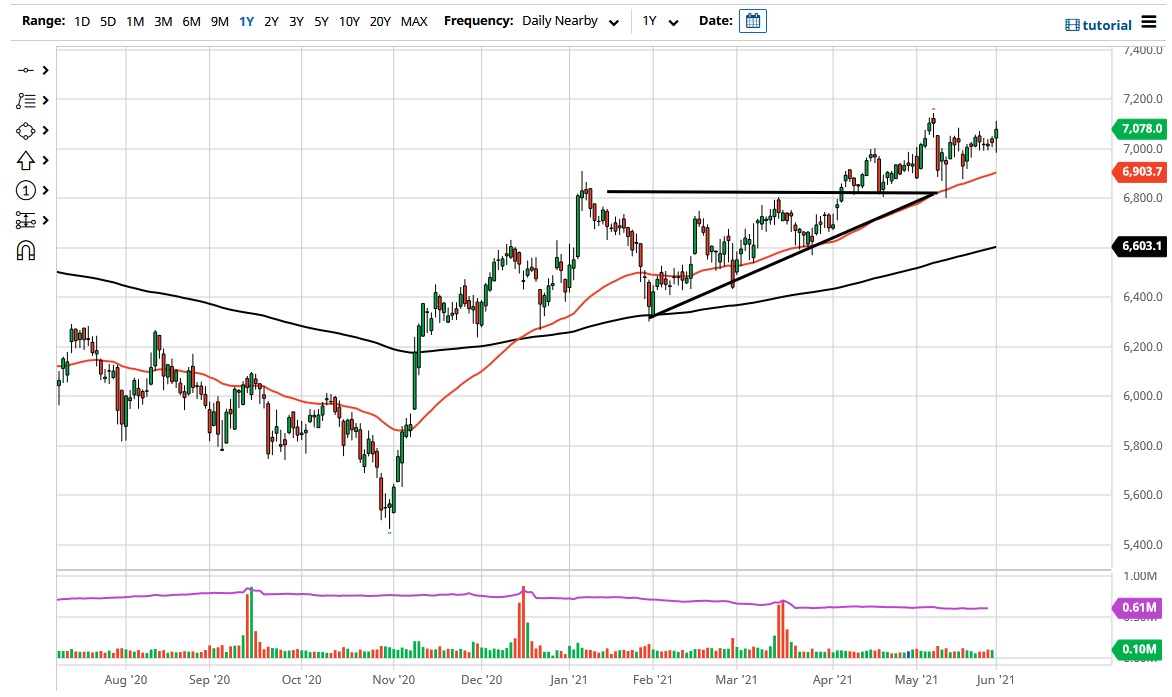

The FTSE 100 fluctuated during the trading session on Tuesday to reach out towards the 7000 level but then recovered nicely to pick up 77 points from there. Ultimately, this is a market that I think continues to see a lot of upward pressure, and it is worth noting that during the trading session on Tuesday we have filled the gap from a couple of weeks ago. The question now is whether or not we can break above there. If we do, then it is very likely that we go looking towards the 7200 level, and then possibly even the 7400 level after that. The FTSE does tend to move in 200-point increments, a lot like the S&P 500.

To the downside, the 7000 level being broken could open up the possibility of a move down to the 50-day EMA, which is currently sitting at the 6900 level. The 50-day EMA is simply an extension of the uptrend line from the ascending triangle, so that is worth paying attention to as well. With that being the case, I think you are looking for pullbacks as a potential value play, and I believe that the market will behave as such going forward.

The shape of the candlestick is somewhat bullish, but it also shows a little bit of confusion so do not be surprised if that reoccurs. The market seems to have a hard “floor” near the $6800 level, where we see the top of the previous ascending triangle, so what we are seeing here is a market that is going to continue going higher and, based upon the measured move of the ascending triangle underneath, it is likely that we could go looking towards at least 7200, if not higher than that.

Keep in mind that the FTSE 100 is looking at the reopening trade in the United Kingdom as a potential accelerant, so I think that we continue to look at this as a scenario where we see money flowing into Great Britain due to the fact that it had been closed down so long. Ultimately, I think that buying the dips will continue to work, unless of course we were to break down below the 6800 level, when I would look at a potential move towards the 200 day EMA.