The British pound initially pulled back a bit during the trading session on Tuesday, but then turned around to show signs of stability again. The pound has seen a certain amount of negativity due to the fact that the Federal Reserve spooked the markets due to talk of tapering a few days ago. That being said, it looks like the market is trying to recover again as the Federal Reserve has already started to walk back some of the hawkish attitude. With that being the case, it is very likely that we will continue to see the market pressure to the upside, reaching towards the 1.40 handle above.

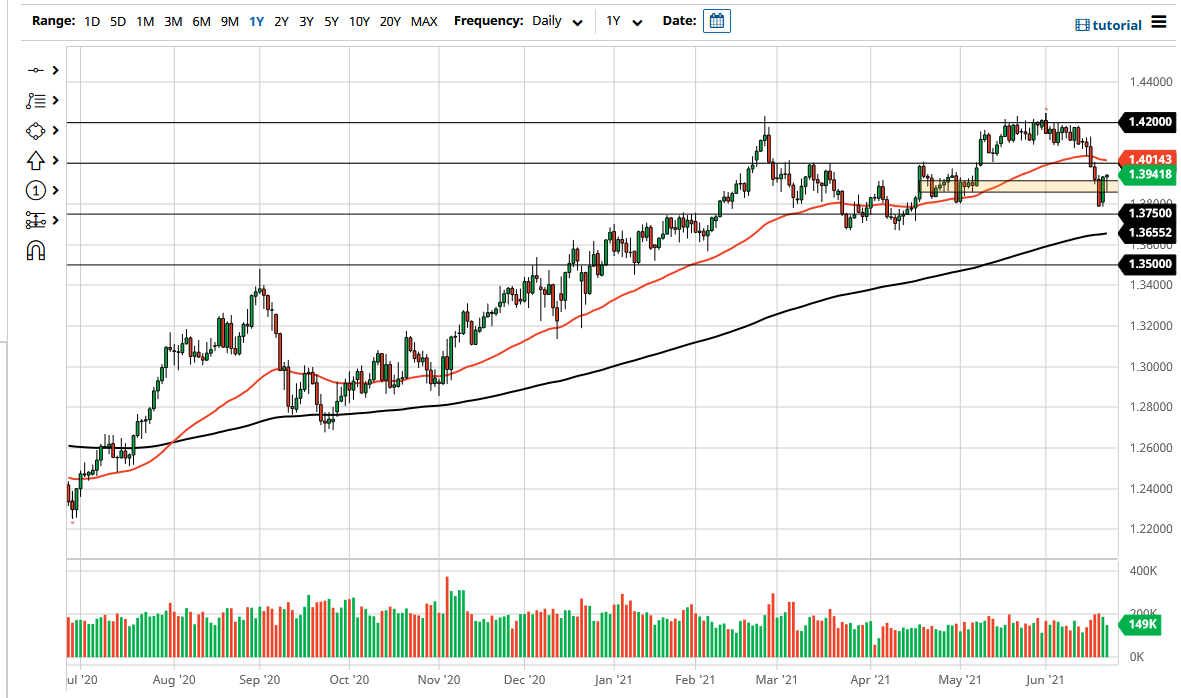

The 50-day EMA sits just above the 1.40 handle, so I think that at this point it is very likely that we will continue to see a confluence of pressure. Breaking above the 1.40 handle could open up the possibility of a move back to the highs again, which looks to be the most likely path of the market going forward. At this point, it looks as if short-term pullbacks will continue to be buying opportunities, as the 1.38 level has offered significant support. Now that we have turned around a bit and Jerome Powell has been rather dovish, that will more than likely continue to be the case going forward.

To the downside, it is not until we break down below the double bottom near the 1.37 handle that I would be a seller, and it should be noted that the 200-day EMA is coming into the picture in that general vicinity as well. With that being the case, the market is likely to see a flush lower if that does in fact happen, but it looks very unlikely to happen based upon the significant bounce that we have seen. Furthermore, it should be noted that the US dollar is losing ground against most other currencies, so that should all come back into play as well. Another thing that I like about the idea of going to the upside is the fact that the trend had been very bullish until recently, so it matches up quite nicely with the longer-term trade. Ultimately, this is a market that I think continues to find buyers based upon the fact that the Federal Reserve remains loose for ages.