The share of the GBP/USD currency pair fell to the 1.4053 support level, the lowest for the currency pair in a month, before settling around the 1.4105 level at the time of writing the analysis. Amid cautious anticipation until the US Central Bank announces today an update to its monetary policy, and in any case, the pair will be subject to strong fluctuations in response to the event.

What increased the pressure on the sterling recently increased the intensity of skirmishes between the two parties to the Brexit - the European Union and Britain - to implement what was agreed upon regarding the BREXIT deal. Accordingly, the sterling gave up the gains of the improvement in the results of the British economic data recently, as happened with the announcement of a strong improvement in the British inflation numbers this morning.

Yesterday was the announcement of the latest UK labor market data showing that the recovery extended into May with the number of employees increasing for the sixth month in a row, increasing by 197 thousand in May 2021 to 28.5 million. The increase in employment came on a three-month, rolling basis at 113K for the three months to April according to the Office for National Statistics reports, which was below market expectations for a reading of 150K.

Commenting on the figures, James Smith, an economist at ING Bank, says: "Things are improving in the UK job market, although the remaining months of 2021 are likely to be turbulent." Despite the opening up of the British economy, wage pressures were seen growing with the average income + bonus index rising 5.6% in April, well above the 4.9% the market had expected.

Wages increased during the pandemic as low-wage workers fell out of work, but this was expected to reverse as these jobs return.

The number of British job vacancies in March-May 2021 was 758,000 which is only 27,000 less than it was before the COVID-19 pandemic in January-March 2020, according to the Office for National Statistics, most industries have recovered. To show vacancies above pre-pandemic levels.

Rising wage pressure may reflect the limited supply of workers to fill the many jobs now on offer in the economy, as the pandemic brings about demographic changes. For example, there are many reports in the national media regarding the hospitality industry struggling to find employees. The concern for the BoE is that upward pressure on wages translates into unexpected inflationary pressures, which in turn could lead to the need to raise interest rates.

Higher interest rates are in turn seen as supportive of the pound, especially if the Bank of England is moving faster than its peers.

Pantheon Macroeconomics is more upbeat about wage growth as a deeper dig into the data reveals that near-term momentum is actually very weak. Economists argue that wage growth was also supported in April by the concentration of job losses in the second half of last year at the lower end of the wage range. The Office for National Statistics estimates that compositional changes among employees boosted the headline rate by 2.5 points in April. Wage growth is currently very weak.

Looking ahead, economists say the UK labor market will see some big changes in the coming months as the government's job-retention scheme (leave) is ended ahead of the September cutoff. For their part, Pantheon Macroeconomics say they doubt that the final leave scheme can be completed at the end of September without causing a renewed decline in employment in the final months of 2021.

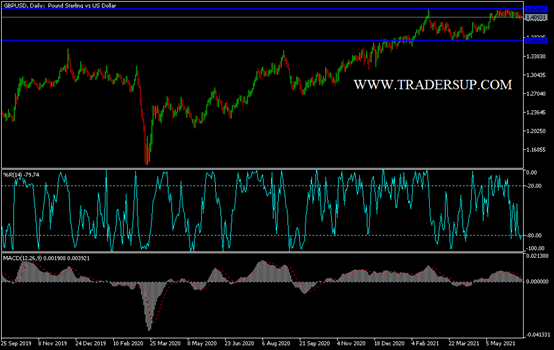

Technical analysis of GBP/USD: The general trend of the GBP/USD currency pair will change to a bearish move with the bears moving towards and below the 1.4000 psychological support level, with which the selling may increase to rush towards stronger support levels. On the other hand, the bulls' control will remain in place if the pair returns to the top of the 1.4200 resistance. I prefer buying the currency pair from the support levels 1.4020, 1.3945 and 1.3880, respectively.

As for the economic calendar data today: From Britain, inflation figures will be announced. The most important monetary policy decisions of the US Central Bank, its policy statement and updating its expectations, then the statements of Governor Jerome Powell. The currency pair will move aggressively in response to this data, so be careful.