The price of the yellow metal is stable around the level of 1783 dollars an ounce at the time of writing the analysis. The rebound gains since the beginning of the week’s trading did not exceed the resistance level of 1790 dollars an ounce.

Expectations of imminent tightening of US central bank policy support the dollar and increase pressure on gold. In his prepared remarks, Fed Governor Powell said the current rise in inflation is likely to be temporary and could return to the Fed's 2% target when supply imbalances are resolved.

The Fed chair gave a positive assessment of the labor market, saying that employment should rebound in the coming months as vaccinations advance and the economy emerges from the pandemic. "We at the Fed will do everything we can to support the economy as long as it takes to complete the recovery," Powell noted.

On the economic side, a report from the National Association of Realtors showed that US existing home sales fell further in May. Whereas, NAR said, existing US home sales fell 0.9% to an annual rate of 5.80 million in May after declining 2.7% to a rate of 5.85 million in April. Economists had expected existing home sales to decline 2.2% to a rate of 5.72 million.

Existing home sales are down 12.9% since January but are still 44.6% higher than in May of 2020.

Policy makers at the Federal Reserve advised last week that US interest rates would rise from record lows sometime in 2023, to refresh earlier expectations of hikes through 2024. A bullish stance on interest rates boosted the dollar. As a result, the DXY Dollar Index is up 1.5% over the past week. It was his best performance since last September.

In contrast, the goods received a heavy blow. Gold was trading for the worst weekly performance in 15 months.

For the record, the US Federal Reserve is not alone in offering potential interest rate increases. Norway's central bank plans to raise interest rates in September, according to the Financial Times. A second rate hike is possible as soon as December. Meanwhile, the Central Bank of Canada reduced its bond purchases from April. He is therefore the first to reduce the quantitative easing (QE) stimulus. While no one else has made announcements about imminent changes, the trend is developing for less quantitative easing and higher interest rates.

The positive conclusion is that global central banks see growth as strong enough for monetary policy to gradually return to some sense of normality.

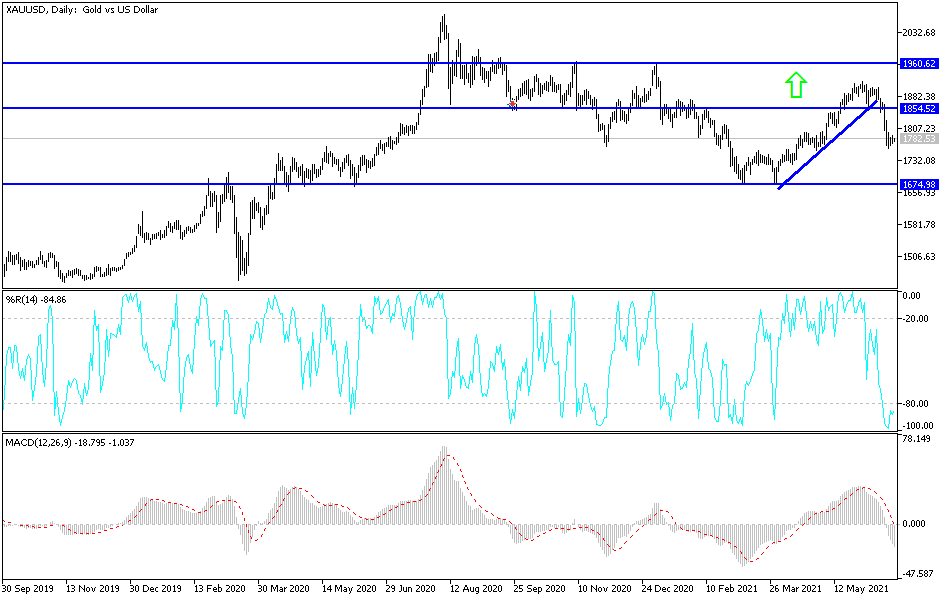

According to gold technical analysis: On the daily time frame, the price of gold is still under pressure of a downward correction, and there will be no opportunity for the bulls to control the performance without settling above the psychological resistance of 1800 dollars an ounce again. Currently, the closest support levels for gold are 1775, 1760 and 1745 dollars, respectively, and I still prefer buying gold from each descending level. The price of gold will be affected today by the price of the dollar and the market's reaction to the announcement of the readings of the manufacturing and services PMI for the euro area, Britain and the United States.