This is during cautious anticipation of the pound against the rest of the other major currencies and before announcing the monetary policy update of the Bank of England today.

The expectations so far are that the Bank may keep its policy unchanged, but the fear is that the bank will surprise the markets, as it happened from other global central banks by announcing the imminent date of tightening the bank's policy. Any signs of tightening will be a positive catalyst for sterling in the forex market today.

The British pound made a comeback as analysts said a good part of the gains at the time could be attributed to headlines showing that tensions between the EU and the UK over the Northern Ireland Protocol are easing. "British and European officials are increasingly optimistic that they will avoid a post-Brexit trade war, believing that the two sides will reach a truce in the dispute over checking goods destined for Northern Ireland," the Bloomberg report said.

Tensions between the UK and the EU escalated during June as both sides appeared to be deadlocked over the issue of food flowing from the rest of the UK to Northern Ireland. The EU wanted the UK to impose strict movement controls while the UK said the EU was weighing its approach and potentially threatening the nation's food supply. The UK had said it would unilaterally extend the current grace period on controls in July if the issue was not resolved, to which the EU responded by threatening trade tariffs on British goods.

As such, many FX analysts have pointed to the specter of a trade war as a potential political risk to the GBP's valuation. “The allowance for sterling in the next six months is the possibility of a small trade war with the EU if the current impasse over the implementation of the NI protocol is not resolved,” says Paul Megizzi, head of FX research at JPMorgan.

The UK has requested an extension of the grace period and "officials on both sides now believe it is likely that the current grace period will be extended," according to the report. A meeting is scheduled between the UK and the EU where it is hoped an announcement will be made to confirm the extension of the grace period.

The UK's rapid economic recovery may wane according to much-watched data, but signs of increased demand for workers should ensure the pound remains well supported. June's PMI survey results showed a slowdown from May's record figures and largely disappointed against economists' expectations, even though employment growth hit a record high.

The June Services PMI read at 61.7, down from May's 62.9 and below market expectations for a reading of 61.7. The manufacturing PMI actually exceeded expectations at 64.2 but was lower than the May reading of 65.6. And the composite PMI - which takes the two readings and adjusts them to give a more accurate reading for the broader economy - came in at 61.7, lower than the 62.9 in May and market expectations of 61.7.

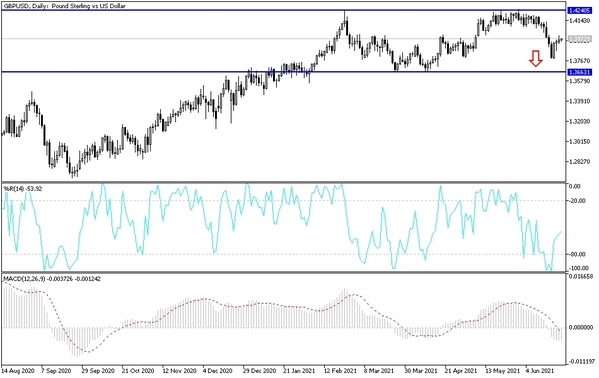

GBP/USD technical analysis: The GBP/USD pair is still in a downward correction phase and stability below the 1.4000 level still supports the bears’ control and is ready to test stronger support levels, the closest to them currently are 1.3935, 1.3880 and 1.3790, respectively. A need to breach the resistance level 1.4130 that vision according to the performance of the currency pair on the daily time frame.

As for the economic calendar data today: From Britain, the Bank of England will announce an update on its monetary policy decisions, interest rate, asset purchase plan and the vote of policy committee members. During the US session, important data also includes the announcement of the US GDP growth rate, jobless claims and durable goods orders.