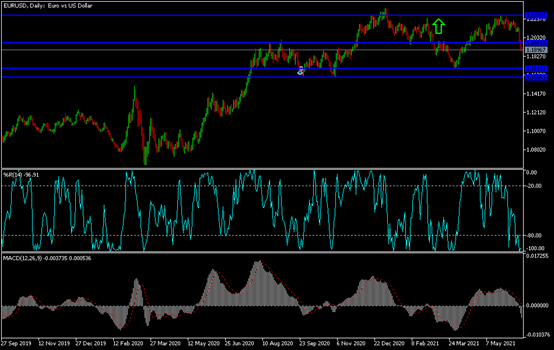

The EUR/USD is settling around the 1.1885 support, the lowest in two months, from the resistance level 1.2145 at the beginning of this week's trading.

The markets reacted strongly to the US Federal Reserve's hints that the date of raising the US interest rate is nearer than before, in light of the strong rate of vaccination and a rapid return to economic openness. Forex investors ignored the European opening and improved economic releases coming from there.

Final data from European statistics agency Eurostat yesterday showed that consumer price inflation in the euro zone exceeded the European Central Bank's target for the first time in more than two years in May. Consumer price inflation rose to 2.0 percent from 1.6 percent in April. The rate was in line with the estimate published on June 1. Actual inflation was the fastest since 2018. The European Central Bank targets inflation "below 2% but close to" 2%.

The increase in inflation was largely driven by the 13.1 percent rise in energy prices. Food, alcohol, and tobacco prices rose by 0.5 percent, and service costs rose by 1.1 percent. Prices of industrial non-energy goods rose 0.7%. Core inflation, which does not include prices for energy, fresh food, alcohol, and tobacco, accelerated to 1.0 percent from 0.7 percent in April. The rate was revised up from 0.9 percent.

Compared to the previous month, consumer prices rose 0.3 percent in May, in line with flash estimates.

Lane, the ECB's chief economist, played down the debate expected at the central bank in September over increased bond buying. The ECB program is more flexible than other global central bank efforts. For example, the Fed, committed to purchasing a fixed amount of at least $80 billion in Treasuries and $40 billion from the agency's MBS per month. The European Central Bank has a very flexible purchasing program.

EUR/USD technical analysis: On the chart of the daily time frame, the reversal of the general trend of the EUR/USD currency pair is strong, and reaching the support level of 1.1885 as happened in the morning, or moving below that will push the technical indicators to oversold levels. The closest support levels for the pair are currently 1.1880, 1.1810 and 1.1735, respectively. On the upside, there will be no return to the bulls' dominance without breaching the 1.2150 resistance, as is the performance over the same time period.

There is no significant US data today. From the euro area, current account numbers will be announced.