The return of pressure on the US dollar allows the currency pair, the British Pound against the US dollar, to rise again, stabilizing around the 1.4219 resistance level. This is the same level of resistance that it recorded last week, from which it returned amid profit-taking selling to the support level at 1.4091 before the current rebound.

The British Pound was looking to consolidate its monthly gains against the euro and the dollar on the last day of trading in May, supported in part by the increasingly hawkish tone of the Bank of England. The last day of the month is usually marked by low liquidity due to holidays in the UK and US markets. Commenting on the performance, Valentin Marinov, a currency analyst at Credit Agricole, says, “The British pound is still close to its recent highs, and in the recent period one of the big support for the pound has been surprisingly hawkish comments by a member of the Monetary Policy Committee, who changed the crowns of Flegg so far.”

Despite the gains in the value of the pound sterling, the end of the month could prove difficult for the bulls as confidence about the country's exit from Covid-19 restrictions is tested and some recent excitement over the Bank of England (BoE) dampens. Looking ahead, how the British pound trades in June could depend on how the two issues will take place.

A speech by Bank of England's Monetary Policy Committee (MPC) member Ghettan Flegg at the University of Bath on Thursday 27 May gave some enthusiasm for the GBP exchange rate due to the more optimistic message about the outlook for the British economy. In particular, Flegg said that the rate hike case sometime in the middle of 2022 will become increasingly valid if the UK labor market recovers from the Covid-19 crisis faster than the Bank of England is currently projecting.

Markets are currently expecting a UK interest rate hike at the end of 2022, but this timing has been brought forward by comments.

It is this adjustment in money market pricing that creates an attraction for international capital to the UK, which in turn provides an supply on the British pound. Chris Turner, analyst at ING Bank says, “The British pound has performed well… on the back of comments from the Bank of England pigeon, Flag. He laid out three scenarios for the course of the British economy and the Bank of England response - yet the market only reacted to the hawkish scenario. The analyst believes that the currencies of those central banks that are looking to raise interest rates are currently witnessing a rise in the global currency markets, forex . Flee also said that raising the interest rate earlier than expected depends on whether or not stopping the government holiday plan will lead to higher unemployment in the country.

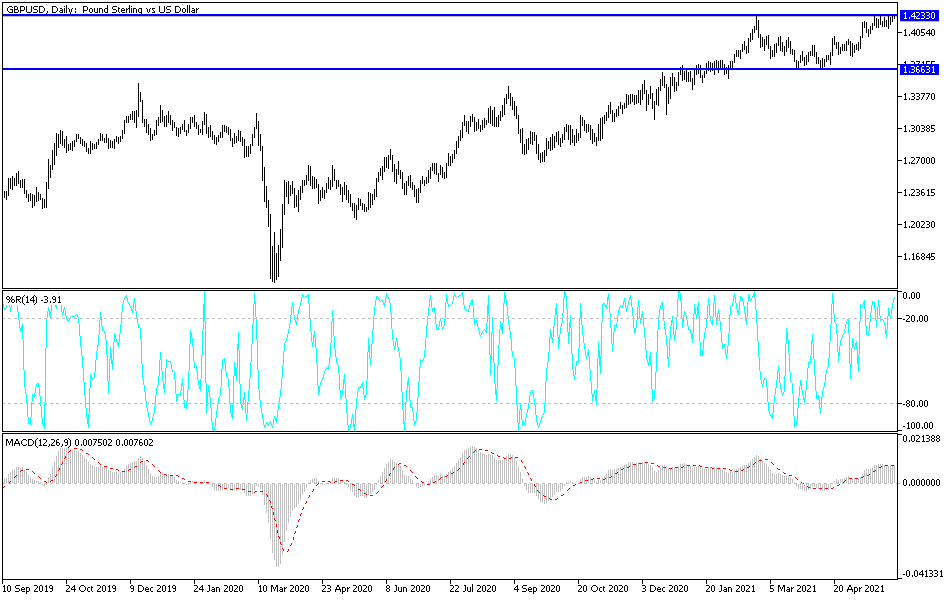

According to the technical analysis of the pair: the general trend of the currency pair sterling against the US dollar is upward. This trend is still in need of further stimulus so as not to be subjected to selling to reap profits again as the technical indicators on the daily timeframe chart are heading towards levels. There is strong buying saturation, especially with the currency pair moving towards the resistance levels 1.4255, 1.4320 and 1.4400, respectively, which we support. On the downside, the bears will regain control over the performance if they succeed in breaching the 1.4000 support again.

As for today's economic calendar data: The British Pound will be affected today by the announcement of the UK Manufacturing PMI reading along with new comments from the Governor of the Bank of England. The US dollar is affected by the announcement of the US ISM Manufacturing PMI reading and construction spending.