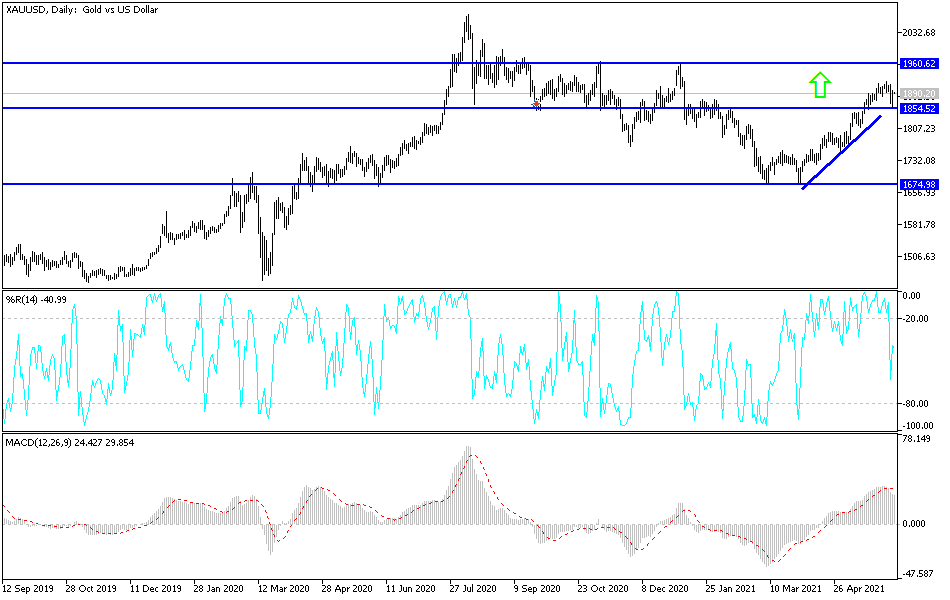

The gold markets fell initially during the trading session on Friday, reaching down towards the $1850 level before turning around and showing signs of life again. This is a market that recently has broken out of significant resistance, and the action on Friday only solidified the idea that it could go higher. Gold is being thought of as a way to beat inflation at the moment, and as long as we will get some type of major spike in US yields, it is very likely that we will continue to see overall upward pressure.

The $1850 level is a large, round, psychologically significant figure, which is an area that previously had been resistance. Furthermore, that support is backed up by a downtrend line that we had broken out of and the 50-day EMA. We recently had the “golden cross” that a lot of longer-term people will pay close attention to. With that in mind, I think the whole idea of the support underneath should continue to lift this market. If we can break above the highs of the candlesticks from earlier in the week, that could open up the possibility of a move towards the $2000 level, possibly even the $2100 level. Furthermore, you should keep in mind that although we have not wiped out all of the selling from before, we have most certainly seen a whole lot of upward pressure.

That being said, if we were to break down below the previous uptrend line, that probably would send gold much lower. This will be especially true if yields in the bond market get out of control, or if the US dollar strengthens in general. At this point though, that does not look likely to be the case, so I think we will continue to see more of a “buy on the dip” situation in gold, albeit at a very slow pace. Market participants will continue to look at this market through the prism of positivity, so it is difficult to fight that argument. I would be adding slowly and would not be overly excited to build up a huge position right away because of the inherent volatility of gold markets in general. I would also keep an eye on that US Dollar Index chart because it could lead the way as well, as it does tend to have a strong negative correlation.