Profit taking selling operations contributed to the decline in the price of the GBP/USD currency pair. The support level of 1.4073 and before closing the trades, it tried to rebound up to the resistance level 1.4185 and closed the trades around the 1.4113 level. I mentioned earlier that this could happen at any time and the current situation is ideal for that.

There are fears that Britain will complete the final conquest of the economy, as well as sharp skirmishes between the two sides of the Brexit - the European Union and Britain. In addition, forex traders accept to buy the US dollar ahead of an important date this week, as the US Federal Reserve will announce an update to its monetary policy, along with a package of important economic data related to inflation and spending in the United States.

Ahead of this week's trading, Britain accused European Union leaders of taking an "offensive" view that Northern Ireland is not a full part of the United Kingdom, as Brexit cast a shadow over the G7 summit. Britain and the European Union are at odds over post-BREXIT trade arrangements that could block some British exports to Northern Ireland, the only part of the UK that borders the 27-nation bloc. The dispute raises political tensions in Northern Ireland, where some identify as British and others as Irish.

British Prime Minister Boris Johnson asked French President Emmanuel Macron when they met on Saturday in the English resort of Carbis Bay how he would feel if sausages could not be transported from Toulouse to Paris, British media reported. They said Macron responded that the comparison did not work because Paris and Toulouse are part of the same country.

UK Foreign Secretary Dominic Raab said the notion that Northern Ireland is not an integral part of the UK is "not only offensive, but has real global impacts on communities in Northern Ireland, of great concern, of great bewilderment". "Can you imagine that we talked about Catalonia, the Flemish part of Belgium, northern Italy, Corsican France, as different countries?" he added to Sky News. We need a little respect here. And also, frankly, in recognition of the situation for all communities in Northern Ireland.”

Relations between Britain and the European Union have been strained since the UK seceded from the final bloc at the end of 2020, more than four years after the vote to leave.

The European Union is angry at the British government's delay in implementing new checks on some goods coming into Northern Ireland from the rest of the United Kingdom, as agreed in the Brexit divorce deal. The union is threatening legal action if the UK does not fully bring in checks, which include a ban on refrigerated meats such as sausages from England, Scotland and Wales to Northern Ireland early next month.

Britain accuses the European Union of taking a "fundamentalist" approach to the rules, which leads to cumbersome red tape for businesses. For his part, Johnson said that if a solution is not found, he may pull the emergency brake to allow either side to suspend parts of their agreement. It is only intended for use in extreme cases, but the European Union briefly threatened to recall it in January to halt vaccine doses from Ireland across the border.

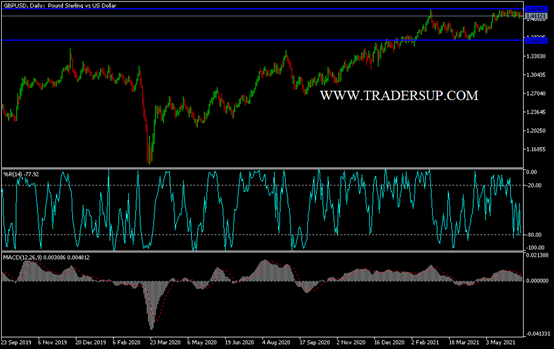

Technical Analysis of GBP/USD: In the near term and according to the performance on the hourly chart, it appears that the GBP/USD is trading within a highly volatile sideways channel. The pair recently dropped to the oversold levels of the 14-hour RSI. Accordingly, the bears are looking to extend the current decline towards 1.4080 or less to the 1.4038 support. On the other hand, the bulls will target rebound profits around the 1.4143 resistance or higher at the 1.4182 resistance.

In the long term and according to the performance on the daily time frame, it appears that the GBP/USD currency pair is trading within the formation of an ascending channel. This indicates a significant long-term bullish momentum in market sentiment. The pair pulled back recently to avoid crossing over to the overbought levels of the 14-day RSI. Accordingly, the bulls will look to ride the current bullish wave by targeting profits at around the resistance 1.4258 or higher at the 1.4428 resistance. On the other hand, the bears will target pullbacks around the 1.3953 support or lower at the 1.3778 support.

With the economic calendar today devoid of important US data, the focus will be on the reaction from new statements by the Governor of the Bank of England.