Last Monday’s GBP/USD signals were not triggered, as none of the key support and resistance levels were reached that day.

Today’s GBP/USD Signals

Risk 0.75%.

Trades must be entered between 8am and 5pm London time today only.

Short Trade Ideas

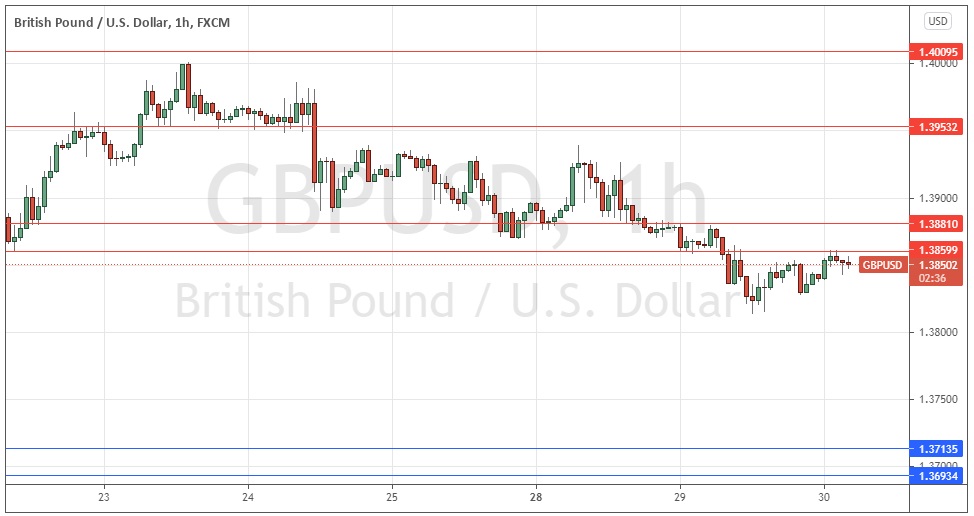

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3860, 1.3881, or 1.3953.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Idea

- Long entry immediately upon the next touch of 1.3714.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote last Monday that as the price had made a weakly bullish turn from the support level at 1.3860, the price may be more likely to rise than fall over the day, but I had little confidence in that.

This was a good call as the price did little over the day, as I suspected would be the case.

The technical picture has become more bearish here, as the USD advances against all major currencies, with the British pound being one of the relatively weaker currencies. Another bearish factor is that the former support level at 1.3860 has been invalidated by recent price action, meaning there are now no obvious key support levels above 1.3714, so the price has considerable room to fall in the direction of the long-term trend.

The price action here is likely to remain weakly bearish until the ADP jobs forecast is released later today, which could have an impact upon the USD. A strengthening of the USD there will be likely to push the price down considerably here.

I will be happy to take a short trade today from a firm bearish reversal which may set up later at the key resistance level of 1.3860.

Regarding the USD, there will be a release of the ADP non-farm employment change forecast at 1:15pm London time today. There is nothing of high importance scheduled concerning the GBP.