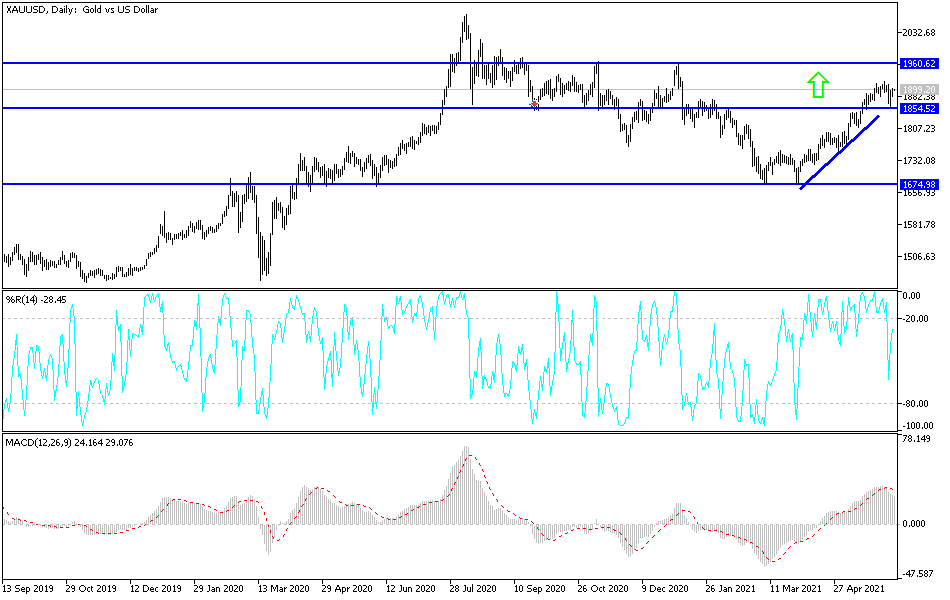

Gold markets pulled back a bit during the trading session on Monday, but then turned around to show signs of life again. As we stand right now, it looks as if the $1900 level is going to continue to be a place where we attract a lot of inflows on dips. However, gold markets have a lot of different things going on at the same time, so it is very likely that we will continue to see a lot of choppy and misdirected volatility.

The Consumer Price Index comes out in America on Thursday, which could have a significant influence on what happens next year. Nonetheless, it certainly looks as if the market is trying to find its footing, so I pay special attention to pullbacks near the $1850 level, because I think that is an area where we could see quite a bit of interest based upon the bounce in the previous resistance. After that, the previous downtrend line comes into play as support, and then the 50-day EMA comes into the market for support as well.

To the upside, if we could break to a fresh high for the last month or two, then it is likely that we could go looking towards the $1950 level, an area where we have seen selling pressure in the past. Beyond that, then we open up the possibility of a move towards the $2100 which was the all-time high, so it will attract a lot of attention. If you are paying close attention to the market, you can see that we have recently had the “golden cross”, which is when the 50-day EMA has broken above the 200-day EMA, and that is something that a lot of longer-term traders will be paying close attention to, with an eye on that longer-term resistance barrier in the form of $2100. That is an area that I think would attract a lot of attention and therefore a lot of resistance, but if we can break above there, then it becomes even more of a “buy-and-hold” scenario. On the other hand, if we break down below the 200,-day EMA then it is likely we will drop $100 rather quickly to go down towards the $1700 level underneath where we have seen quite a bit of support in the past.