasing global fears currently from the variables of the Corona virus, which may return the global economy to closing again. In this regard, Russian health officials approved booster doses for those vaccinated against COVID-19 six months after their first dose. Yesterday, 20,616 new infections and 652 deaths were recorded - the highest daily death toll from the epidemic.

Russian Health Minister Mikhail Murashko told a government meeting on Tuesday that the ministry had updated its vaccination guidelines. Those infected with the Coronavirus are allowed to be vaccinated six months after their recovery and those who have been vaccinated are allowed to receive a booster injection six months after the first vaccination. Russia's coronavirus task force has reported more than 20,000 new infections per day since last Thursday, more than double the average in early June.

Russia was among the first countries to announce and deploy a coronavirus vaccine last year, but it has since vaccinated only a fraction of its population of 146 million. More than 23 million - just over 15% - have received at least one dose, Murashko says.

Corona’s variables also caused the postponement of Freedom Day in Britain to July 19, instead of June 21.

South Korea reported its biggest daily rise in new coronavirus cases in about two months, just a day before it plans to relax physical distancing rules. On Wednesday, the government said it had confirmed 794 new cases over the past 24 hours, about 80% of them in the greater Seoul area, where more than half of South Korea's 52 million people live. As of Thursday, authorities plan to allow social gatherings of up to six people - up from the current four. Restaurants, cafes and other businesses will be allowed to stay open until midnight, instead of 10pm. The relaxed distancing guidelines will apply outside the Seoul area.

Health Minister Kwon Duc Chol said the government will restore strict social distancing rules if the outbreak becomes more serious.

In general, the price of gold will be affected in the upcoming trading sessions by the level of the US dollar, especially after the announcement of US job numbers, in addition to the extent to which investors are willing to risk or not, the path of the outbreak of the Corona virus variables and the threat of imposing restrictions on the global closure again.