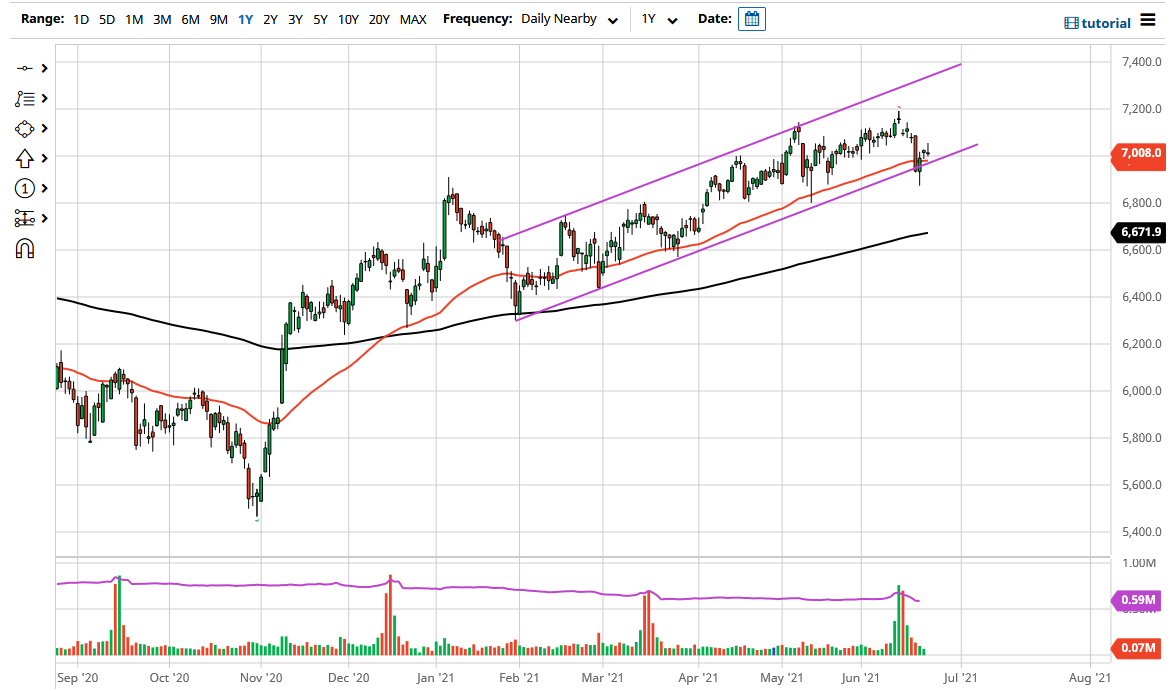

The FTSE 100 initially tried to rally during the trading session on Wednesday but gave back the gains to show signs of slight exhaustion. The 7000 level seems to be a focal point of this juncture, which makes sense considering that the figure is a large, round, psychologically significant number, and an area where we have seen a lot of reaction previously.

Furthermore, the 50-day EMA and the bottom of the uptrending channel sits just below there, so it all ties together quite neatly for signs of support. The market had tried to break down but recovered quite nicely in this general vicinity. At this point, if the market were to break above the top of the shooting star for the trading session on Wednesday, then the market will continue the overall uptrend, and perhaps make a move towards the 7100 level. After that, we could go looking towards the 7200 level.

To the downside, if we were to wipe out the candlestick from the Monday session, that could open up the possibility of a move down to the 6800 level, perhaps even followed by the 200-day EMA. If the FTSE 100 starts to fall apart, it is likely that the majority of the European indices will follow right along with it. That being said, there is a lot of uncertainty out there, and that is something that should be paid close attention to. Looking at this chart, we have been in a channel for some time, so if we do break down it would be a rather significant negative sign. If we were to turn around and break above all of the short-term resistance, the top of the channel will be found closer to the 7300 level.

I believe that breaking above the top of the candlestick for the trading session on Wednesday allows the building of a larger position, but until then I would be very cautious about how big my position was. The next couple of days could be very noisy, so it is worth paying close attention to your risk parameters. Ultimately, I do not like the idea of shorting indices with so much central bank participation in liquidity out there, but it obviously looks like a market that is under some stress.