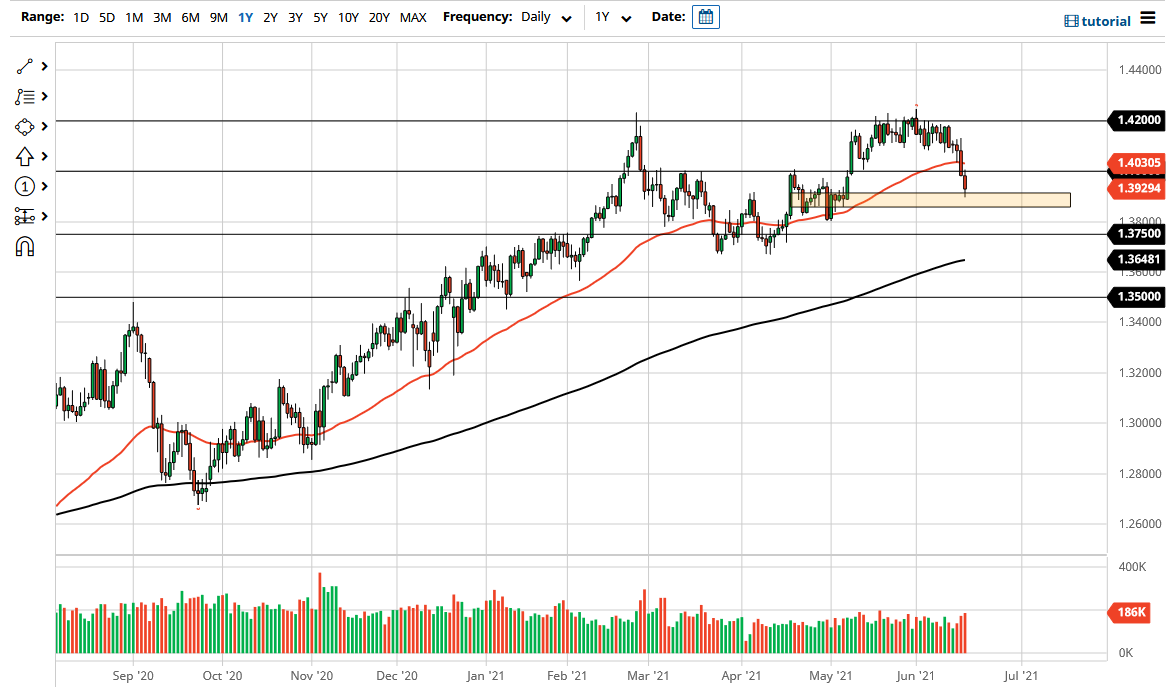

The British pound has walked back the entire bullish move over the last couple of months and just a quick few sessions due to Federal Reserve statement suggesting that perhaps they may “think about thinking about tapering.” This is the course is complete nonsense, but at this point in time the narrative is what the narrative is. This has caused a bit of a headache, and it is worth noting that we have stopped right where you expect the market to do so. The question now is where do we go from here?

I think that the market needs to prove itself a bit, meaning that I would like to see the British pound recapture the 1.40 handle to the upside. If it does, then it is very likely that we could go looking towards 1.42 handle. That of course is an area that has been very difficult for a while to overcome, and as a result I would need to see a daily candlestick close above that area in order to add to a position that would start at the 1.40 handle. If all of that comes to fruition, then it is very likely that we could go looking towards the 1.45 handle.

To the downside if we do take out the rectangle that I have on the chart, then it is very possible that we could go looking towards the 1.3750 level. With all things being equal, the market is at a crossroads, so the question now is whether or not we see the buyers come back in to try and lift the markets higher based upon the overall trend, or are we seeing something bigger? I think it still too early to tell but clearly the sellers have everybody’s attention at the moment.

I think the only thing you can probably count on is a lot of volatility, so I would keep my position very small until we get a bit of clarity, something that we may not have for a couple of days. All things been equal, this is a market that has a lot of questions around it, and it will probably come down more or less to Federal Reserve expectations that traders will be digesting over the next several days. Be cautious because something big is probably about to happen one way or the other.