It has often been noted that the gains of the sterling pound may be subject to evaporation if the current fears of the future of ending plans to reopen the British economy continue. This is amid the outbreak of variable strains of the COVID-19 epidemic, negatively affecting the British vaccination path, compared to other global economies. The price of the GBP/USD currency pair is stable around the support level 1.4110 at the time of writing the analysis. From the 1.4250 resistance level, the highest in more than three years, recorded during last week's trading. Yesterday the Pound gained some momentum after comments from Bank of England Chief Economist Andy Haldane that the bank may request to stop benefiting from massive monetary stimulus following some heavy pressure on the bank.

Speaking to LBC Radio, Haldane said that "the British economy is on its way to eliminating the effects of the pandemic" and should not rely excessively on "monetary medicine". "If both wages and costs are on the rise, inflation is not too far behind," he added. This could mean that at some point we need to start turning off the tap when it comes to the monetary policy support that we have provided during the time of the coronavirus crisis.”

Haldane also warned that there is a risk that inflation will exceed the target for a little longer than planned.

The deterioration of relations between the European Union and the United Kingdom will be the focus in the coming days amid whispers of a possible trade war between the two sides due to the failure to reach an agreement on the implementation of the Northern Ireland Protocol. After years of obsession over BREXIT and its impact on sterling, 2021 has been relatively free from headlines related to the UK's divorce from the European Union.

However, this appears set to change, and the future of the Brexit clauses is affecting the direction of the Pound amid threats from the European Union that it will impose duties on UK exports if it fails to fully implement the provisions of the Northern Ireland Protocol next month.

The Telegraph reported that British Prime Minister, Boris Johnson is considering "all options" amid "a looming trade war, after Brussels threatened to impose sanctions on British exports to Northern Ireland". The issue is likely to increase interest in the forex markets, and past experience has shown that the British pound tends to depreciate in value when concerns about Brexit grow.

The UK has so far refused to fully implement the Northern Ireland Protocol - which forms part of the UK's EU withdrawal agreement - saying the protocol effectively bans trade of some goods between Northern Ireland and the rest of the UK. Tensions over this issue have erupted within the union community in Northern Ireland over recent months whose leaders want the protocol to be scrapped entirely.

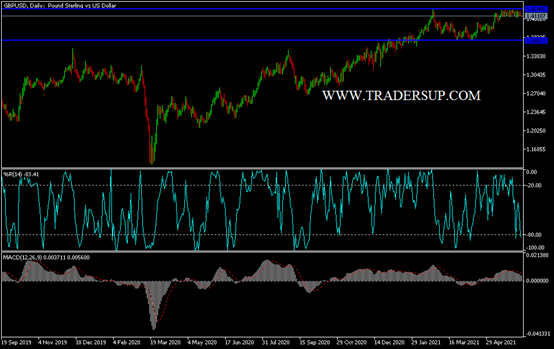

Technical analysis of the pair: The current bears’ control of the performance of the GBP/USD currency pair will increase in the event that it moves towards the support levels 1.4070, 1.3985 and 1.3880, respectively. This will be very likely if Britain’s plans to exit from Corona restrictions are completely disrupted, and if infections increase with Corona variables. The dispute between the European Union and Britain has increased.

On the upside, the bulls will return to control the performance of the Sterling Dollar, with the resistance of 1.4220 being breached again. So far I still prefer selling the currency pair from every bullish level. The currency pair is not awaiting any important British economic data, and the focus will be on the announcement of the US consumer price index and the number of weekly jobless claims.