There is talk that the Federal Reserve will have to taper sooner rather than later, but anybody who has been watching the Federal Reserve for more than about 10 minutes realizes that the Fed is nowhere near doing that. Because of this, it is very likely that this gets turned around rather quickly, although perhaps people are trying to get ahead of the jobs number on Friday that could be a bit shocking to the upside.

Looking at the candlestick, it obviously is very bearish but at the end of the day we are sitting right around the support level that the market has been rather stringent, so it would not surprise me at all to see this market try to bounce during the day. This will be especially true if there is any type of hint that the Federal Reserve will have to stay loose for ages. (Here is a hint: The Federal Reserve is nowhere near being able to tighten, because quite frankly the interest of the debt would crush the United States given enough time.) However, Hope burns eternal and people are still looking for some type of reason for tightening.

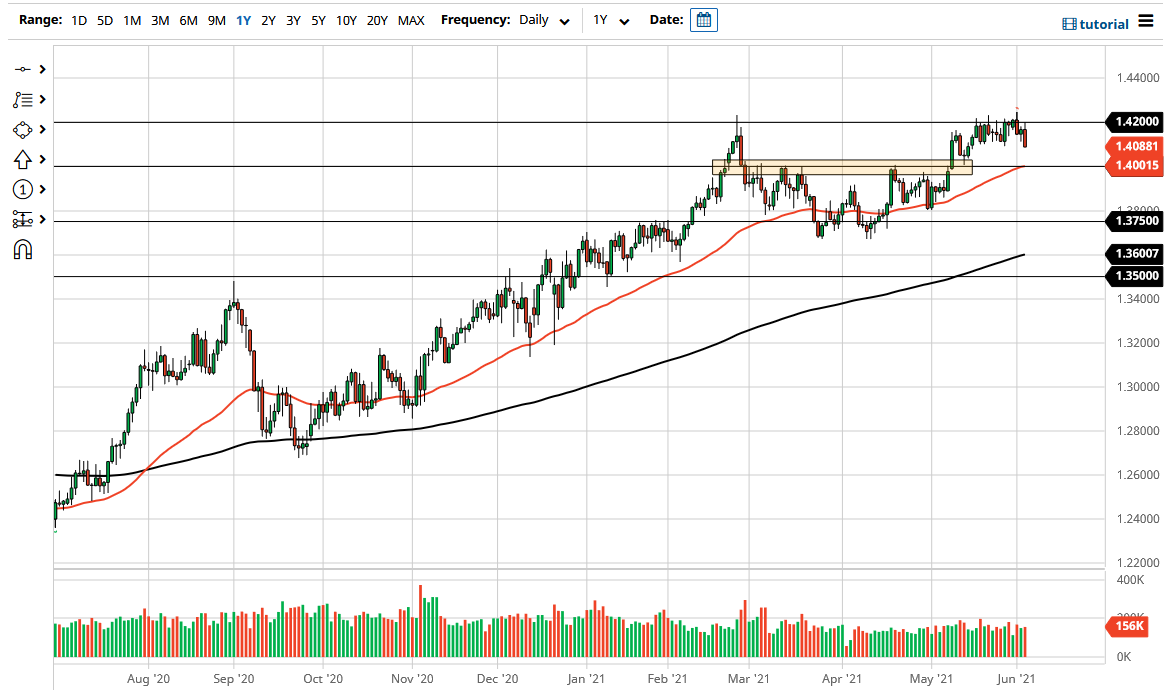

To the downside, I believe that the 1.40 level offers plenty of support and I would be rather interested in buying there, not only due to this previous support level, but also the large, round, psychologically significant figure and of course the 50 day EMA reaching towards that area. With this being the case, I think that this is a market that is trying to build up the necessary momentum to break out, recognizing that the 1.42 level continues to be a major barrier to overcome. If we can get above there, then the market is likely to go looking towards the 1.44 handle, followed by the 1.45 level which is a large, round, psychologically significant figure, and an area that has been rather important for longer-term traders as well. Because of this, I think it makes for a very interesting place to aim for once we finally get the push to the upside. As far as selling is concerned, I do not really have a desire to do so currently.