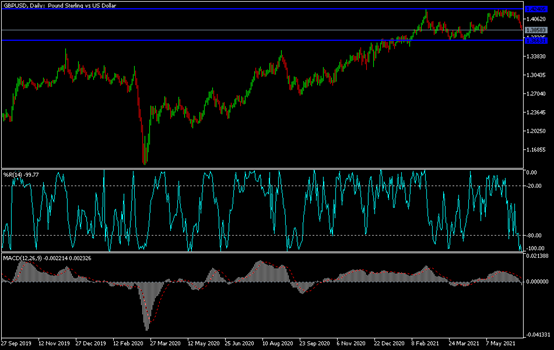

Amid a trend for a bearish weekly closing, the price of the GBP/USD currency pair moved towards the 1.3855 support level. This is its lowest in a month and a half, and stable near it at the time of writing the analysis, waiting for any news.

The US dollar is still reaping many gains against the rest of the other major currencies after updating the US Federal Reserve's policy, which gave a clearer picture to the markets, with the date of tightening its monetary policy approaching closer than previously expected.

Commenting on the performance of sterling, HSBC's forex analysis team are unsure that the good times will continue for the British currency beyond the year 2021. In fact, the team led by Paul McKelle, the bank's forex analyst remains "the most pessimistic of the sterling". In a regular paper on FX being brought to the fore by the UK's preeminent lender and international banking giant, he says sterling's recent strong performance has been driven by a stronger economic recovery and "a higher movement in interest rates at the front of the curve".

“We remain skeptical that outperformance can be sustained with expectations that are too high compared to reality.”

The British pound is one of the best performing currencies in 2021 - second only to the Canadian dollar - rising 4.0% against the euro and 3.35% against the US dollar. The outperformance has persuaded a large portion of the market to engage in bets that favor further gains, something McCell describes as an "optimistic frenzy".

HSBC has found that the main driver of the pound - UK interest rates - has now decoupled from the currency's current values, leaving it at risk of a correction down. They found that the movement in the GBP/USD pair was much more aggressive than the movement of forward interest rates in the GBP. In general, what underpins HSBC's pessimism towards the British pound is the state of the British economy. They acknowledge that while he recovers, he will continue to fail to outperform his peers over the next two years.

It is this lag among its peers that ultimately leaves sterling on the slow track.

The headwinds blowing against the economy include the Brexit adjustments while the UK's persistent current account deficit (the UK imports more than it exports) is seen as a long-term headwind for the currency. Another reason forex FX analysts regularly cite for the pound's strong performance in 2021 is the country's rapid vaccination rate that was expected to allow the country to launch on a sustainable basis ahead of others. But the country's vaccination rate has now fallen behind that of Canada, the United States, Germany, France and Italy, with little sign that it will regain its once-enjoyed position given limited vaccine supplies.

The vaccination benefit may not be counted in vain given the UK's delay in fully lifting restrictions due to the high delta variant cases of Covid.

HSBC's research shows that the positive vaccine story has not necessarily been reflected in the UK's outperforming economic performance, and is unlikely to ever be. HSBC raised its forecast for the pound, but these estimates are still below current levels at once. The GBP/USD exchange rate is expected to be at 1.40 by the end of June 2021, up from 1.34 previously. It is forecast at 1.34 by the end of the year, unchanged from the previous forecast. By mid-2022, the exchange rate is expected to be 1.34.

EUR/GBP is expected to record 0.85 by the end of June 2021, 0.9179 by the end of the year and 0.88 by mid-2022.

GBP/USD technical analysis: The general trend of the GBP/USD currency pair quickly turned to the downside. Some indicators still have space before moving towards strong oversold levels, and accordingly, the support levels 1.3850, 1.3775 and 1.3690 may be in the crosshairs of the upcoming bears' targets. On the other hand, returning to the resistance 1.4080 might give the bulls some hope to control the trend again. So far, the general trend is to the downside and is heading towards a bearish weekly closing, and next week is counting on some correction.