Last Monday’s GBP/USD signals were not triggered, as there was no bearish price action when the resistance level at 1.3832 was first reached.

Today’s GBP/USD Signals

Risk 0.75%.

Trades must be entered between 8am and 5pm London time today only.

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3966 or 1.4010.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3905 or 1.3838.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

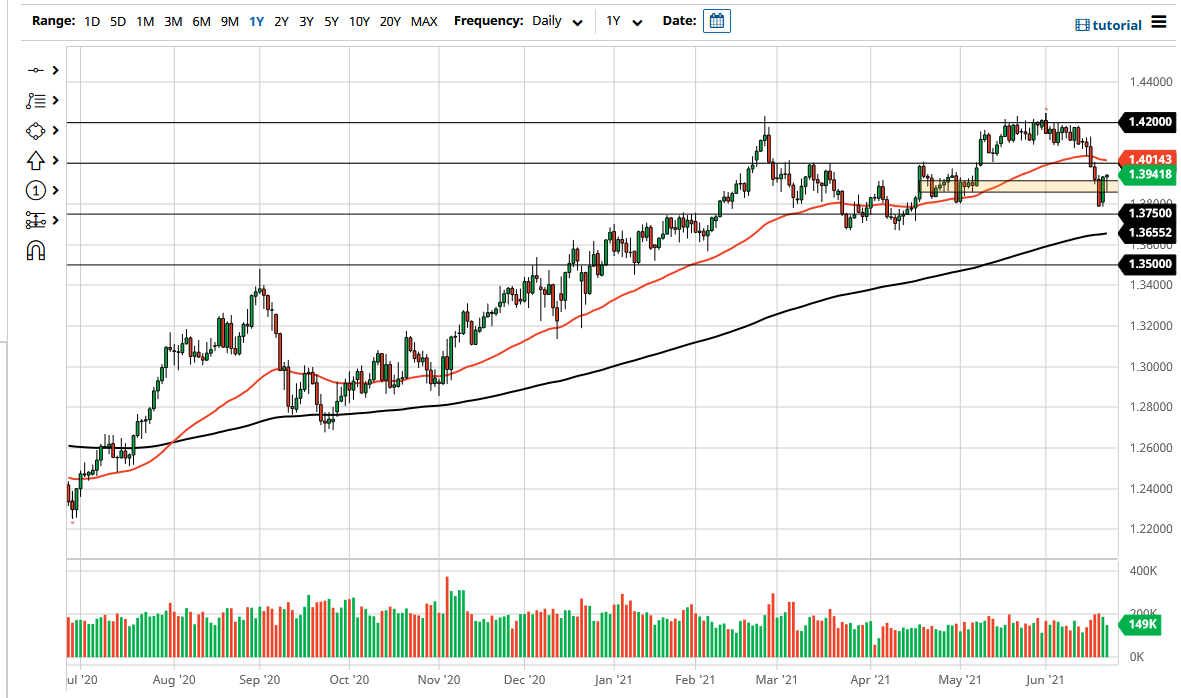

GBP/USD Analysis

I wrote last Monday that the bearish momentum had been strong, so we seemed likely to get some follow-through for a while. I thought this was likely to depend upon whether the resistance level at 1.3832 held, and I was looking for a long trade if we had gotten two consecutive hourly closes above 1.3832. This was a great call as we did get these closes and the price went on to rise by more than 90 pips, giving a nice opportunity for profit on the long side.

We have seen a continuation of the recovery by the British pound despite USD strength, with a clear sequence of higher lows and higher highs since Monday morning.

There is moderate short-term bullish pressure, but we do see both support and resistance levels nearby looking firm and likely to hold. For this reason, I would be equally happy to enter either a long trade from a bounce off the support level at 1.3905, or from a reversal from the resistance level at 1.3966, in each case targeting the other level as a take profit price.

Traders interested in being long of the British pound may find looking for long trades in GBP/JPY more profitable today, as the yen is weaker than the dollar.

Concerning the GBP, there will be a release of Flash Manufacturing & Services PMI at 9:30am London time. Regarding the USD, there will be the same at 2:45pm.