This is ahead of the US employment results for the month of May. It is also after gains of optimism about the future of the Bank of England tightened the policy to the resistance level of 1.4250 the highest it has been for three years before settling around 1.4150. Sterling remains well positioned against other major currencies amid fresh signals from the government that all Covid-19 restrictions will be lifted on June 21 as originally planned. Some analysts have said that even if there is a delay in the final lifting of restrictions, it will be less lasting consequences for the currency.

Sterling lost value at the start of the month, which some analysts said may be a result of growing fears of a postponement of "Freedom Day" on June 21, which dampened sentiment towards the UK's economy and currency. “Concerns about the spread of the Indian Covid variable and the risks facing the full reopening plans for June 21 have once again weighed on the pound,” says Peter Karpata, currency analyst at ING Bank.

How the sterling trades in the future could depend on the strength of the economic recovery that comes from the opening, so with any disappointing news about the delay in unlocking, vaccines and data are likely to put the British currency in a weak position. Although concerns about the eventual easing of restrictions have increased recently, the British government maintains a cautiously optimistic tone noting that vaccines are preventing people from hospitalization while analysts say any delay is unlikely to derail the economic recovery anyway.

British Prime Minister Boris Johnson said in the middle of the week that "we have to wait a little longer" to see the impact of the Indian variable. But at the same time he added, “I can't see anything in the data at the moment which means we can't go ahead with the fourth step, the opening on June 21. But we have to be very careful because there is no doubt that the ONS data on infection rates show an increase.”

On the economic side, the US ISM Manufacturing PMI for May beat expectations at 60.7 with a reading of 61.2. ISM manufacturing prices paid came in at 88 against an estimate of 86.8 while the new orders index beat the 66.3 with a 67. On the other hand, the manufacturing employment index came in lower than 61.5 with a 50.9 while the Markit manufacturing PMI beat the expected 61.5 with a reading of 62.1.

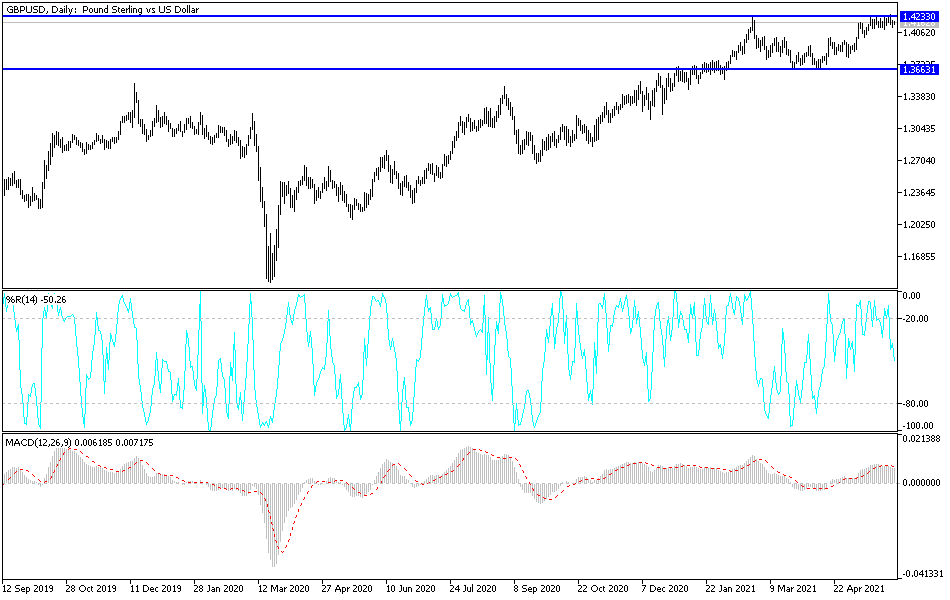

According to the technical analysis of the pair: In the near term and according to the performance on the hourly chart, it appears that the GBP/USD currency pair is trading within the formation of an ascending channel. The pair is now floating near the overbought levels of the 14-hour RSI. This indicates a short-term bullish slope in market sentiment. Accordingly, the bulls will target short-term profits around 1.4199 or higher at 1.4231. On the other hand, the bears will look to pounce on a potential pullback around the 1.4150 support or lower at the 1.4116 support.

In the long term and according to the performance on the daily time frame, it appears that the GBP/USD currency pair is trading within the formation of an ascending channel. The pair continues to trade near the overbought levels of the 14-day RSI. This shows a long-term bullish bias in market sentiment. Accordingly, the bulls will look to pounce on long-term profits around the 1.4584 resistance or higher at the 1.5010 resistance. On the other hand, the bears will target potential pullbacks around the 1.3724 support or lower at the 1.3300 support.

The British pound will be affected today by the announcement of the British Services PMI reading. The dollar will be affected today by the announcement of the ADP reading of the change in the number of non-farm jobs, the weekly US jobless claims, the non-farm productivity and the ISM services purchasing managers index