Despite the strong gains of the US dollar during last week's trading, the GBP/USD pair remained steadfast. The pair's losses did not exceed the 1.4083 level before closing the week's trading stable around the 1.4165 level, and its gains last week reached the 1.4250 resistance level, its highest in three years. Britain's distinctive pace of vaccinations and reopening still supports the pound, despite some fears that this will exacerbate the crisis again.

Recently, CHAPS Bank of England data showed that consumer spending on credit and debit cards was 95% of the February 2020 average in the week ending May 27, down slightly from 96% in last week's report. The data continue to dampen expectations of a major consumer-led economic boom now that COVID-19 restrictions have been lifted across the UK.

The numbers come as part of a batch of short-term weekly data being collected by the Office for National Statistics in their efforts to understand how the economy and consumer behavior are evolving through the COVID-19 pandemic and subsequent recovery. We reported last week that any disappointments in the extent of the UK economic recovery could eventually undermine the positive narrative driving the GBP higher, but we suspect that markets are waiting for official data.

All in all, a bid was made for sterling until 2021 as economists ramped up their forecasts for the British economy, estimating that the huge pile of pent-up savings accumulated during the lockdowns would be used up once restrictions were in place. But the upcoming short-term tepid spending figures may serve as a cautionary warning about the market's continued bullish stance on the economy and the British pound.

Therefore, this week's data set is likely to be of particular interest, as it will cover the period of better weather and the long weekend.

On the other hand, from the short-term statistics agency ONS data, the news is more constructive. The average estimate for seven days of restaurant dining in the week ending May 31 was 173% of its level in the same week in 2019, according to Open Table. This is up 41 percentage points from last week, continuing its recovery since indoor restaurants reopened across the UK. The total volume of online job postings in the UK on May 28, 2021 was 127% of the February 2020 average, according to Adzuna.

Job advertisements in all UK states and English regions increased compared to the previous week. UK retail footfall in the week ending May 29, 2021, was 73% of its level in the same week in 2019, according to Springboard. The footfall as a percentage of its level in 2019 is still strongest in retail parks compared to high street and shopping malls.

All in all, the UK is currently in a race to vaccinate its population as a new variant of COVID-19 threatens a third wave of infections, and if the vaccinations can prevail, it could provide more impetus to the British pound in the forex market. The Indian variant is believed to be significantly more transmissible than the variant responsible for the UK's 'second wave', which means it is able to easily penetrate vulnerable groups.

However, vaccinations mean the infection does not translate into an increase in hospital admissions, which will be a major test for the British government when it decides whether or not to drop restrictions entirely on June 21. Last week, the UK reported that half of all adults have now received two doses of the COVID-19 vaccine, which is expected to provide this part of the population with strong protection against the alternative.

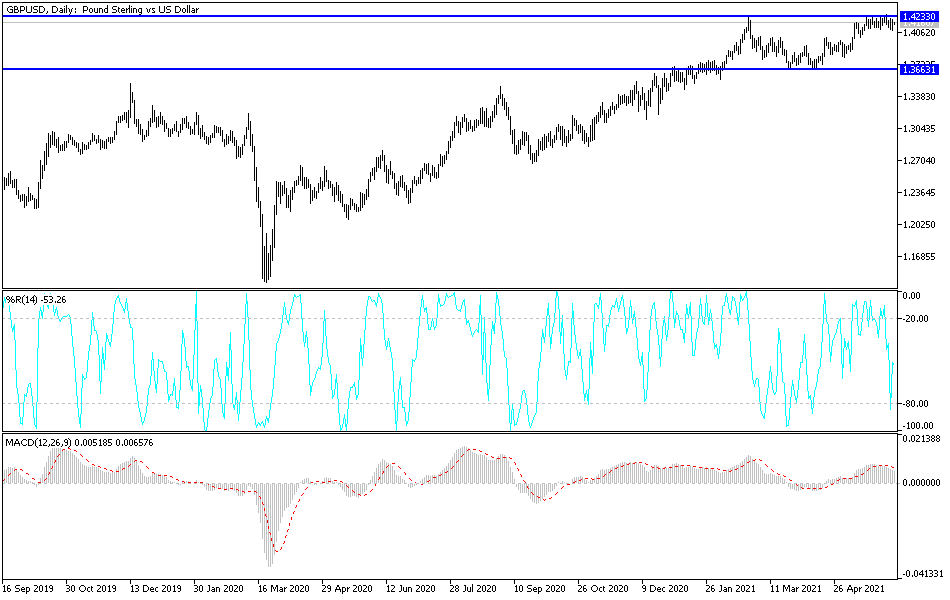

Technical analysis of the pair:

On the daily chart, the bulls still dominate the general trend of the GBP/USD currency pair, which is the close to breaching the 1.4200 resistance again, which supports the upside and motivates Forex traders to consider buying. A bearish trend will only happen by breaching the 1.4020 support level and 1.3965. So far, I still prefer buying the currency pair from every bearish level.

Today, the currency pair is not awaiting any important economic data, whether from Britain or the United States of America. Accordingly, investors risk appetite will have the strongest impact on performance.