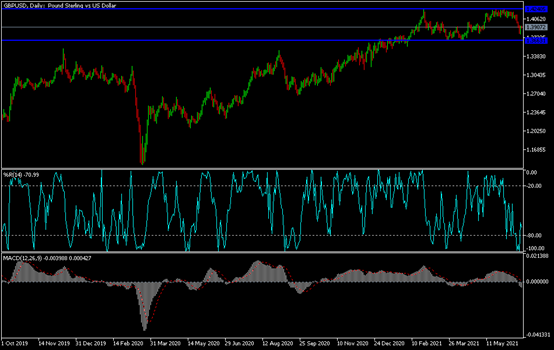

The attempts to rebound upwards are still weak, as it did not exceed the resistance level 1.3936 before settling around the 1.3895 level at the time of writing the analysis.

The factors of weakness for the pound against the rest of the other major currencies are still present. These factors are represented in the renewed tension between the European Union and Britain, and the increasing number of British infections with the Delta variable, which caused the postponement of the date of the full opening of the British economy to July 19 instead of this week. This confused analysts' expectations for the sterling's future.

Forex analysts at Validus Risk Management remain cautious about the outlook for sterling while investment bank Rabobank says the outlook for the British currency has become more ambiguous. The calls come on the heels of the 1.60% drop in the pound against the dollar last week, while the British currency posted a 0.15% drop against the euro. The British currency's upward trend in 2021 against the dollar is now called into question by analysts as a result of last week's sharp decline, while five consecutive weeks of icy change in the exchange rate from the pound to the euro have failed to inspire confidence among those looking to buy more powerful.

With regard to the immediate expectations, the monetary policy meeting of the Bank of England on Thursday is the most important event this week affecting the performance of the British pound. In this regard, Robert Howard, market analyst at Reuters, says: “The pound may need the Monetary Policy Committee at the Bank of England to deliver a more hawkish message than expected on June 24 to offset some of its recent losses against the US dollar.”

We expect the Bank of England to provide its latest assessment of the UK economy but keep interest rates unchanged.

In fact, sharp and impactful decisions are unlikely and will only be announced in the August Monetary Policy Report when any major policy shift will be announced. However, the market is likely to trade sterling according to where they think the bank may go in August, buying sterling if they believe the UK economic recovery will prompt the bank to raise interest rates in 2022.

Regarding the latest tension over Brexit. Jane Foley, chief forex analyst at Rabobank, sees trade tensions between the EU and the UK as headwinds for sterling. “We see the current headwinds for sterling in the form of a delayed reopening of England's economy and possibly as a result of tensions with the EU over the Northern Ireland Protocol which has increased the risk of a trade war,” Foley says.

GBP/USD technical analysis: After the recent decline, the bulls still need to break the price of the GBP/USD currency pair to the resistance level of 1.4085 to return to its previous ascending path. the current stability below the 1.4000 support will continue to support the bears to move towards stronger support levels, and the closest to them are currently 1.3880, 1.3790 and 1.3700, respectively. So far, according to the performance on the daily time frame, the pair is moving in an opposite descending channel. The sterling will be affected today by the announcement of the British public sector net borrowing. The announcement of the number of existing US home sales, then the testimony of US Federal Reserve Governor Jerome Powell.