A state of cautious stability dominates the performance of the EUR/USD pair since the beginning of this week's trading, awaiting the monetary policy decision of the European Central Bank. This week, US inflation figures are also being anticipated. For a short period, the currency pair tested the resistance level of 1.2200 before settling around the 1.2170 level at the time of writing. Some doubts have been raised about whether the US dollar will continue to decline after the recent strong gains that were made last week on the back of a batch of US economic data that indicated a strong economic recovery, especially with regard to the employment market.

Specifically, the data were strong enough for the markets to start raising bets that the US Federal Reserve (Fed) may change policy soon and start reducing its quantitative easing program. The "regressive" quantitative easing is seen as the first step that the US central bank must take before raising interest rates, which in turn is considered supportive of the dollar against the rest of the other major currencies.

But the dollar bulls later suffered a setback last Friday when all-important US labor market data disappointed, indicating that the Federal Reserve may not actually be in a hurry to raise interest rates.

Goldman Sachs analysts "expect the report to ease market concerns about an early-than-expected decline in Fed asset purchases, even if it does not completely eliminate the possibility of a phased announcement in September. The combination of the Fed’s consistent outlook and global growth should allow the economic recovery to continue the recent dollar weakness.”

Meanwhile, rebounding economic activity and stock flows are providing tailwinds to the single European currency, says Goldman Sachs. Looking ahead to Thursday's European Central Bank meeting, Goldman Sachs economists expect the Lagarde-led council to maintain language that the pace of asset purchases is "significantly higher" than earlier in the year.

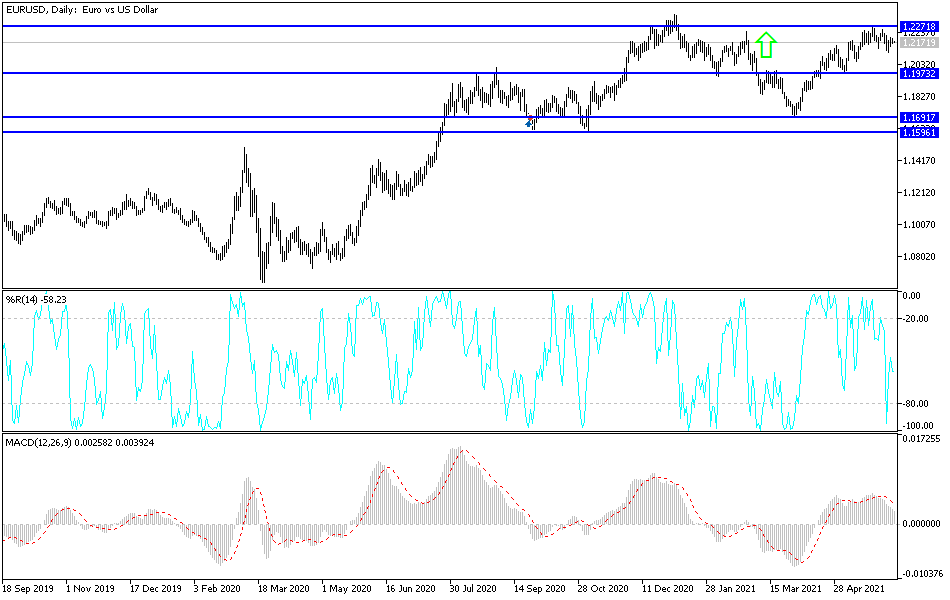

Technical analysis of the pair:

The EUR/USD is trending lower on the hourly chart and has been trading within a bearish channel that has been holding since late May. The price has recently bounced off the support level and is heading towards the area of interest in the middle of the channel. This is in line with the 50% Fibonacci level, which appears to have kept gains in check for the time being. If the bears take over from here, the EUR/USD could pull back to the swing low or channel bottom near 1.2100.

Also, the bigger pullback could still reach the 61.8% Fibonacci level near the key psychological high of 1.2200 or even the channel top at 1.2215. However, a breakout beyond the top of the channel may indicate that a reversal from the selloff is in progress. In the near term, the 100 SMA remains below the 200 SMA to indicate bearish momentum and that selling is more likely to resume than reverse. These indicators are also close to the 61.8% Fibonacci level to add to their strength as a ceiling. The stochastic is already moving downwards to show that selling pressures exist. The oscillator has a little more room to go down before indicating exhaustion among the bears. It also appears that the RSI is heading lower from an overbought area.

The currency pair is not awaiting any important economic data today, so market risk sentiment will have the biggest impact on the performance of the EUR/USD.