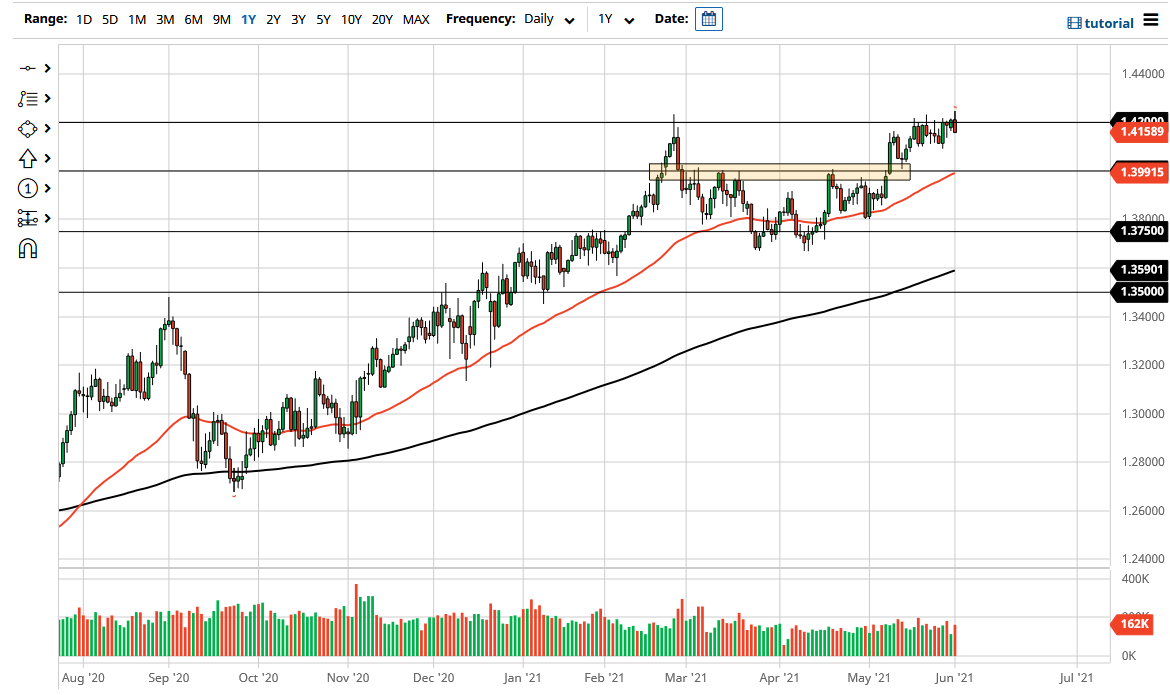

The British pound initially tried to break out during the trading session on Tuesday but has failed yet again at the 1.42 handle. At this point, the market looks as if it simply does not have the will to break out. While I thought that we were trying to make a bigger move, it only took a couple words from the Bank of England to suggest that they were worried about the housing market to have everybody freak out and run away. This is a market that has been annoying to say the least.

It is obvious that if and when we finally do break out, this will be a major move; but when you look at the longer-term charts, it is easy to see why we may struggle. With that being the case, I think what we are seeing here is a market that is trying to figure out whether or not it can actually live up to the hype. Underneath, the 1.40 level will be massive support, and with the jobs number coming out on Friday, we could see nothing but chop between now and then.

Unlike most analysts, I am not going to give you some type of story about how great the next move is going to be, but would rather be honest about the fact that we are in June, and may simply see almost nothing happen. It may simply become just as sloppy and pointless as the Australian dollar has been as of late, but as traders, we know that we need to wait until the market decides to make a move. While it did look like it was going to make a move during Asian trading to finally break out, that has been quickly debunked, and the fact that it turned around as quickly as it did also tells me that there is not as much conviction in this pair as one would think. I will be paying close attention to the 1.4050 level and the 1.40 level for indications as to where we could go next. If you are a short-term range bound chop trader, then this might be your market, but that is only if you have the ability to watch something like the 15-minute charts. For swing traders, this has been very difficult and looks likely to continue to be.