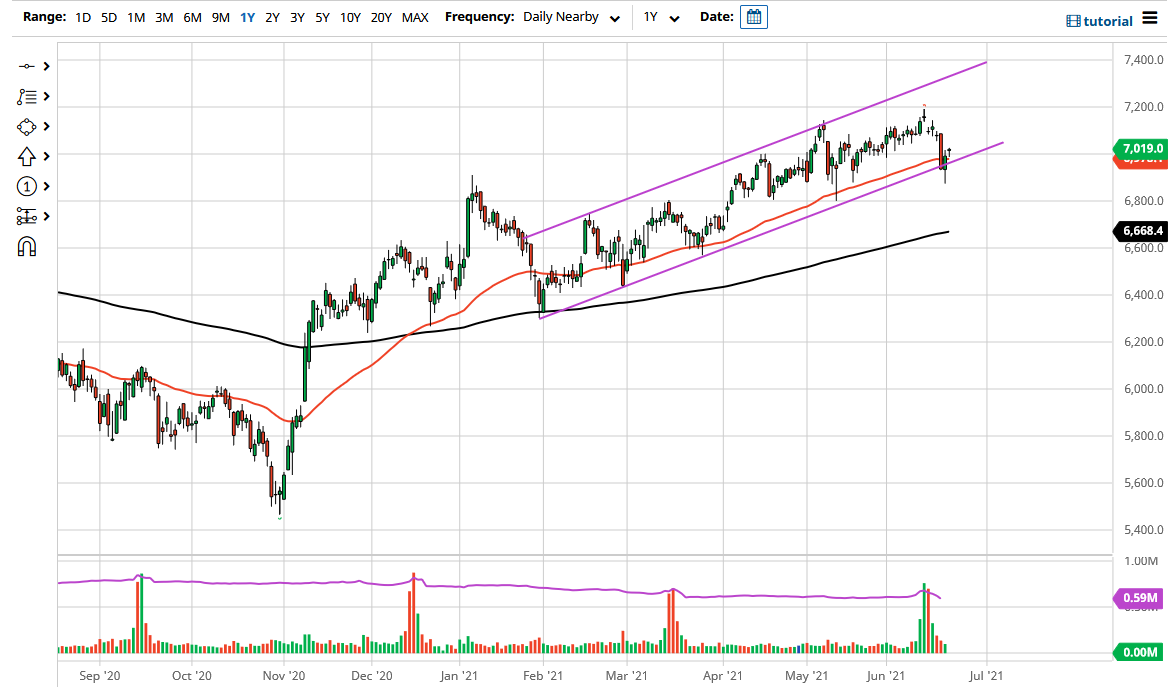

The S&P 500 gapped higher to kick off the trading session on Tuesday, but then turned around to fill that gap only to start rallying again. That is a very strong sign, and now that we have recaptured the 7000 handle on a daily close, it is very likely that we will continue to see buyers jump into this market and try to push it to the upside. After all, the market has been in an uptrend for quite some time, and that clearly has not changed despite the fact that we have seen a significant pullback.

Another thing worth paying attention to is the fact that not only has the 7000 level offered support, but so has the 50-day EMA. The 50-day EMA has essentially acted as a bit of a trend line for quite some time. Speaking of trendlines, we have seen the bottom of this uptrending channel offer quite a bit of support, and as long as we are still in this channel, I believe that the market is going to continue to reach towards the upside again. At this current juncture, it appears that the 7200 level will continue to be targeted.

The candlestick from the trading session on Monday is crucial, because if we break down below it, it is likely that the market could go looking towards the 6800 level, possibly even down to the 200-day EMA. That would be a very negative sign, and I think what we are seeing here is the possibility of the market trying to bottom out and continue higher. The market breaking above the 7200 level could open up the possibility of reaching towards the top of the channel, which at this point would suggest somewhere near the 7400 level. That makes sense, as the FTSE 100 tends to move in 200-point increments.

Going back to the idea of the market falling apart, if we break down below the 200-day EMA it is likely that we could go much lower, perhaps reaching towards the 6400 level, maybe even down to the 6000 level over the longer term. That being said, I think that the FTSE 100 breaking down would more than likely put a lot of negativity in other European indices, so I think it is probably better to short Italy, Spain, or even Greece if you have the ability.