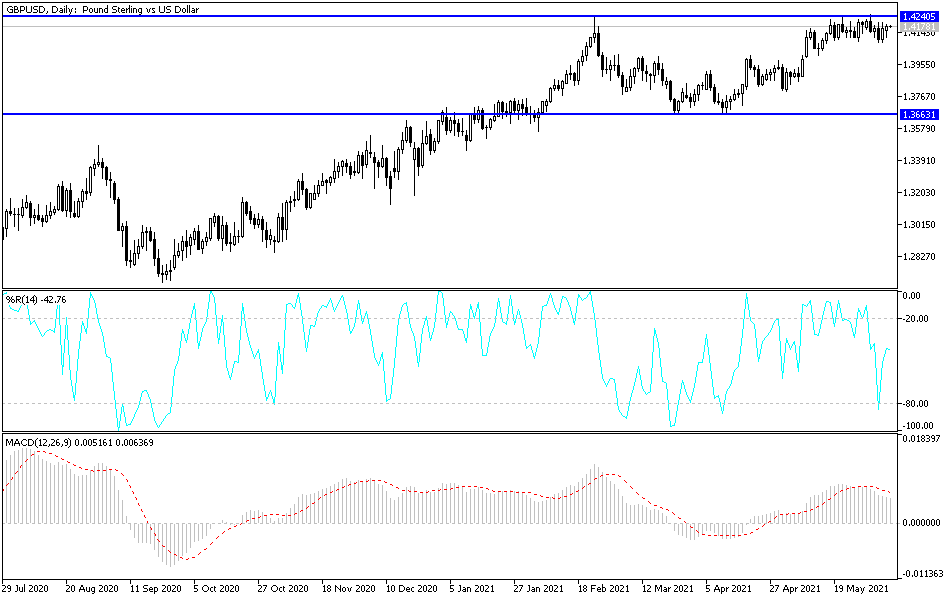

The British pound initially fell during the early hours on Monday, as traders came back from the weekend. That being said, we have seen the familiar pattern of a recovery and push towards 1.42 play out again. This is a market that has been consolidating for a while, perhaps trying to work off a bit of froth. In fact, when you look at the chart, you can see that we not only have a little bit of consolidation over the last two weeks, but you could also make an argument for consolidation since late February.

That being said, it is worth noting that the 1.42 level is an area that seems to be like a brick wall, so having said that, it is likely to be very difficult to get beyond. However, if we were to break above the most recent high, especially if we get a daily close above there, then it is very likely that we would see a much bigger move, perhaps reaching towards the 1.45 handle.

To the downside, if we break down below the 1.41 level, then it is likely that we could go looking towards the 50-day EMA, which is sitting just above the 1.40 handle, so we have to keep in mind that there are not only the psychologically important factors at play there, but also the technical factors due to the moving average that is so widely followed. If we were to break down below the 1.40 handle, then it is possible that we could go down towards the 1.38 region, where we had seen a bit of a bounce. Nonetheless, I do not think any of that will happen, and I think we are much more likely to see this market break to the upside.

When you look at the longer-term outlook for this market, it does seem as if the British pound is going to continue to pick up strength due to the fact that so much US dollar selling is found in the currency markets. Furthermore, there are a lot of things working against the US dollar in general, not the least of which would be inflation and massive spending coming out of the Biden administration. Beyond that, people are starting to look at the United Kingdom through the prism of being an open economy, which should continue to drive money into the currency.